|

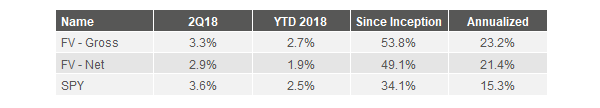

FV slightly trailed the market in Q2, returning 3.3% before fees vs 3.6% for the SPDR S&P 500 ETF (SPY). This brings the portfolio’s annualized outperformance, after typical fees, to 6.1% since inception.1 For the second quarter in a row, the largest negative contributor was Cogeco, as our investments in Cogeco Communications (CCA) and Cogeco Inc (CCA/CGO) declined 10-15%. We continue to think Cogeco is extremely cheap at <10x FCF for a locally dominant cable provider, as we laid out in our Q2 2017 letter. We bought more CCA this quarter, and it remains one of our largest positions. Despite the fall in the stock price, Wall Street EPS estimates for Cogeco Communications have been rising year to date, moving from 6.02 to 6.36 CAD for 2018.2 On June 29th, the shares fetched 64.68 CAD. 1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |