|

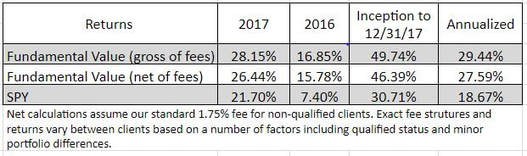

Fundamental Value had an exceptional quarter, up 10.7% gross vs the S&P 500 which was up 6.8%. For the year, FV finished with a 28.2% gross return vs the S&P’s 21.7%. The positive relative results were notable given the material cash balance carried throughout the year and the fact that traditional value indices underperformed in 2017, a headwind for our strategy which tends to favor such stocks.

Despite the market’s increasingly rich valuation, we continue to find stocks we believe will generate high single-digit to low double-digit returns. This leaves us optimistic for the returns of FV going forward, despite our expectation of less than five percent returns for the US stock market as a whole. During the quarter, we made two significant trades, taking one new position and exiting one position. HCA Healthcare The lone position we initiated was a company called HCA Healthcare, one of the largest hospital operators in the country. In 2017, this for-profit operator’s 177 acute care hospitals and 250+ outpatient facilities generated over $43 billion in revenue and adjusted earnings per share of about $6.70. This means the stock, which we began purchasing around $86, is quite cheap at <13 times trailing earnings. HCA is a great business. On a profitability and returns basis it stands apart from its peers, with ~19% EBITDA margins and 16% returns on capital. As a reference point, S&P 500 companies average a ~7% return on capital. HCA does not hurt for growth, either, having doubled revenue and profits since coming public in 2009. It has generated this growth both through acquisitions and building new facilities, and emerged with top two market share in nearly all of its core markets. This makes HCA hospitals and outpatient facilities indispensable to insurance companies in those locales. With increased negotiating leverage comes higher reimbursement rates and larger profits for HCA hospitals relative to their for-profit or non-profit peers. In the end, HCA’s smaller competitors risk getting caught in a cycle of lower reimbursement rates, less money to reinvest, lower quality care, and less relevance to insurers. Many of them have attempted to battle HCA’s scale through mergers, but this has just saddled them with debt. Some are now trying to deleverage by selling assets. This benefits HCA, which has become the natural industry consolidator due to their immense financial resources and ability to tuck acquisitions into their existing networks. Tenet Healthcare’s former CEO said it best when he explained why they sold their Houston hospitals to HCA: “So we had four hospitals in Houston. They were just so far apart that they weren't exactly a network but they sit beautifully within HCA's network. So this is an example where there was a great acquisition for HCA and it was a great sale for us. And they have tremendous synergies in folding that into their system.” Despite HCA’s unique advantages, the market seems to unfairly paint all for-profit hospitals with the same brush, valuing them at 10-11x EBIT and 12-13x PE. This is much cheaper than the overall market and probably justified for the lower-quality operators. But we think this creates an opportunity to invest in HCA at a large discount to intrinsic value. HCA is a top five position in Fundamental Value as of this writing. Biglari Holdings We sold out of Biglari Holdings (BH) in the fourth quarter. Originally called Steak ‘n Shake, Biglari Holdings was solely a restaurant company from its founding in the 1930s until Sardar Biglari got involved in 2007. Biglari, a hedge fund manager at the time, waited a year before launching a proxy challenge that resulted in his taking over the company. He then abruptly stopped opening new restaurants, preferring instead to invest the cash flow outside the core business. He has had success with these investments, the largest of which is BH’s 20% stake in Cracker Barrel. These shares were purchased mostly in 2011, and have grown in value as CBRL’s stock price has risen from $50 to $175. Yet despite these successes, BH stock always traded at a large discount to its apparent value. Most market participants said this was due to the eccentricities and maneuverings of Biglari, who exhibited a blinding ego, sharp mind, and willingness to ignore smaller shareholders. In the end, fears of Biglari were well founded. He managed to secure a lavish pay package, change the company name to his own, and, most egregious of all, vote firm-owned Treasury shares in his own favor to fend off a proxy challenger in 2015. Despite our concerns, we always thought the discount implied by the market and Biglari’s undeniably strong investing track record were more than enough to compensate for his shenanigans. What finally changed our mind was the deterioration of the Steak ‘n Shake business, which saw comparable traffic down 4.5% for the first 9 months of 2017 and a decline in profits from $30m to a mere $1m before taxes. With the core restaurant business in a tailspin, we decided the discount was both smaller and more appropriate than we had previously assumed. We sold the shares at around $340 per share, generating a loss of about 15% on our investment. This was an example of our sell discipline, which emphasizes rational analysis of our investments which have declined in value. It is not easy admitting you are wrong, and research shows that this creates a bias amongst investors called the disposition effect. This analytical flaw causes an irrational desire to hold on to losers in the hopes of eventually booking a gain. We work hard not to fall prey to this bias, and re-examine our thesis any time a company’s share price declines materially. If nothing has changed, we may increase the size of our position, as we did for 21st Century Fox and Express Scripts in the third quarter. But sometimes we conclude that our thesis was wrong. In those cases we sell, as we did with Biglari Holdings. Thank You As always, we are grateful for your business and your trust, and a special thank you to those who have referred friends and family. There is no greater compliment. -Bireme Capital Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |