|

Elevator pitch

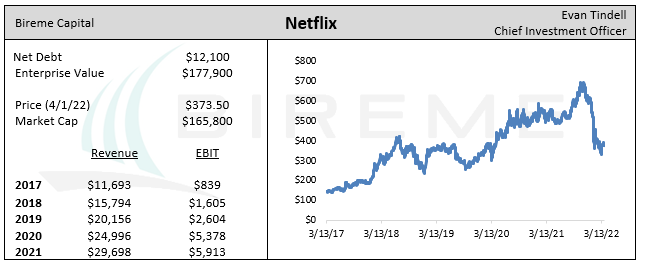

After disappointing Q1 guidance, the market gods have given us a tantalizing opportunity to buy Netflix stock at nearly a 50% discount from its peak. Investors seem to be extrapolating a one-quarter lull in subscriber growth into a multi-year issue, but we think Netflix will continue growing both users and ARPU for years to come. As a result of the drop, Netflix stock price is unchanged from Q4 of 2019. This is despite the company generating an estimated $5.5b of GAAP net income in 2022, up from $1.2b in 2019. The stock trades at a ~33x PE ratio today. This is atypically high for our investing style, but we do not think it is commensurate with Netflix’s quality as a company. This is the cheapest valuation NFLX has seen since 2011, when all of its profits were generated by the DVD-by-mail segment. The current price will look progressively cheaper over time: we conservatively estimate that the company will earn more than $30 per share by 2028 and generate billions of free cash flow along the way. A surprising purchase Our letters over the past two years have contained an unceasing drumbeat of bubble warnings and excoriations of the speculative frenzy in growth names. Thus, long-time readers will doubtless find themselves confused to see us buying a canonical growth stock that, while historically cheap, nonetheless trades at over 30x earnings. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |