|

*We think.

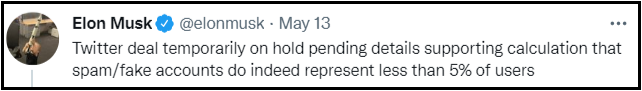

Elon Musk is under contract to buy Twitter for $54.20 per share. The deal came together in April after a breakneck negotiation period, during which Musk was so eager to get the deal done that he waived his rights to due diligence. But since the contract was signed, markets plummeted and Twitter reported disappointing earnings. Based on his tweets, it appears Musk has gotten cold feet:

However, putting a deal under contract "on hold" is not a thing, and we think Musk has no legitimate reason to back out.

Nonetheless, markets appear to believe that he will be able to break the deal, or at least renegotiate a significantly reduced price. Today the stock trades at about $39, a massive discount to the deal price. This discount represents our opportunity. The Twitter board, if they fulfill their fiduciary duty, will sue Musk for "specific performance," a court order that will force him to close. We believe the board will win easily. In the end, we think Musk will have to buy the company at $54.20. At best, he will be able to negotiate a small discount which the Twitter board might take for deal certainty and to avoid a messy legal battle. If we're right, we will earn a >40% return on our <$37 purchase price in a 3-12 month timeframe. We went on Andrew Walker's "Yet Another Value Podcast" to discuss this in more detail, which you can listen to here. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. For current performance information, please contact us at (813) 603-2615. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |