|

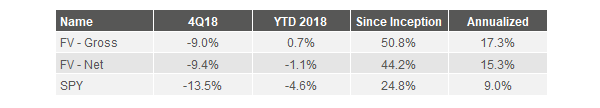

The Fundamental Value strategy returned -9.4% net of fees in Q4, a disappointing result on an absolute basis but an outperformance of 4.1% relative to SPY, the S&P 500 ETF. For the year, FV lost -1.1% after fees vs SPY’s decline of -4.6%. Since inception, the strategy has outperformed by 6.3% annually after fees, a result we work hard every day to sustain.1

The sell-off in stocks in Q4 was broad-based, and most of our stocks dropped in line with the market. A notable exception was Apple, whose stock fell about 30% in the quarter on disappointing FQ1 guidance. The miss was mostly due to weak demand in China, but this was not a situation specific to Apple: analysts estimate a 12-17% decrease in Chinese Q4 smartphone shipments. However, Tim Cook also described a shortfall of iPhone upgrades compared to expectations in some developed markets. While the iPhone replacement cycle may be lengthening, we are not particularly concerned. The data shows that these customers are not switching to Android. Even in China -- historically an Android stronghold -- data indicates the iOS installed base is stronger than ever, capturing 25% of usage. US figures show similar stability at 45% to 55% share. So while iPhone users may be buying fewer new phones, they remain within the iOS ecosystem. This is key, as the size of the active installed drives Apple’s services and accessories segments. These segments have grown from $22 billion in sales for calendar year 2013 to $45 billion in 2017, and we expect them to generate more than $90 billion in revenue by 2023. This will allow Apple to grow profits despite flattening iPhone sales. Regarding Apple’s “Greater China” results, this quarter’s decline in revenue is not unprecedented. Greater China sales were 13% lower year-over-year for FQ3 2013, and shrank for five consecutive quarters starting in early 2016. Both these periods coincided with compelling discounts in Apple stock.2 We remain long Apple. It is not our largest position, but we remain confident in the long-term future of the company and think it is quite cheap at 11x PE net of cash. We were active in the fourth quarter, as the market volatility presented us with more than our usual share of opportunities. We made two new investments: Bayer AG and Facebook. As is often the case for our new investments, both companies face negative investor sentiment and declining valuations. They face negative public sentiment as well, even appearing3 on USA Today’s list of America’s Top 20 most-hated companies. In both cases, we think that public opinion has leaked through to stock market valuations in an irrational way, presenting upside for investors willing to focus on business value and ignore all else. We have watched Facebook from afar for some time. We have long been impressed at the pace they have grown the business, with revenues increasing from $5 billion to about $55 billion over the past six years. That growth has fallen to the bottom line as well, with profits multiplying from $1 billion to $20 billion. For much of that time, Facebook was richly rewarded for this growth, trading at nosebleed valuations of 60 to 100 times earnings. Thus, it was with some surprise that we watched the mounting scandals drag down the stock over the past six months. But despite the move in price from $220 to $140, we believe the bad press is not material to the long-term health of the business. The issues are real: Facebook’s platform did enable Russian interference in the 2016 election and Myanmar persecution of the Rohingya. And the company really did expose data to bad actors like Cambridge Analytica. But while Facebook must end this sort of activity on their platform, there is scant evidence of a change in user behavior since the first story broke in Q1 2018. Facebook’s North American monthly active users have grown since that time, and currently number 242 million (i.e., nearly every adult on the continent). Facebook’s public image amongst Americans is even less likely to impact Instagram, the key growth vehicle of the business over the next five years. 57% of Americans don’t even know the company is owned by Facebook, and 80% of users are outside the US. We purchased Facebook stock in the low 130s, at about 18x earnings. This is a small premium over market multiples, which we are happy to pay given the superior quality and growth of the business. Our second investment in Q4 was Bayer, parent company of the much-hated Monsanto. Bayer was -- prior to the Monsanto acquisition -- a solid, well-liked pharmaceutical company that sponsored top Bundesliga teams. They still support the football club, but the public goodwill appears to have evaporated since the announcement of the Monsanto deal, with Bayer shares underperforming the DAX by about 40%. We suspect this is due to European shareholder4 antipathy for genetically modified crops, which we don’t find rational given their inherent safety and the need to increase food production by 60% over the next 30 years. There are risks to the Monsanto business. For example, thousands of former Roundup users are suing the company on the claim that it caused their cancer. The company (and investors) are taking the lawsuits particularly seriously given a $289m verdict in favor of an early plaintiff. But like in Facebook’s case, we think Bayer’s long-term cash flows will be unaffected by today’s negative headlines. Monsanto’s products are desperately needed by farmers, and we don’t think it’s likely that Roundup causes cancer. As the judge in the above case noted, all of the regulators in the world except for one have found Roundup to be a safe, non-carcinogenic product. A few years hence, we believe Monsanto and Bayer will have grown profits substantially and much of investor focus will be back onto the strength and track record of Bayer’s pharmaceuticals business. If this is true then our investors should do quite well on their November purchases, which were made at about 10x free cash flow. We are grateful for your business and your trust, and a special thank you to those who have referred friends and family. There is no greater compliment. - Bireme Capital 1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |