|

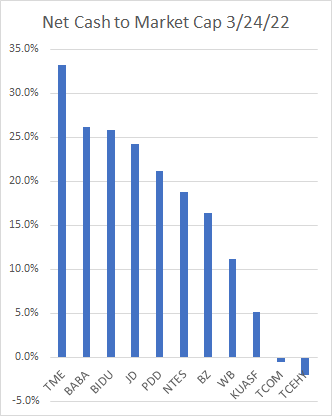

Due to geopolitical tensions, regulatory concerns and valuation compression, Chinese ADRs have taken a beating over the past year. The KWEB ETF, which tracks Chinese internet companies, is down nearly 70% from its peak. And even if we exclude the blowoff / Archegos top of Q1 2021, the index is still down 50% since late 2020. Some of these companies now trade at very attractive earnings multiples. As long-term value investors, this gets us excited. If management believes earnings are sustainable, they should use this dislocation to buy back shares at a discount. Buybacks would be very accretive to shareholders, and could catalyze a valuation rerating from the market. The question is: will management step up and pull the trigger? Or are they just as scared as the market? This is their moment of truth, and the firepower of these companies to do something is substantial: Some of these firms are taking action and have announced buyback plans. However they are generally quite small relative to the size of the net cash balances. Not a single one (that I’ve found) has announced a buyback that amounts to more than half of their net cash balance.

Tencent Music (one of our largest positions) said they’ve completed $553m of a $1b buyback that was authorized in 2021, and they will complete the rest in 2022. Still, this buyback is for less than a third of their net cash balance. Alibaba has increased their buyback plan from $15b to $25b. Still, this also amounts to less than a third of their net cash balance and less than a tenth of their market cap. Baidu announced that it repurchased $1.2b worth of shares in 2021, but has not updated the size of their buyback program (previously disclosed as $4.5b in total). To date their buyback pales in comparison to their gross cash of $27b and net cash of $14b. JD upsized its buyback program in December 2021 to $3 billion, but again this is tiny relative to $22.7b of net cash. PDD does not appear to have ever repurchased shares or commented on a buyback program, unless I’ve missed it. This is despite their net cash balance of $12b (21% of market cap). While we are heartened by the fact that companies like TME and BABA are making moves in the correct direction, all of these companies could go much bigger. Large buybacks could be a powerful signal that management believes earnings are sustainable, and a powerful catalyst for shareholders to realize the inherent value. Only time will tell if these companies will muster the courage to do so. |

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |