|

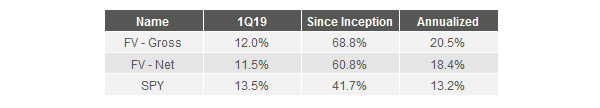

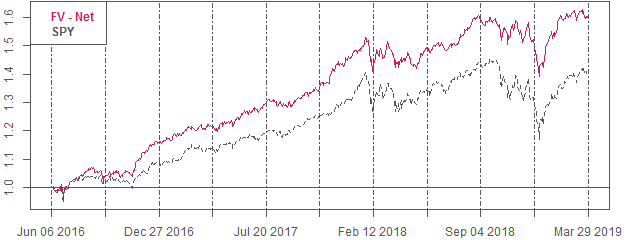

The first quarter of 2019 was one of Fundamental Value's largest gains since inception, returning 11.5% net versus a gain of 13.5% for the S&P 500. For the S&P, this was merely a reversal of losses created in the fourth quarter, when the market dropped -13.5%. Since FV only dropped -9.4% in Q4, we've come out 2.9% ahead during this 6 month period. Market commentary

1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016.

Bireme Capital LLC is an SEC Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |