|

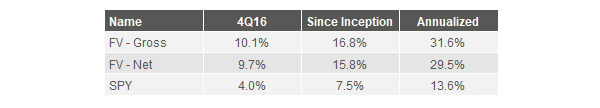

Fundamental Value (FV) had an exceptional 2016, returning 16.8% before fees vs 7.5% for the SPDR S&P 500 ETF (SPY). The majority of FV’s return came in the fourth quarter, as it gained 10.1% vs a 4.0% return in the benchmark. This brings the portfolio’s outperformance, after typical fees, to 8.3% since inception.1 We made three significant trades in the fourth quarter: selling Qualcomm, selling Viacom, and purchasing Time Warner.

Samsung’s shares deserve an earnings multiple consistent with its dominant industry position. But even after meaningful appreciation in 2016, Samsung’s common shares trade at 13 times earnings, a sharp discount from the roughly 20x PE of our benchmark, the S&P 500 Index. The preferred shares are even cheaper than the common, trading at a 20% discount despite equal economic ownership. Samsung Electronics Preferred Shares continue to be one of Bireme’s largest investments. If you are interested in learning more about why an investment in Samsung Electronics is so compelling, we encourage you to read Elliott Management’s detailed presentation on the company. 1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |