|

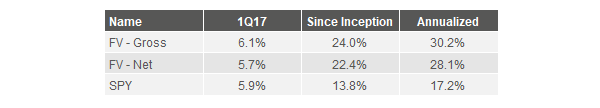

FV edged out the market in Q1, returning 6.1% before fees vs 5.9% for the SPDR S&P 500 ETF (SPY). This brings the portfolio’s annualized outperformance, after typical fees, to 10.9% since inception.1 We made one new investment in the quarter, the French holding company Bollore SA. We had been following Bollore for about two years, ever since a positive report on the firm was released by noted short seller Muddy Waters. In this report, a rare buy recommendation for the outfit, Muddy Waters claimed that the effective share count of Bollore was less than one half of the official number. This is important, as a halving of the share count doubles the value per share, all else equal. If Muddy Waters was right, and other investors were relying on the public share count, the stock might be undervalued indeed.

When excluding treasury shares, we estimate that Bollore trades at roughly ten times 2016 earnings per share, less than half the median of this group. We think Bollore SA will see strong returns to investors if a portion of the discount closes. 1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |