|

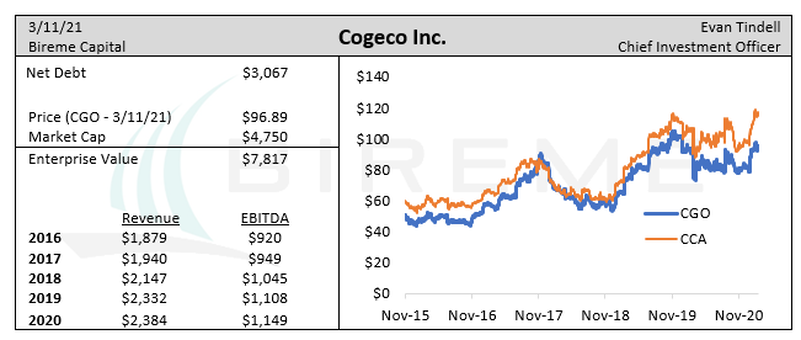

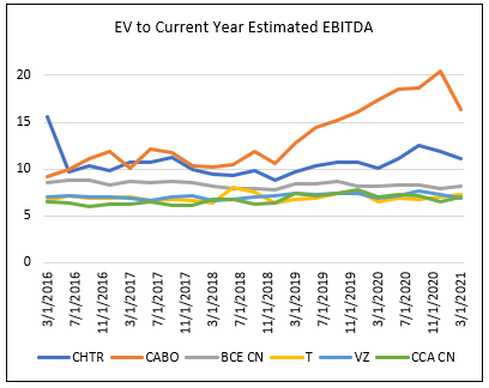

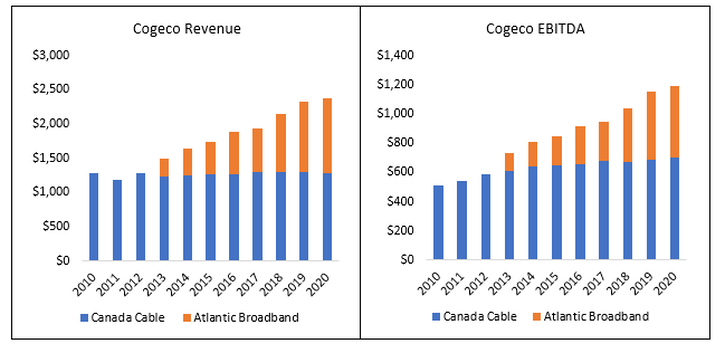

Elevator pitch Cogeco Cable is an undervalued Canadian cable company, with shares of Cogeco Inc. trading at about 10x free cash flow and 7x EBITDA. For these multiples you get a company with a near-monopoly on high-speed internet in its Canadian footprint as well as significant exposure to US cable customers. Cogeco has more than doubled sales, EBITDA, and FCF since 2008, all without growing the share count. Long term, a strategic buyer is likely to purchase these assets at a significant premium, as Altice and Rogers attempted in the summer of 2020. Why Cogeco is undervalued At Bireme Capital, we seek to find securities that are mispriced due to human cognitive biases. We think investors looking at Cogeco stock may be suffering from representativeness bias -- they appear to be valuing Cogeco like a legacy telco. At first blush, we can see why: legacy telephone companies like AT&T, Verizon, or Bell Canada/BCE provide many of the same services as Cogeco such as landline telephones, internet access, and video. But legacy telecom providers tend to be technologically (and therefore economically) disadvantaged vs the cable companies and have much higher exposure to the brutally competitive world of wireless. They therefore deserve lower valuations than companies like Cogeco whose results are predominantly determined by their near-monopoly cable assets. We think Cogeco should trade closer to 15 or 20x free cash flow. There are three prominent but misguided bearish narratives:

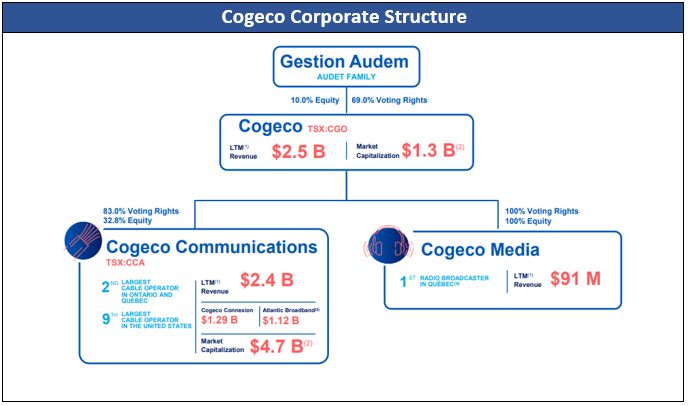

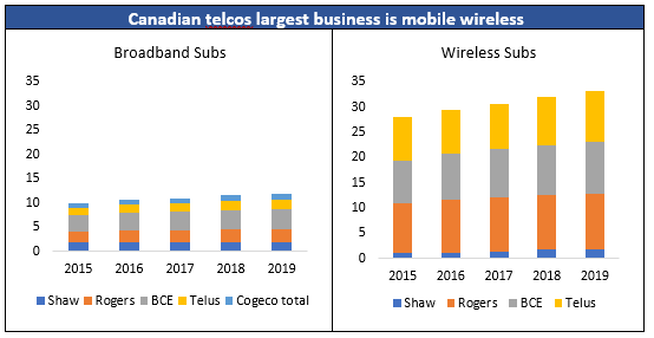

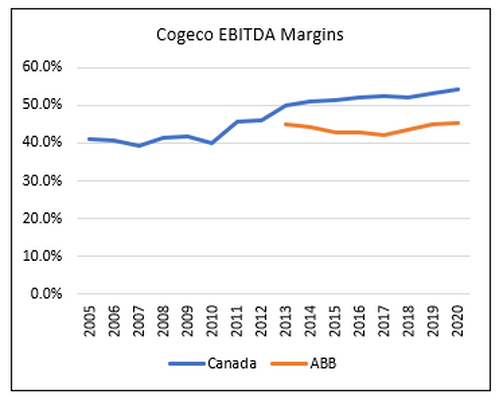

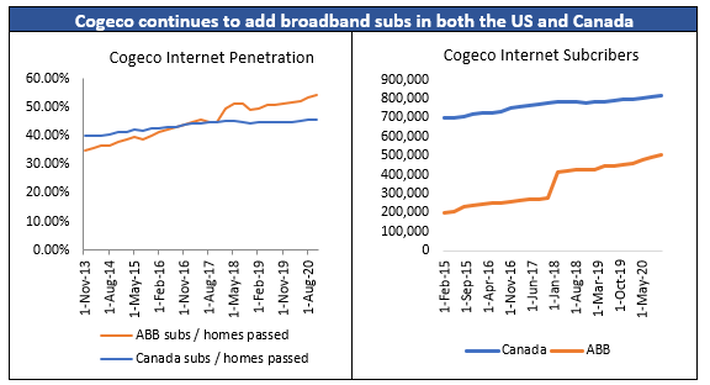

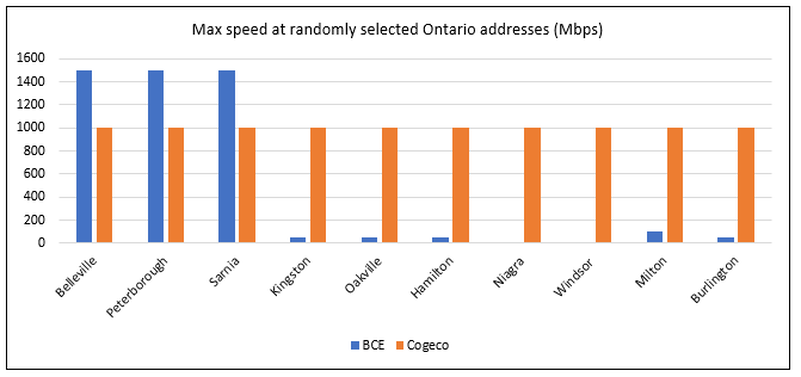

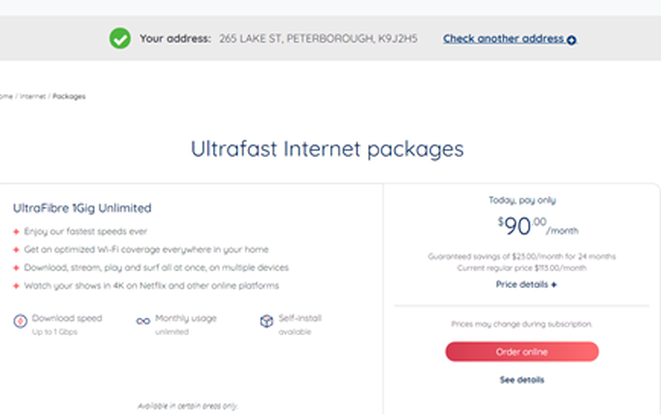

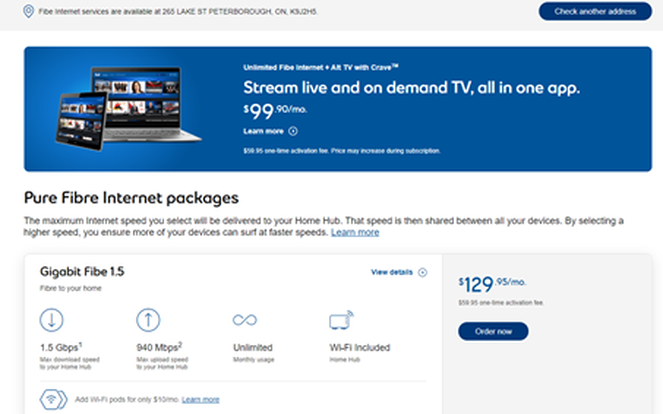

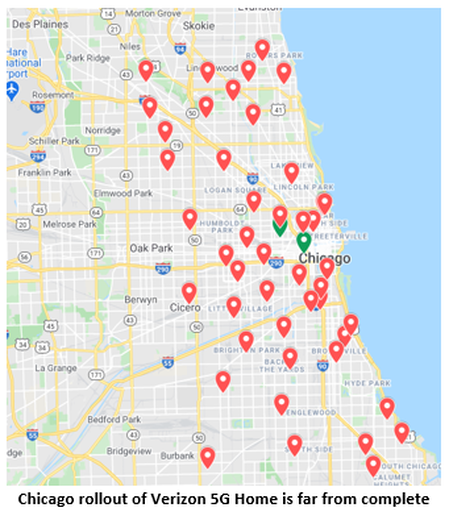

We do not think any of these hold water and will address them in detail below. Corporate structure On top of the misperceptions listed above, the company’s odd corporate structure may contribute to the irrational market price. There are two publicly traded entities: Cogeco Communications (OpCo) and Cogeco Inc (HoldCo). HoldCo owns 31.8% of the OpCo, and OpCo directly manages the business. The whole thing is run by a son of the founder Henri Audet; the Audet family controls both entities through about $150m worth of super-voting HoldCo stock. HoldCo is less liquid and is essentially invisible to the sell side, covered by only two Canadian banks. OpCo is more liquid and does draw the interest of eight analysts, but zero Wall Street firms. This perhaps leads to a provincial valuation of the company, whereby it is valued like the Canadian telcos and less like the pure-play cable companies which mostly reside in the US. Fundamentals of cable in Canada The cable business involves selling subscriptions to households. Offerings typically include phone service, TV channels, and internet access. The first cable systems sprang up in the late 1940s, when small communities in Arkansas, Oregon, and Pennsylvania which had poor antenna reception decided to connect their homes to hilltop TV antennas via cables. Over time, the coaxial cables that were run into people’s homes added channels outside of the broadcast networks, such as TNT and HBO. Eventually, these cables became an important fourth utility service along with electric service, gas, and water. The technology improved over time and the cables have much higher capacities than the phone lines they still compete with in many places. Today, cable systems provide crucial internet access to the majority of US homes. In Canada, smaller cable systems were formed in the late 1950s, with Cogeco starting operations in the late 1960s. As in the US, cable companies eventually expanded into phone and internet service, with some adding mobile phone service in the 90s. Today the major telecom operators in Canada are BCE, Telus, Rogers, Shaw, and Cogeco. All these firms have one major distinction relative to Cogeco: they get most of their revenue from mobile subscribers. In our view, this should lead to a lower valuation for these firms. Broadband home internet tends to be a monopoly or duopoly due to the expense required to dig up streets to lay cables. Wireless service, on the other hand, has four major national players in Canada vying for market share. This includes Shaw, which is much smaller than the big three (as you can see from the chart) but is pushing hard to grow with expansion plans in British Columbia and Alberta launched last summer. Commentary from one analyst will be familiar to US readers who have seen the discounting wars ignited by T-Mobile: Levy added that while Shaw has indicated it is not interested in acquiring more spectrum and expanding its mobile offering into other parts of the country, the launch of Shaw Mobile will still get reaction from Canada’s Big Three telecom