|

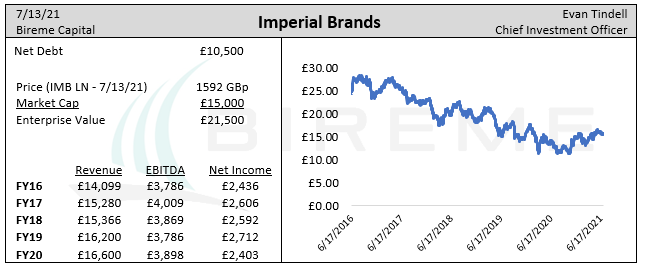

Elevator pitch At less than 6.5x earnings, Imperial Brands -- a UK tobacco firm -- is one of the cheapest stocks we have ever seen for a company with consistent profits. The stock has declined by about 50% since 2017 despite flat EBITDA and profit figures. We believe this is due to Imperial’s underwhelming operational performance combined with the market's infatuation with growth and ESG stocks, two themes which do not include Imperial. We think investors excluding Imperial on these grounds are falling prey to social conformity bias, which means they are simply aping their peers. At Bireme Capital, this is exactly the type of mistake that we seek to exploit in our Fundamental Value strategy. In contrast to our investor peers that see a no-growth, unsavory business, we see a company with stable cash flows, beloved brands, and high returns on capital, not to mention the ridiculously cheap earnings multiple. Due to the company’s 8.5% dividend yield, we expect Imperial’s stock to provide satisfactory investment returns regardless of where the stock trades in the short term. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |