|

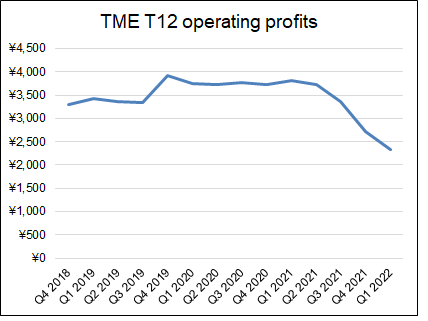

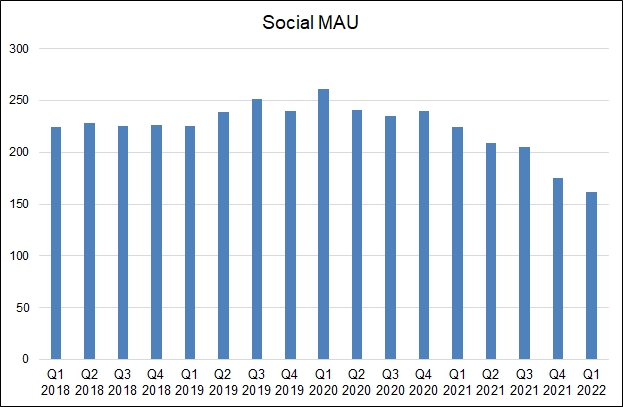

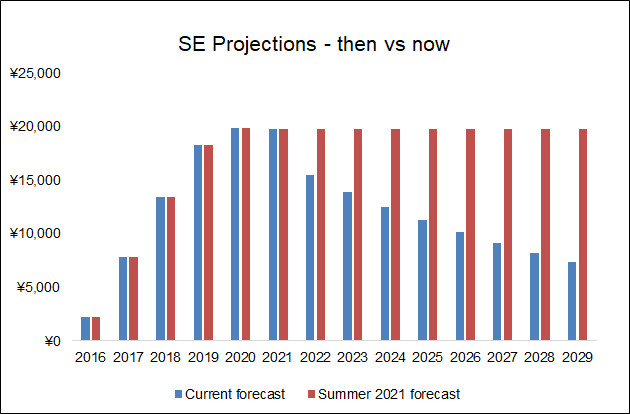

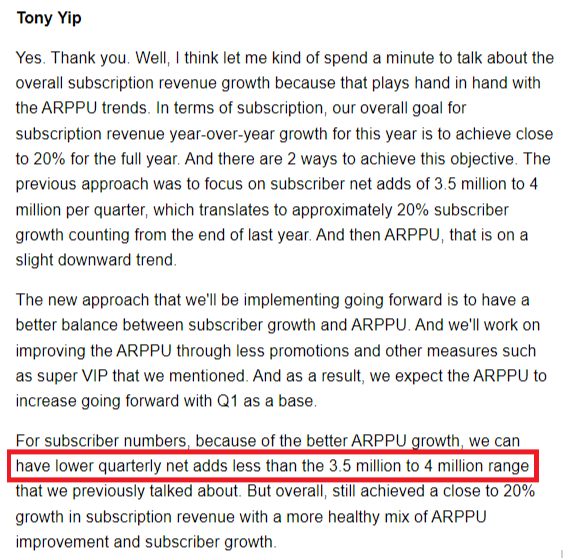

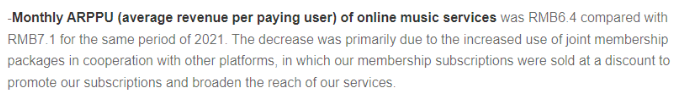

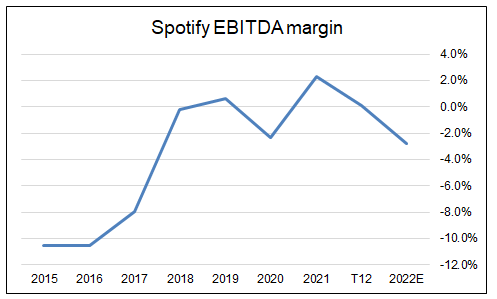

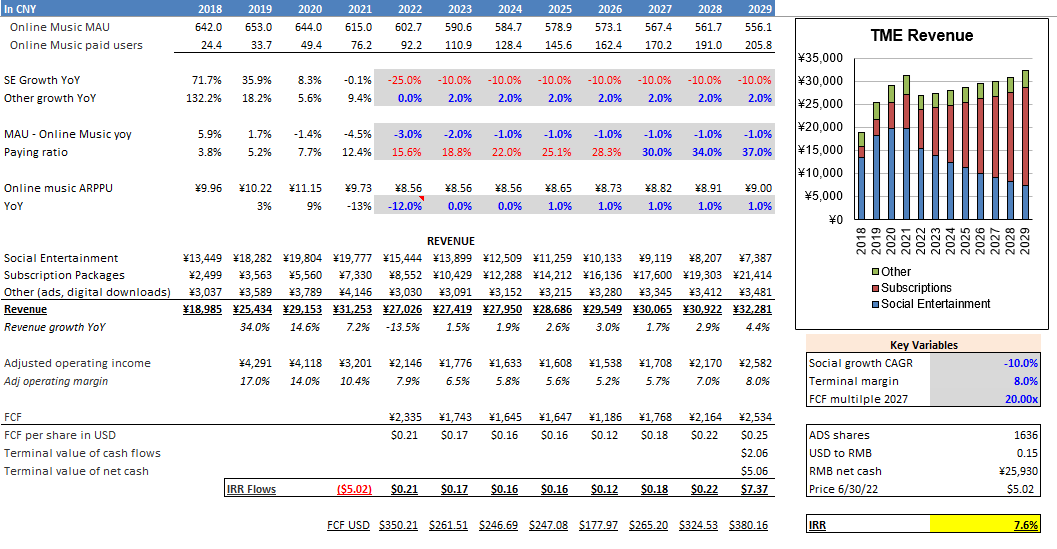

We exited our position in TME in early Q3. Here's why. The original story When we invested in Tencent Music about a year ago, we said the following: With over 800m users across its many apps, Tencent Music is the primary way that people in China interact with online music. Today, the majority of revenue comes from virtual gifts sent to streamers in its “Social Entertainment” segment, which has grown revenue from $300m in 2016 to $2.9b in 2020. Within this segment, the most popular app is WeSing, a karaoke app with hundreds of millions of users in China. While competition from platforms such as Douyin (the Chinese version of TikTok) is increasing, WeSing continues to generate substantial profits for TME. The smaller segment (by revenue) is a subscription-based business similar to Spotify, utilizing a “freemium” model and providing Chinese users access to millions of songs. Their apps Kugou, Kuwo, and QQ Music have more than 600m users, but as of Q2 2019 more than 95% of them were on the free tier. Since then an aggressive effort has been made to grow subscription revenue, and 30% of songs are now behind a paywall. This shift has driven rapid growth in paid users, and today almost 11% of users pay for access to these songs. The size and consistency of this segment’s growth is extremely impressive. How many other companies can add 5m paid users per quarter? The theory was that the Social Entertainment segment, with EBIT of more than $500m, seemed to fully support the $8b enterprise value of the company. Separately, TME’s music subscription business was already doing around $1b of sales despite just having begun on their journey to monetize >600m unpaid users. This resulted in substantial upside should the growth of subscriptions materialize as we projected and the Social Entertainment business continued to throw off profits. However, our thesis failed on multiple fronts. As a result, TME has generated large shortfalls in operating income relative to our projections. While we thought the business would grow, profits are actually down around 40%. The problems at WeSing The decline in the Social Entertainment segment was the primary cause of the TME earnings drop, and this decline was driven by a fall in active users, which were down 27% over the past year. Prior to our investment, MAU’s had been moving lower, but we were able to convince ourselves that these were normal fluctuations around a base of 200-250m active users. But since we’ve invested, TME has posted another 3 straight quarters of user declines, making it 5 in a row on a QoQ basis. ARRPU (average revenue per paying user) growth could not overcome this, and revenues in the segment declined materially. We think this decline may be inexorable. While TME blames the drop primarily on “macro and industry” factors, not all streaming businesses in China are experiencing such declines. For example, Kuaishou grew DAUs by 17% YoY in Q1 2022. TikTok/Douyin almost certainly grew users in China, and Alibaba’s China Commerce (which includes live streaming platform Taobao Live) business grew users by 10% YoY. Netease Cloud Music – a key competitor which we will discuss later – grew paying users for their live streaming business by 61% YoY. So this is a TME / WeSing specific problem, and we don’t see why it would go away. It seems that users have simply begun to prefer other live streaming apps, and the platform's network effects may be working in reverse. YoY user declines have been accelerating, from the single digits a few quarters ago to 27% in Q1 2022. But even if the decline slows from 27% in Q1 2022 to 10% annually for 2023-2026, revenues would fall from 19b Yen to <10b yen. The graph below shows how our forecasts for this segment have changed. We think this implies just 1b Yen per year of operating profit from the SE segment in 2026. If the rest of the business is not profitable by that point (as it stands today), the company may only do 700 or 800m Yen of net profit, which is less than $200m USD. This figure does not compare favorably to TME’s $8b market cap. It doesn’t even look cheap against the current $4b current Enterprise Value, which subtracts the $4b of net cash and investments. Paying 20x five-year-out earnings is not a recipe for success. Online Music - will it ever be profitable? When we originally invested in TME, we expected the online music business to become profitable over time. But we did not invest in the company simply on this speculation; the valuation appeared well supported by profits in the SE segment. But with profits from that business collapsing, the long-term margins in the Online Music segment take on much greater importance. While the segment has been growing paid users, the other key input to revenue, ARPPU has disappointed materially. While we assumed 1% annual growth in ARPPU, it actually declined by 11% in the past year. While the company says that they expect ARPPU to increase going forward, with “Q1 2022 as a base”, they also implied that this may come at the expense of paid user growth: This is not a good sign. It implies that paid users are very sensitive to price, which is understandable but not what we had been expecting for a near monopoly. We had also assumed that the low absolute price of 9 RMB per month would allow for both user growth and ARPPU growth. One possibility is that we simply underestimated the strength of the competition, namely Netease Cloud Music (NCM). We assumed that a two-company market would act oligopolistically, and allow greater profits than the four-way slugfest between Spotify, Google, Amazon, and Apple in developed markets. But perhaps two aggressive competitors with a commodity product and a digital (ie, mostly fixed) cost structure is sufficient to create a race to the bottom in terms of pricing and profitability. NCM’s most recent quarterly results show that the company is in fact operating in a fairly aggressive manner. Paying users were up 50% YoY, to about 37m, and ARPPU fell from 7.1 RMB/mo to 6.4 RMB. In other words, NCM has dropped their effective pricing to a level that is 20% below TME’s. Here’s what NCM said about their decline in ARPPU: While both companies have an 8 RMB/mo bottom tier of pricing, NCM’s promotions may continue to exert downward pressure on TME’s pricing and/or user growth. Given this level of competition from NCM, it may be that TME’s long-term margins on the subscription business will not be materially different from Spotify's. This would be disastrous, since Spotify remains unprofitable on $12b of 2022e revenue. Even if Spotify eventually raises their margins, as their valuation implies they can, following in Spotify's footsteps would mean a very long road to profitability for TME's subscription business. By then, the Social Entertainment business may have withered to almost nothing. Projections Given what we know now, our current model for TME assumes the following:

With these assumptions, the stock would generate a mere 7-8% IRR from current prices. Not terrible, but we have better opportunities. |

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |