|

Elevator pitch

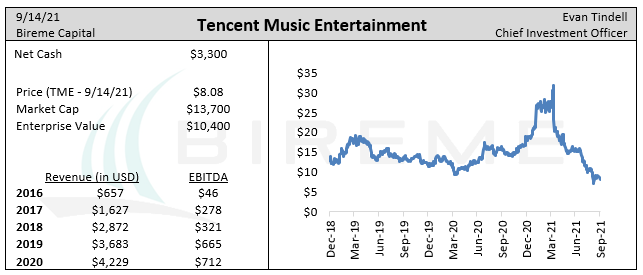

The history of Tencent Music is one of exponential growth, having increased revenues from 4.4b RMB to 32b RMB over the past 5 years. Today they dominate the online music business in China, with 800m users across multiple platforms. But despite generating nearly $5 billion in revenue, their subscription business has barely begun to scratch the service in terms of monetization. The stock price has collapsed in recent months, first with the liquidation of the Archegos fund -- a major shareholder -- and more recently with the decline of all stocks related to the Chinese internet sector. We think investors worried about the regulation of these companies are falling prey to narrative bias, attributing all actions by the Chinese government to a ruthless power grab. A deeper look reveals a government that is just reining in practices that would’ve been banned in Europe a long time ago. This is exactly the type of investor bias that we seek to exploit in our Fundamental Value strategy. The stock trades at a record low of just 14x ‘20 EBITDA and 17x ’21 EBITDA, a pedestrian valuation for a company that is likely to double its revenues over the next 6-7 years. We think investors buying today, at a stock price of less than $8, will generate an IRR of more than 15% over that time period. |

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |