|

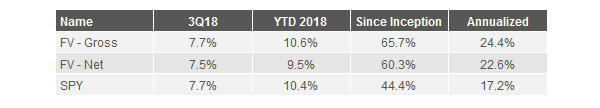

Fundamental Value had a solid quarter, returning 7.71% gross of fees, in line with the S&P 500 ETF’s return of 7.65%. This brings the portfolio’s annualized outperformance, after typical fees, to 5.4% since inception.1

While the market soared in Q3, most of the market’s YTD returns evaporated in the beginning of Q4. This has not surprised us in the least. We have kept a material cash buffer of ~10% in FV in order to have dry powder to buy stocks at discounted prices should the market turn lower. We are sharpening our pencils on a number of potential new investments. Our largest positive contributor in the quarter was HCA Healthcare, which we wrote about in Q4 2017. HCA gained more than 35% in Q3, after their quarterly results showed profits growing about 7% compared to last year. This level of growth is typical for the company: patient volumes at HCA hospitals (excluding new facilities) have increased for 17 straight quarters. We think HCA will continue to grow, as the demographics in their core markets and strong negotiating position with insurance companies allow them to build hospital additions and outpatient centers at high returns on capital. When we purchased the stock in 2017, we paid about 13x trailing earnings, which we thought was a bargain. In fact, this was even cheaper than it appeared, as the combined effect of HCA’s growth and the corporate tax cut meant that our purchase price was only about nine times what HCA will earn in 2018. Today, the shares are about 50% higher than our cost, meaning that they again trade at a low-teens multiple of current earnings. And again we find this to be undervalued relative to the long-term prospects for the business. Our second largest positive contributor was Express Scripts (ESRX), which appreciated almost 25%. This was despite an attempt made by Carl Icahn to break up the company’s pending merger with Cigna. Icahn wrote a letter on August 7th explaining why Cigna shouldn’t buy ESRX, even claiming that the deal “may well become one of the worst blunders in corporate history.” In his letter, he trotted out a number of ideas that have been used to criticize ESRX and the PBM industry in the past, including regulatory risk, risks to pharmaceutical rebates, and the risk of a decline in profitability after the expiration of ESRX’s contract with Anthem. While we discussed our reasons for owning a stand-alone ESRX in our 3Q17 letter, the best response to Icahn’s points came from Glenview Capital, whose missive rebutted Icahn’s points so thoroughly that we were wincing by the end. The piece explains:

Unfortunately for Icahn’s ESRX short position, ISS and Glass Lewis, who advise institutional shareholders on votes of this nature, voiced their approval for the merger on August 10th. To his credit, Icahn made the quickest about-face of his investing career, abandoning his effort to scuttle the deal on August 13th. Shareholders overwhelmingly approved the deal on August 24th. The DoJ approved it in early September. While the merger is still in the final stages of closing, the share price of ESRX has appreciated substantially towards the ~$100 value of the merger to ESRX shareholders. We made no material trades in the quarter. This is a first for the FV strategy--never before have we so fully executed on a strategy of thoughtful idleness. Of course, no rational investing strategy will produce trades in all time periods. Investment decisions ought to be based on a comparison of market prices to underlying business values, not on the schedule of the earth’s orbit around the sun or on the desire to simply do something. But then, what do we write about in a quarter devoid of portfolio changes? A short discussion of the value of patience is what we came up with. The human brain has spent precious few centuries evolving in the time of markets, portfolios, and compound interest, all of which reward patience. Rather, it developed in a dangerous, threat rich environment, where a quick reaction to new information costs little relative to the risk of getting eaten by a tiger. Man thus developed a tendency to act quickly: to be impatient. In securities markets, this bias towards action is not rational. After all, any form of trading involves costs, and good returns are not enough to justify a new investment--it must also outperform the position it is replacing. In addition, there are other biases which can compound action bias, such as the disposition effect and herding. These are exactly the sort of investor biases we seek to take advantage of to achieve market-beating returns in the FV strategy. Given the many bad reasons for acting, we might expect portfolio managers that can fight this urge to beat their peers. And in fact, lower-turnover mutual funds do outperform their more frequently trading competitors by 2.4% annually. We will continue waiting, only trading when we feel it improves the risk and return profile of the portfolio. We are grateful for your business and your trust, and a special thank you to those who have referred friends and family. There is no greater compliment. - Bireme Capital

1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |