|

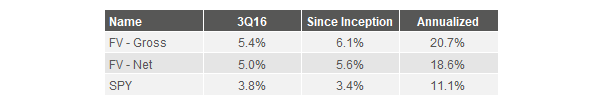

FV outperformed the market in Q3, returning 5.4% before fees vs 3.8% for the SPDR S&P 500 ETF (SPY). This brings the portfolio’s outperformance, after typical fees, to 2.2% since inception.1 FV made three new investments in the quarter. They were Humana, Express Scripts, and Twentieth Century Fox. 1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |