|

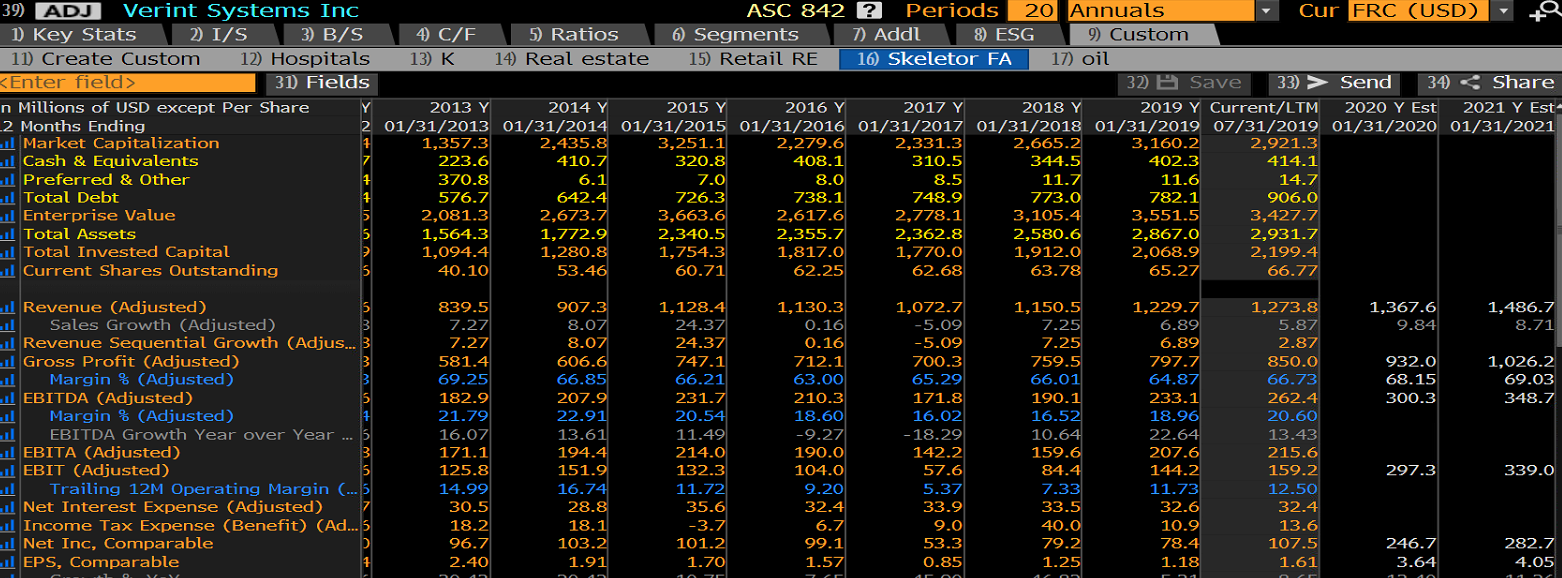

Today's post is on Verint Systems (VRNT), a software company started under Comverse Technology in the 1990s and IPO'd in 2002. I decided to take a look at this company because it's in the software business -- an industry I like -- and it was trading near a 3-year low price. We find that screening for this level of negative sentiment provides good hunting ground for stocks that are affected by cognitive biases. For more background on our cognitive bias framework for finding undervalued stocks, see here. The financials Here's a look at their numbers over the last few years: What is clear at a glance is that this company is not exactly a rocket ship: sales appear to be growing at a mid-single digit rate in recent years and are nearly flat since 2015. Adjusted EBITDA margins are flat at around 20%, lower than many software companies. Shares outstanding are up more than 50% since 2013, probably evidence of the company's looseness with share issuance for acquisitions and employee compensation. In an idea shamelessly stolen from Andrew Walker of Rangeley Capital, I’ve decided to start writing down my thoughts on stocks more often. Some of these thoughts may be quite long, as today’s is. Some may be merely a paragraph or two. But either way, I think putting my thoughts out into the world more frequently will help clarify them.

Today’s stock is Pershing Square Holdings, which trades as PSH on both the LSE and Euronext exchanges. In this post I may refer to PSH (the fund itself), PSCM (the asset management company), and Bill Ackman (the billionaire founder of both entities). |

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |