|

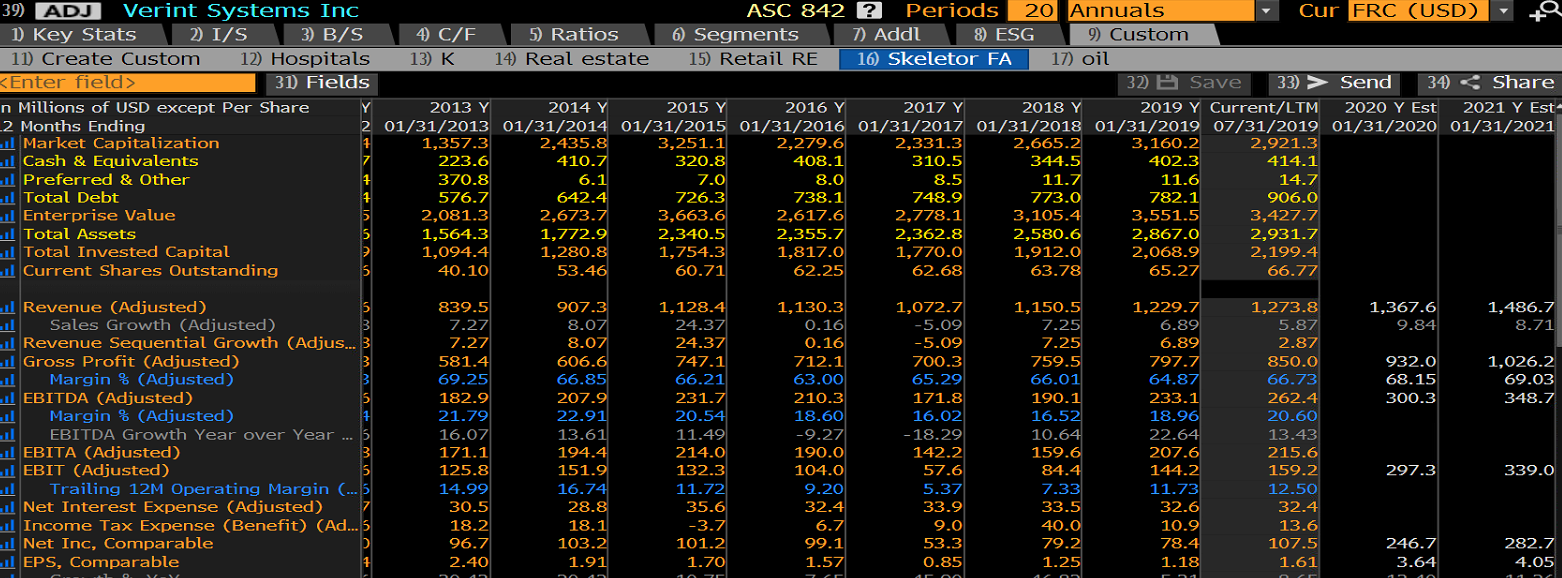

Today's post is on Verint Systems (VRNT), a software company started under Comverse Technology in the 1990s and IPO'd in 2002. I decided to take a look at this company because it's in the software business -- an industry I like -- and it was trading near a 3-year low price. We find that screening for this level of negative sentiment provides good hunting ground for stocks that are affected by cognitive biases. For more background on our cognitive bias framework for finding undervalued stocks, see here. The financials Here's a look at their numbers over the last few years: What is clear at a glance is that this company is not exactly a rocket ship: sales appear to be growing at a mid-single digit rate in recent years and are nearly flat since 2015. Adjusted EBITDA margins are flat at around 20%, lower than many software companies. Shares outstanding are up more than 50% since 2013, probably evidence of the company's looseness with share issuance for acquisitions and employee compensation. The valuation, though, is relatively undemanding compared to other software vendors - roughly 13x trailing EBITDA and 3x sales. The PE on trailing GAAP earnings is about 28x, and about 12x on forward, adjusted earnings. What they do Verint's original software products were designed to capture and store data, primarily voice and video. The top customer use cases were call centers, where Verint would record the call audio, and in government surveillance, where they would collect CCTV footage for foreign government entities. Over time, they developed algorithms to further process and analyze this data for their customers. Here's how the company's 2003 annual report described the functions their software performed: From phone call and CCTV data capture, Verint's suite of software products expanded over time, providing more and more functionality to "support" center operators (customer requests now come in many forms other than phone calls) and governments. But those two customer groups still represent the primary division between Verint's business segments: Customer Engagement and Cyber Intelligence. Here is how the company describes Customer Engagement ("CE") in their latest 10-K: "As The Customer Engagement Company™, Verint is an established global leader in cloud and automation solutions for customer engagement with over two decades of experience helping organizations worldwide achieve their strategic objectives. Our strategy is to help organizations elevate customer experience and at the same time reduce operating cost by simplifying, modernizing, and automating customer engagement across the enterprise." Basically, this is multi-functional call center software. Customers of this segment include companies like Uber, who use Verint software to manage staffing levels in their physical support locations (called "Greenlight Hubs"). A Google search shows Uber with many Verint-related job openings, such as this one. Notably, though, Google uses a Zendesk cloud-based application for their main support center software. This segment accounts for about 2/3 of the revenues of the company, and is its most important line of business (as you might have guessed from the self-declared nickname "The Customer Engagement Company"). About 75% of the company's profits are from CE. The Cyber Intelligence segment accounts for the remaining 1/3 of sales (and a smaller portion of profits). This segment provides a wide range of software solutions to governments and enterprises seeking to protect their data, people, and facilities. Short report As a mission-critical software provider, Verint's current valuation at 11x 2019e EBITDA appears cheap at first blush. Their largest competitor, NICE Ltd, trades at 17x EBITDA. Most cyber security software firms trade even more richly than that. But publicly available reports written by short sellers cast this valuation in a different light. The most comprehensive report was released by Spruce Point in May of 2019. VRNT was trading at around $60 per share at the time, vs $43 today. That report laid out some troubling allegations:

Overall, I find it most concerning that Verint may not be growing organically and is dragging its feet on the transition to the cloud. The company's recurring earnings adjustments, which account for more than half of reported EBITDA, also give me pause. I found myself agreeing with most of Spruce Point's analysis as I read their piece, and overall the numbers seem to indicate that Verint is a troubled, (mostly) legacy software provider that does about $100m in recurring free cash flow (the company did $178m last year but $66m was from stock comp). At a market cap of $2.8b as of today, I'm going to pass. I might take another look if the stock got cut in half to about $22 per share. -Evan Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may have positions in the securities mentioned.

Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. For current performance information, please contact us at (813) 603-2615. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |