|

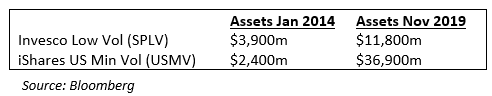

THE LOW-VOLATILITY ANAMOLY For most of its existence (Jan 2010 to today), the S&P Low Volatility Index (SP5LVI Index on Bloomberg) traded in line with the S&P 500 on a valuation basis. However, investor interest in these stocks has grown materially, likely due to academic research showing the outperformance of stocks whose prices varied less than the market. This interest has meant asset growth for ETFs that employ a low-volatility strategy. For example, AUM for the iShares US Minimum Volatility ETF, USMV, has skyrocketed, up about 15x in the last five years. Unsurprisingly, the surge in assets thrown at low-vol has resulted in higher valuations, and these stocks now trade at >25x earnings vs 22x for the S&P 500.

Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |