|

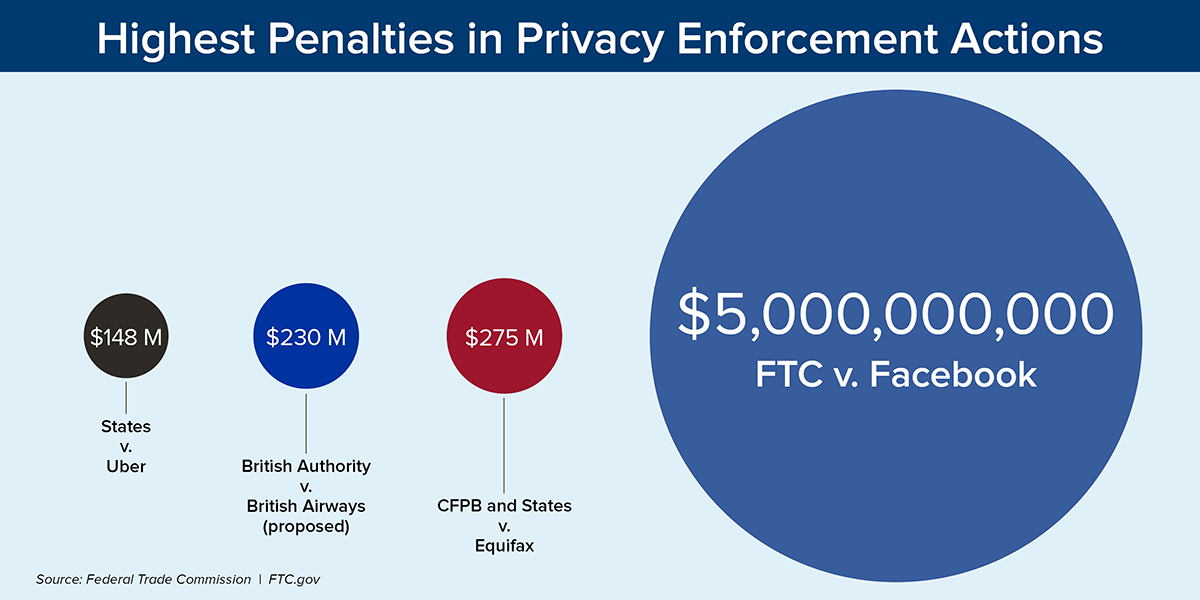

Over the weekend, we were the lede in a Fortune feature on the Twitter v Musk case. We were honored to be quoted along luminaries including Professors Eric Talley and Ann Lipton (see either the paywalled article, or a PDF version). We are overdue for an update on our biggest position as significant news has come out since we last wrote about Twitter in May. As a refresher, this is a merger arbitrage trade; Elon Musk signed a binding merger agreement to take the company private at $54.20 a share on April 24th. The company trades today around $39, a large discount to the deal price. The reason for the disconnect is simple: only a few weeks after the deal was signed – coincident with a downturn in the Nasdaq – Musk began to lay the groundwork to terminate it. The first public indication of his desire for an out was on May 13th when Musk tweeted that the deal was “on hold” pending investigation of the prevalence of bots on the platform. Since our post in May, many things have changed. First, Musk sent a letter on July 8th purporting to unilaterally terminate the contract. We used the resulting decline in Twitter’s share price to add to our position. Unsurprisingly, claims about spam accounts were front and center in Musk’s letter: While this analysis remains ongoing, all indications suggest that several of Twitter’s public disclosures regarding its mDAUs [monetizable daily active users] are either false or materially misleading. First, although Twitter has consistently represented in securities filings that “fewer than 5%” of its mDAU are false or spam accounts, based on the information provided by Twitter to date, it appears that Twitter is dramatically understating the proportion of spam and false accounts represented in its mDAU count. Twitter’s board chairman Bret Taylor immediately responded with a tweet that they would pursue legal action to enforce the contract. The Delaware Court of Chancery will adjudicate. Musk has pursued a “throw everything at the wall and see what sticks” strategy. His initial termination letter and complaint alleged, among other things, that Twitter had materially misstated mDAU, committed fraud when it stated that mDAU was the best metric to track engagement, refused to share information that Musk believed he was entitled to, had violated the ordinary course provision by firing employees and initiating lawsuits, and that more-favorable Texas law was actually applicable to the case rather than Delaware. And in light of new information from a purported Twitter whistleblower, he’s trying to amend his complaint to add even more attack vectors, as we’ll discuss below. The Court will look to the Merger Agreement to determine whether Musk has an appropriate reason for termination. For example, the agreement allows Musk to terminate if Twitter has wrongly represented information in its SEC filings to such an extent that the error would result in a “Material Adverse Effect” on its financial condition. The standard for this type of claim is very high. In fact, only once has the Court of Chancery allowed a buyer to walk away due to an MAE. That case, Akorn v Fresenius, found that Fresenius could walk because Akorn’s regulatory fraud, which was revealed after the merger agreement was signed, was so extensive that it would permanently impair Akorn’s earnings power. Akorn later went bankrupt. mDAU and Bots Here is the bot-related disclosure Musk has latched onto and is now calling a lie: The numbers of mDAU presented in this Annual Report on Form 10-K are based on internal company data. While these numbers are based on what we believe to be reasonable estimates for the applicable period of measurement, there are inherent challenges in measuring usage and engagement across our large number of total accounts around the world. Furthermore, our metrics may be impacted by our information quality efforts, which are our overall efforts to reduce malicious activity on the service, inclusive of spam, malicious automation, and fake accounts. For example, there are a number of false or spam accounts in existence on our platform. We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the fourth quarter of 2021 represented fewer than 5% of our mDAU during the quarter. The false or spam accounts for a period represents the average of false or spam accounts in the samples during each monthly analysis period during the quarter. In making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated. We are continually seeking to improve our ability to estimate the total number of spam accounts and eliminate them from the calculation of our mDAU, and have made improvements in our spam detection capabilities that have resulted in the suspension of a large number of spam, malicious automation, and fake accounts. We intend to continue to make such improvements. After we determine an account is spam, malicious automation, or fake, we stop counting it in our mDAU, or other related metrics. We also treat multiple accounts held by a single person or organization as multiple mDAU because we permit people and organizations to have more than one account. Additionally, some accounts used by organizations are used by many people within the organization. As such, the calculations of our mDAU may not accurately reflect the actual number of people or organizations using our platform. There are many reasons why this paragraph cannot be used by Musk to back out of the deal. First, note that Twitter does not actually represent that <5% of its accounts are spam accounts. Instead, it represents that <5% of its mDAU are spam accounts. mDAU stands for “monetizable daily active users,” an internal Twitter metric that already screens out many legitimate and illegitimate Twitter accounts. This distinction clears up some of the confusion from some commentators – including Musk himself – who have noted that spam appears to be much more prevalent on the platform than a mere 5%. Second, a close reading shows that Twitter does not actually represent that <5% of its mDAU are spam accounts. Instead, it represents that it has a subjective, manual process for auditing mDAU for spam accounts that have slipped through its automated screening process. It says that this subjective process results in an estimate for spam mDAU accounts, and that this estimate is <5%. Musk may have decided that he doesn't like Twitter’s process, and perhaps he can even demonstrate that he has a vastly superior approach, but that is not inconsistent with Twitter’s representation, which explicitly states that their estimate “may not accurately represent the actual number of such accounts.” Nonetheless, Twitter’s process for estimating spam in mDAU seems eminently reasonable. It involves a human audit, in triplicate, of 100 mDAU per day (~9,000 per quarter). Assuming a random sampling, this is more than enough to generate a statistically accurate estimate of the share of bots on the platform. Any beginning statistics textbook will confirm this, and similarly sized data sets are used to test the most important questions of our time. For example, the Pfizer / BioNTech vaccine was tested on less than 5,000 children aged 6 months to 4 years before it was approved in that age group. Finally, even if Twitter lied about the existence of this process, we do not believe this would materially impact Twitter’s business. A simple falsehood in one of Twitter’s financial statements is not enough to derail the merger; the lie must be material to the long-term value of Twitter’s business. Akorn gives a rough guideline that a 20% impact would reach the threshold for materiality. Twitter primarily makes money by showing ads, and advertisers carefully measure the impact of their ads. Advertisers will spend $5b on Twitter in 2022 because of the verifiable performance of ads on the platform, not because Twitter told them it had so many millions of accounts according to some vaguely defined internal metric. In fact, if Twitter has significantly overstated its mDAU, that arguably increases the value of Twitter, since it means that a smaller number of users generates $5b of revenue, and thus the value per user and the TAM is larger than expected. Twitter’s complaint On July 15, Twitter filed a complaint asking the Court of Chancery to compel Musk to close the deal. The complaint details the numerous ways in which Musk’s strategy is a “model of bad faith.” It shows how each of Musk’s supposed concerns are mere pretexts to cover up his remorse over signing the agreement immediately prior to a turn in market valuations. This was discussed in detail on the podcast we did with Andrew Walker. The complaint also notes the various ways that Musk has violated the agreement, including how Musk’s public disparagement of the company – like responding to the Twitter CEO’s tweets about the deal with a poop emoji – is a violation of the agreement. If Musk is found in breach, it could prevent him from pulling out of the deal. The Judge The judge, Chancellor Kathaleen McCormick, is a key factor in the litigation. A Harvard-educated lawyer, she is the head of the Delaware Court of Chancery, arguably the most powerful business-focused court in the world. By all accounts she is smart, tough, and not one to treat a defendant differently simply because they are a billionaire. This is key when it comes to adjudicating cases involving Elon Musk, two of which are now scheduled for October trials in her courtroom. As Chancellor, she assigns cases to Court of Chancery judges. And so it was notable when she decided to take the Twitter case for herself, despite the immense amount of work it would entail and her already busy schedule. She wanted this. Or perhaps she was allocating based on experience, as this is not her first broken merger case. In fact, the last time she issued an opinion in such a case, she ruled for “specific performance,” exactly what Twitter asks for here. In that opinion, she ordered a private equity firm to close its deal to buy a cake decorations supplier. The deal was closed a few days later. Motions, proposed orders, and subpoenas have been flying for months now in the Twitter case, and Chancellor McCormick has not held back when settling disputes between the two sides. During one pre-trial tussle over discovery, she remarked that “no one in their right mind has ever tried” to gather the information Musk was seeking and denied his “absurdly broad” request. Her other interim rulings have also consistently been in Twitter’s favor. The Whistleblower One surprise has been the emergence of a purported whistleblower, Peiter Zatko, the former head of security at Twitter. In an 84-page document sent to the FTC, SEC, and DOJ in early July, he makes many claims about security and privacy issues at Twitter and how that was communicated to users, the board of directors, and investors. This is far from the first time an internet company has had a whistleblower file suit. Facebook, for example, has had at least three of them over the last few years, one of which resulted in a $5b FTC settlement. This has not been lost on Musk’s lawyers, who wrote the following in a letter dated August 29, where they purport to terminate the merger agreement for additional reasons: Mr. Zatko’s statements purport to reveal that Twitter has not been, and perhaps never will be, in compliance with that decree. Twitter has already paid a fine of $150 million for violating an aspect of that decree, and Facebook recently paid $5 billion for similar user data violations. In addition, the Zatko Complaint alleges that Twitter has repeatedly violated the 2011 FTC consent decree (by going well beyond the violations settled in Twitter’s recent $150 million settlement), in addition to breaching a slew of other data privacy, unfair trade practice, cybersecurity, and consumer protection laws and regulations that Twitter must comply with, including but not limited to Twitter granting agents of the Indian government access to confidential user data. These violations would have material, if not existential, consequences to Twitter’s business, constituting a Company Material Adverse Effect as defined in the Merger Agreement. We feel that the claims relating to the FTC consent decree are the most worrisome portion of Zatko’s letter, and we are not alone. Technology analyst Ben Thompson also thought the FTC-related section was “by far the most substantial part of the complaint.” Thompson also noted the $5b Facebook fine: [The allegations are], frankly, extremely believable, and, in retrospect, makes one wonder why the FTC did not look more deeply into the 2020 hack in particular (the FTC did recently fine Twitter for intermingling phone numbers used for two-factor authentication with data used for advertising, in violation of the 2011 order). I think it’s safe to say they will look more deeply now, and if Mudge is correct, this seems like a violation of at least the scale of Facebook’s, which came with a $5 billion fine. While we agree that the alleged FTC violations are cause for concern, it is an error to assume a fine on the order of the Facebook settlement is likely. The truth is that $5b is about 20x higher than previous privacy-related fines. The FTC commissioners showed this when presenting the settlement to the public: In fact, the commissioners admitted that the fine was larger than they could’ve gotten had they gone to court: The $5 billion penalty assessed against Facebook . . . is orders of magnitude greater than in any other privacy case, and also represents almost double the greatest percentage of profits a court has ever awarded as a penalty in an FTC case. If the FTC had litigated this case, it is highly unlikely that any judge would have imposed a civil penalty even remotely close to this one. When attempting to get a district court to approve the settlement, Facebook’s lawyers noted FTC’s statutory civil penalty authority is limited to $43,280 per violation, and past courts have ruled that this maximum applies on a ‘per day’ basis. This would’ve limited Facebook’s maximum FTC fine to a little over $100m, making the $5b settlement look huge in comparison. Shareholders even sued Facebook over this discrepancy, arguing that the additional $4.9 billion was a bribe designed to protect Zuckerberg, given that the settlement granted him broad immunity and absolved him of the need to submit sworn testimony. The lawsuit quotes FTC Commissioner Chopra as saying: “The government essentially traded getting more money, so that an individual did not have to submit to sworn testimony and I just think that’s fundamentally wrong.” For this reason, and because Twitter is a much smaller entity in terms of users and profits than Facebook, we think any FTC fines emanating from the Zatko complaint are likely to be in the sub-$300m range, and highly unlikely to be an MAE, which would necessitate a fine on the order of roughly $10b. The rest of Zatko’s claims have little relevance to the case and are very unlikely to in the aggregate result in an MAE, in our view. For example, how much does the value of Twitter decrease if some of their internal software is improperly licensed, as Zatko claims? Certainly not by the $10b that Musk needs to blow up the merger. Though Zatko’s complaint has caused a sharp decline in the stock price, it actually supports Twitter’s case regarding the prevalence of bots in mDAU. Executives are incentivized to avoid counting spam bots as mDAU, because mDAU is reported to advertisers, and advertisers use it to calculate the effectiveness of ads. If mDAU includes spam bots that do not click through ads to buy products, then advertisers conclude the ads are less effective, and might shift their ad spending away from Twitter to other platforms with higher perceived effectiveness. While we disagree with Mudge’s logic regarding the importance of the mDAU metric to advertising effectiveness calculations, Mudge makes it clear he does not think that Twitter’s mDAU count includes a plethora of bots. This of course runs directly counter to Musk’s central claim. Indeed, it confirms what we knew all along: there are plenty of bots on Twitter, just not in mDAU. Twitter remains our largest position. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. For current performance information, please contact us at (813) 603-2615.

Comments are closed.

|

Telephone813-603-2615

|

|

Disclaimer |