carriers — and will likely result in fresh deals for customers this summer as a result. “I would expect the national players to look at their marketing strategies in Alberta and B.C., and pivot and take aim directly at Shaw’s new offering,” Levy said. “No major move goes unanswered in the Canadian market, and this will be no exception.” US investors have largely figured out that mature wireless operators and old-school telecom companies deserve a lower valuation than pure-play cable broadband companies. Consider the massive difference in valuations between companies like Cable One (17x EBITDA) and Verizon (8x EBITDA). Canadian investors have apparently not yet realized that Cogeco’s business is more like Cable One’s than Verizon’s. Cogeco’s business Cogeco Communications (OpCo) has two segments: a Canadian business under the Cogeco brand, and a US cable business branded “Atlantic Broadband.” The Canadian business is the legacy operation, and that free cash flow has funded their purchase of independent cable operators in the US, which now contributes more than 40% of EBITDA. The Canadian cable business was started in 1972, and in 1994 Cogeco was the first company in Canada to offer high speed internet over cable lines. Revenue in Canada has stagnated recently due to video subscriber losses, which has been partially offset by growth in internet subscribers. Because video subs come with much higher costs, this swap has caused EBITDA margins to rise. Last year this segment generated $700m in EBITDA. Cogeco’s entry into the US came in 2012, when they purchased Atlantic Broadband from two private equity firms. At the time, ABB provided cable services to mostly non-urban customers in Pennsylvania, Southern Florida, Delaware, and South Carolina. Cogeco later added more US cable customers with 2015 and 2017 acquisitions of pieces of Metrocast’s business. While the margins have not been quite as high as in Canada, the business has generated plenty of growth: ABB’s EBITDA has expanded from about $160m in 2013 to $497m last year. Like Cable One and Charter, a large portion of Cogeco’s revenue and most of their profit comes from their home broadband subscriptions. Generally, competition comes from a telco with inferior technology (such as DSL). In some places, the telco upgrades their system to fiber (FTTH) to create an equal-footed duopoly. Margins are high in this business, especially in mature markets, as can be seen from the results of Cogeco’s Canadian segment, where EBITDA margins have grown from 40% to 54% over the past decade: With the Canadian business stable and myriad growth opportunities in the US, we think Cogeco deserves much higher multiples. Bear case 1: Competition in Canada For years, the thrust of the Cogeco bear thesis was encroachment by incumbent telecom provider Bell Canada (BCE). The theory was that, as BCE built out more and more fiber-to-the-home (for some background see here), competition for Cogeco subscribers would increase substantially. A Barclays analyst (who has since stopped coverage) had these comments explaining his hold rating: March 2015: “Cogeco’s overlap with BCE fiber will grow from 25% to 55% by the end of 2016, and Cogeco’s subscriber losses are likely to accelerate.” January 2016: “BCE fiber expansion strategy remains a serious long-term threat.” In the end, we think the data shows that telco fiber buildouts are no more of an existential threat to cable companies in Canada than they are in the US where the low ROICs of fiber “overbuilds” are notorious. Verizon Fios have such low returns that Verizon mostly halted them in 2015, resulting in complaints from city governments where Verizon had promised to expand the service. Rather than losing share as forecasted, Cogeco has continued gaining internet market share in its footprint in Canada: internet subs as a percentage of homes passed rose to 45% from 40% in 2013. Over that period, the company has added over 100,000 internet subs in Canada, not to mention 300,000 subs in the US. We think analysts who are or were bearish on Cogeco due to the BCE fiber buildout do not fully understand the competitive dynamics and economics. While BCE has laid FTTH in portions of Cogeco’s footprint, we believe it is mostly focused on denser locations where it can hit more homes per square mile. Many cities in suburban Ontario, for example, remain on <100 Mbps DSL service. There are essentially two types of homes in Cogeco’s footprint: those where BCE offers competitive internet service and those where it does not. Even where BCE does offer 1.5 Gbps service, the product is priced for profits rather than for market share. This makes sense, since the company needs to make a return on the significant capital it invested to lay the fiber. A perfect example of this can be seen at 265 Lake Street, Peterborough ON K9H2H5. Cogeco offers 1Gig Unlimited for $90 / month at this location: BCE does offer 1.5 Gbps service at this location, but for a significant premium of $129.95 / month: And BCE does not offer much of a discount for slower speeds: BCE’s 150 Mbps service is $99.95 per month, which is roughly equivalent to the average price for Cogeco broadband. We do not expect BCE’s FTTH buildout to crush Cogeco’s margins any time soon. Cogeco’s profit growth in Canada has been slow, to be sure, but this must be weighed against the growth generated by the company’s investment in the US. The net result has been an increase in EPS from $4 in 2013 to an estimated $8.40 in 2021 for CCA, a track record which we find incompatible with the massive discount to market multiples. Bear case 2: 5G home broadband 5G home broadband uses cell towers to provide home internet service and is directly competitive with cable. Before 5G, hosting many households on a single cell tower was not practical, given the typical household download quantities of >200 Gb per month. However, 5G uses higher frequencies that are capable of higher data throughput than earlier generations of wireless protocols. But radio waves at these frequencies have a major drawback: they do not propagate far, meaning that 5G “small cell” towers must be much closer to the end user. This increases capital costs and the time required to roll out the service, since you need many more towers to cover a given area. It can also lead to frustration if a household lacks adequate service despite living in a city where 5G home service is technically available. There are numerous examples of 5G home service complaints such as this, this, and this. A comment here, complaining about the performance of the in-home 5G router, is representative: “It’s highly position dependent – rotate the cylinder wrong and lose half your speed. Even moving it across the room will make a huge difference.” To see how quickly the rollout is really going, we looked at Chicago, which became the fifth city to receive Verizon 5G Home Internet when it launched in October 2019. We selected 50 random Chicago addresses and entered them into Verizon’s 5G Home website. We only found 5G Home Internet service at just two locations. We made a map of the results: Verizon plans to add 20 new cities and 15,000 small cell sites to the 5G Home service in 2021. This may sound like a lot, but the math tells a different story. If each small cell covers a 1000-foot radius, this means that Verizon’s 30,000 year-end 2021 mmWave cells will cover about 3,400 square miles. The Chicago MSA is 7,195 square miles and its “urbanized” area is 2,441 square miles. So given its current rollout pace, Verizon can cover 1.4 areas the size of the Chicago MSA per year. T-Mobile’s 5G home broadband guidance is 7-8m in 5 years (see page 14 here). This is a laudable goal but represents just 6% of total US households. We think it will be a long time before 5G home moves the needle against cable. In Canada, BCE’s Wireless Home Internet service is focused on providing 50 Mbps download speeds (i.e., not really 5G) to rural communities that don’t have broadband internet today. It is not currently competitive with Cogeco. Another indicator that 5G home is a limited threat to traditional cable providers is the valuations of US cable companies. With Charter and Cable One trading at double-digit EBITDA multiples, investors clearly do not expect 5G to upend the economics of home broadband. We think 5G home service will continue to improve and is something to be monitored but is not a material risk to Cogeco in the near or even medium term. Other cable companies – specifically Rogers and Altice – seem to agree with us, as we will demonstrate below. Bear case 3: Management The strength of management is an important consideration for any investment but is particularly important at Cogeco given the controlling stake held by the Audet family. Based on discussions with other investors, we believe management is another reason shares trade so cheaply. The key man is chairman Louis Audet. He was CEO from 1993 to 2018 and is the son of the founder. He is an engineer by training and has a Harvard MBA. He gets paid about $2m per year in total compensation, but his primary economic interest is in his portion of the $150m family trust. Since taking over for his father in 1993, Louis has done a solid job growing the core Canadian cable business. Since 1995, revenues in Canada are up 6x and EBITDA has increased more than ten-fold, from $60m to $700m. But the Canadian business throws off substantial excess cash flow, and Louis has a mixed record when it comes to deploying this cash for acquisitions. In 2006, Cogeco purchased Cabovisao, a Portuguese cable company, for $660m. This was a complete disaster. The business went from generating $88m in EBITDA in 2008 to $21m in 2011. Cogeco unloaded the business for a mere $59m six years later. In 2012 they purchased Peer 1 Networks for $526m, an acquisition which expanded Cogeco’s data hosting business from six to twenty-five data centers. However, further growth in this segment proved elusive due to fierce competition from public cloud providers, prompting the company to sell the division. They were able garner $720m in 2019, a good price for the asset but a lackluster return on capital for Cogeco. In another 2012 deal, Cogeco bought Atlantic Broadband (ABB) for $1.4b. The US expansion has been financially successful and is the primary growth lever for the company going forward. ABB is on track to generate about $500m in EBITDA in 2021, a solid return on about $4b in total investment. The 8x multiple of total investment to EBITDA compares quite favorably to EBITDA multiples of pure-play US cable operators today. All in all, given management’s current preference for tuck-in cable acquisitions in the US and Canada, as well as their rational decision to part ways with Peer 1, we feel comfortable with the capital allocation process. We certainly do not think management’s stewardship warrants a large discount. Long-term catalyst: Rogers deal The relationship between Rogers and Cogeco began in 1996, when Rogers sold some cable assets to Cogeco for a mixture of cash and stock. This deal appears to have been primarily about money, based on Ted Rogers’s comment that it would “substantially improve the financial position of the group.” Given how valuable cable businesses (and Rogers itself) would become over time, we suspect that the Rogers family always regretted selling those assets. Today Rogers is a CAD $30b market cap cable and mobile wireless provider. They own about 33% of the shares of the Cogeco entities, and it has long been rumored that they desired to own the whole company. These rumors were proven true in September 2020, when Altice and Rogers unveiled an unsolicited bid for the entire company. The bid was for $106 per CGO (HoldCo) share and $134 per CCA (OpCo) share. The total consideration was CAD $10.3b, with Altice offering CAD $4.8b for the US assets and Rogers planning to take the Canadian assets for the remaining CAD $5.5b. After being told by Cogeco that the company was not for sale, Rogers and Altice increased their bid to CAD $11.1b total, with $6.0b for the Canadian assets and $5.1b for the US assets. This offer represented C$123 per CGO share and $150 per CCA share, more than a 50% premium to their unaffected trading prices. This bid was rebuffed as well. Despite consistent declarations that the company is “not for sale,” we think that eventually the Audet family will find it in their best interest to get fair value for their stake by selling to Rogers. This may be in one year, it may be in ten years, but based on the 2020 bid by Rogers we think the final selling price is likely to be >10x EBITDA, a large premium relative to where the stocks trade today. Regardless, we will be happy to own these high-quality assets for the long term if this does not occur. Conclusion Cogeco, via CGO, trades for 10.5x FCF and 7x EBITDA. We think investors are falling prey to representativeness bias, valuing the company like Bell Canada or Rogers despite the markedly different nature of the business. We think CGO should trade for 10-12x EBITDA and 15-20x FCF, in line with US peers, implying 50-100% upside. The unsolicited Rogers bid, still 30% above current trading prices despite zero engagement from CGO, confirms the value we see. We think negative views on management, the BCE fiber buildout, and the dangers of 5G home are overstated, and that Cogeco generates a mid-teens IRR from current prices. Bireme Capital LLC is an SEC Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV.

Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |