|

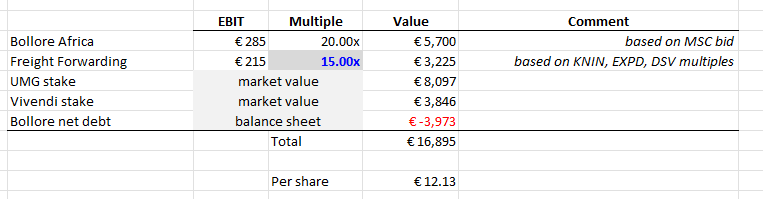

Bollore is a French conglomerate controlled by Vincent Bollore. We have been shareholders for years and wanted to send out some updated thoughts. First, some background. Bollore's primary assets are Vivendi (29% stake worth around 4b EUR), Universal Music Group (18% stake worth around 8b EUR), and 100%-owned operations in African Logistics, Freight Forwarding and Electric Batteries. For more detailed thoughts on the individual segments, please see our full writeup from 2019. The market has never given Bollore full credit for these assets, even when those assets have been publicly traded. Today, Bollore's ~12b EUR worth of Vivendi and UMG almost gets you to more than the entire market capitalization of the firm when netted against ~4b EUR in Bollore-level debt. Essentially, the market is saying that Bollore's other businesses have no value. The "conglomerate discount" thus swallows up businesses which appear likely to do more than 900m EUR of EBITDA in 2021. There are a number of academic theories as to why the conglomerate discount exists. One driver is the principal-agent problem: management (the agent) simply has different incentives than shareholders (the principal). Management is incentivized to ensure and grow their own compensation, which may mean building an empire of diversified businesses rather than pursuing a higher-returning, more focused strategy. And just as important, management is incentivized to retain excess capital as opposed to paying it out as dividends. Inefficient conglomerates may be the result, and such firms trade a discount due to the implication that capital will be poorly reinvested. Academic research has found typical conglomerate discounts to be in the range of 10-15%. But of course the proper discount should vary based on the quality of management. Some conglomerates overcome the pull towards bad decision-making. Signs of this include: 1) Buying back stock when it is cheap 2) Paying large, chunky dividends 3) Selling off businesses when you get a good price 4) Spinning off key subsidiaries IAC Corporation (some background here) is a great example of this. Over the years, Chairman Barry Diller has maximized shareholder value at IAC, outperforming the S&P 500 and generating his multi-billion dollar net worth. IAC has executed more spinoffs than any other firm, and their progeny include such well-known businesses as Home Shopping Network (later QVC), TripAdvisor, Ticketmaster, Hotels.com, Expedia, Match, Vimeo and others. So when you own IAC, you know that the CEO (who answers to Diller) is not pursuing deals simply to increase the size of his empire -- he is going to spin them to you at the end of the day. Bollore is no stranger to spinoffs, with Bollore-controlled Vivendi recently issuing one of the largest in recent history. While the UMG spin was done downstream of Bollore itself, it indicates Vincent Bollore's willingness to shrink the fiefdom of his son Yannick, the Chairman of Vivendi. While Bollore still owns 18% of the company, UMG is now totally independent and no Bollore family members are involved in its operation. That business could be acquired at any time. But the most interesting move came more recently, when the family put its African Logistics business up for sale, hiring Morgan Stanley in October 2021. This resulted in a Christmastime offer of 5.7b EUR from MSC Group. This sale would be a massive change to the Bollore business, with the company's logistics arm exiting an entire continent. It requires the sale of a stable, profitable business which the family painstakingly grew over a period of decades. The price for this transaction seems to be quite good - about 20x EBIT. Not bad for something which is valued at zero by the stock market. It will be interesting to see what happens to this large chunk of capital should the deal come to fruition. Today, we think the total value of Bollore's assets is about almost 17b EUR today or 12 EUR per adjusted share. This implies a conglomerate discount of more than 50%, a level which is completely out of line with historical precedent. It also gives the Bollore family zero credit for the shrewdness of their recent moves nor their willingness to cede control of businesses when the time is right. We think Bollore stock will substantially outperform the market from current levels.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |