|

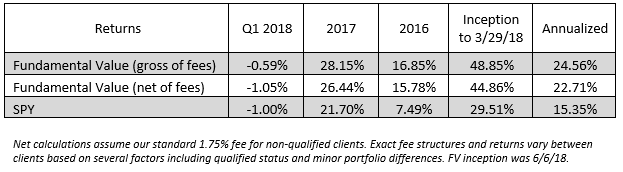

Fundamental Value (FV) was down 1.05% in Q1, slightly trailing the -1.0% total return of the SPDR S&P 500 ETF (SPY). Since inception, FV has returned 22.7% annualized (net) vs 15.4% for SPY, an outperformance of 7.3% annually.

No stock in the portfolio had a more eventful quarter than Express Scripts (ESRX), which agreed on March 7th to be acquired by health insurer Cigna in a $67 billion dollar deal. The consideration to ESRX shareholders consists of $48.75 in cash and 0.2434 in Cigna stock. This amounted to $96 per ESRX share based on Cigna’s $194.25 stock price prior to the announcement.

Cigna’s stock, though, has declined to $171.65 since the deal was announced, underperforming its peers by about 10%. Most of this move occurred in the first day or two after the deal was announced, as investors apparently questioned the logic behind such a large purchase for the $41 billion insurance firm. The deal is worth about $90 to ESRX shareholders today. Somewhat surprisingly, ESRX traded lower for the quarter, finishing at $69 per share. It's currently priced for a >30% return should the deal close. There are risks to the deal, including antitrust risk and the risk that Cigna shareholders will vote against it. But to put this in perspective, deals requiring shareholder votes at the purchasing company are completed about 82% of the time, and that includes deals that fail due to antitrust challenges. Cigna/ESRX may appear to have a greater than average amount of antitrust risk. Health insurers can be clients of Pharmacy Benefit Managers (PBMs) like ESRX, making this the type of "vertical" integration that has recently come under increased scrutiny. In fact, the government is at this very moment midway through an attempt to break another vertical integration in AT&T/Time Warner. The DoJ lawsuit challenging that merger surprised many participants and appears to have made investors leery of all vertical deals, as demonstrated by ESRX’s large discount to the merger price. We do not think the government would have a compelling case if they chose to similarly challenge the ESRX deal. Often, when the government challenges vertical mergers, they attempt to show that the acquirer would withhold the acquiree's product in an attempt to sell their own upstream service. This was the argument put forward in the Time Warner (TWX) case: AT&T might attempt to push consumers to drop Dish satellite service and sign up for DirecTV by withholding TWX-owned channels like CNN and TNT from Dish. The corollary in the Express Scripts case would be if Cigna withheld Express Scripts PBM services from insurance companies that compete with Cigna. In the case of TWX, this sort of vertical foreclosure is plausible; after all, TWX does have exclusive content such as CNN and HBO that are important to carriers like Dish. But PBMs have no such exclusive intellectual property. All PBMs do pretty much the same thing, and compete on service, reputation, and price. Perhaps the government will object to the fact that the market will lose the sole “independent” PBM, with almost all others being aligned with health insurers or pharmacy networks. This may be true, but we feel it will be difficult to show that this would harm the consumer. After all, ESRX does not have anything close to 100% market share amongst health insurers, who would be heavily motivated to seek out an independent provider if they thought a competitor-owned PBM would harm their insurance customers. Cigna itself currently uses OptumRx for a large portion of its PBM function. OptumRx is owned by Cigna’s competitor UnitedHealth Group, a fact which does not seem to have harmed the relationship. There is even a history of health insurers starting PBMs from scratch. This includes ESRX’s largest customer, Anthem, which is in the process of launching its own PBM service and cutting ESRX out of the contract completely. Whether the DoJ challenges this deal remains to be seen. We plan to hold the stock for now, barring a dramatic appreciation towards the deal price. The largest negative contributor in the quarter was a name we highlighted in a previous letter, Cogeco Communications. Cogeco declined about 20% for the quarter after posting admittedly mediocre profit growth from the core business. However, they continue to gain broadband share in their markets, management is still guiding to low single-digit profit growth, and the shares trade at less than 10 times free cash flow. We continue to believe this massive discount to the overall market is unwarranted. We added to our stake in the company, and it is now one of our largest positions. We made one sale during the quarter, letting go of National Presto Industries (NPK), a diversified manufacturer of ammunition, electrical appliances and (until recently) adult diapers. We owned NPK for many years. We thought highly of management's conservative nature and focus on the business as opposed to impressing Wall Street. The CEO, MaryJo Cohen, is a second-generation manager with a large amount of skin in the game due to her 24% stake. While NPK has multiple segments and a multitude of products, the defense segment generates 90% of its profits. Within this segment, historically >50% of sales came from a single contract to produce 40mm grenade ammunition. Unfortunately, a recent change to the way this contract is awarded (the removal of the small business requirement) makes it much more likely that this contract will eventually be lost to a larger rival. In fact, there have already been contracts for next-generation 40mm training rounds awarded to two competitors, including the behemoth General Dynamics. With the playing field leveled and competitors already starting to make inroads, we felt it was time to part ways with this investment. We sold the stock for about 14x PE (after backing out net cash), which we felt was a full multiple given the risks. We made one purchase in the quarter, of a strip-center focused REIT called Kite Realty. Kite, headquartered in Indianapolis, is a $1.2B market cap firm that was started in 1960 as a drywall, painting, and construction company. They have concentrations in Indiana and Florida, and own 117 properties with 23.3m square feet of leasable space. The stock is down 32% over the last year, causing it to trade at an 8.4% dividend yield and 12.5x EBITDA. This is a nine-year low in valuation. We have been looking for a way to invest in retail for years. We've looked at department stores, apparel retailers, and malls, all in an effort to bet against the Amazon-induced panic surrounding physical retail. By and large, we’ve found that investor pessimism was well founded, and up until now our only investment on this theme has been Walmart. But in Kite, we believe we have found the intersection of negative sentiment, cheap valuation, and good business prospects that we look for. Sentiment and valuation levels are obvious -- you don’t often get to purchase REITs at 7x cash flow from operations. Yet, the business is stable, and occupancy rates are at a fairly high 94% averaged across the portfolio. This is in large part because their tenants are stable. Their largest customers are firms like TJ Maxx, Publix, and Ross, firms with solid business plans and positive same store sales. This is unlike the mall companies, which are dominated by struggling apparel retailers that are beginning to question the $30-40 per square foot rents of the enclosed malls (vs the $15 or so they might pay at Kite’s properties). Another important metric is releasing spreads -- this is the difference between the prices on outgoing and incoming leases. At Kite, this number has been a positive 7-10% for the last 8 quarters, in stark contrast to some of the mall operators that are generating double-digit negative releasing spreads. We are not the only ones that have noticed the value in the stock, as four Kite insiders purchased a total of over 110,000 shares in the first quarter. We started purchasing shares of Kite at around $15 per share, similar to where they stand today. We are grateful for your business and your trust, and a special thank you to those who have referred friends and family. There is no greater compliment. - Bireme Capital Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |