|

In an idea shamelessly stolen from Andrew Walker of Rangeley Capital, I’ve decided to start writing down my thoughts on stocks more often. Some of these thoughts may be quite long, as today’s is. Some may be merely a paragraph or two. But either way, I think putting my thoughts out into the world more frequently will help clarify them. Today’s stock is Pershing Square Holdings, which trades as PSH on both the LSE and Euronext exchanges. In this post I may refer to PSH (the fund itself), PSCM (the asset management company), and Bill Ackman (the billionaire founder of both entities). Closed-end Funds The first mutual fund, started by a Dutch merchant in 1774 [1], was designed to pool the capital of a group of investors and own shares of a number of different companies. The idea was to decrease single-stock risk, and was in large part a reaction to the collapse of the East India Company in 1772, which ruined many individuals. This fund was "closed-end": once the 2,000 units were sold, investors could only participate by buying shares in the open market from others who wished to exit or reduce their investment. This sort of fund was the only type that existed until the Massachusetts Investors Trust was created in 1924. This was an "open-end" fund, which meant that the investment company agreed to repurchase shares -- at net asset value -- from anyone that wished to sell. This arrangement reduces the risk for an individual investor. If you know you can sell at fair value, you don't have to worry about liquidity risk (the chance that so few people will want to buy when you need to sell that you will be required to offer a discount). This risk is not theoretical: closed-end funds often trade at 5-10% discounts to net asset value [2], and rarely trade at premiums. Reducing this risk proved very popular with investors, and open-end funds eventually took over the industry. Today, there are $21 trillion in assets invested in US-based open-end funds; closed-end funds have just $250 billion in AUM [3]. Pershing Square Holdings is one of these closed-end funds. Its NAV is about $27, up 57% for the year. However its price is a little under $20, implying a roughly 28% discount. Some investment pitches on the name have argued that this discount is too large, and must close. Pershing Square themselves has commented that they don't view the discount as rational: "The second big drawback of being structured as a European closed-ended fund rather than a U.S. corporation is that many investors lump PSH into a category with completely unrelated “investment funds” about which there is much received wisdom. While we chose the closed-ended fund structure for its tax benefits and long-term stable capital, for now we are branded with the closed-ended fund nomenclature and its negative perceived attributes. Pershing claims the best description of the firm is a "publicly traded investment holding company," not a hedge fund or a traditional closed-end fund. The implication is that this sort of vehicle should not trade at a discount. Here are the reasons they give for this claim:

The problem with this list is as follows: #1 and #2 are also true for many closed-end funds. This doesn't stop them from trading at a discount. Regarding #3, most private equity funds that are more than a few years old have returned some amount of capital to investors. And most private equity funds have significant ownership by the firm's partners. Neither of these attributes stop LP stakes in PE funds from trading at substantial discounts to net asset value. In fact, PSH looks a like a PE fund in some important ways:

As it turns out, average PE fund discounts on secondary markets are a little higher than typical closed-end mutual funds: a paper from 2017 finds an average discount of 13.8% and a median of 9%. Therefore, if we knew nothing more about Pershing/Ackman, we might say that 10% is a good starting point for a proper discount to NAV. Instead, let's take a deeper look at the four items above and see if an investment in PSH has any advantages over the average PE fund. Capital returns Here, I think that PE funds look better. Most funds have a ten year or so stated lifetime. While many funds extend this, the GP's reputation rests on the return of investor capital in a reasonable amount of time. After all, the GP will almost always look to raise another fund which requires continued investor goodwill. PSH does not have this constraint. They have no timeline for returning capital, and in fact, they have some incentives to not return capital: it reduces the AUM of PSCM, which reduces management fees and performance fees paid to the GP. This may be offset by Ackman's desire to raise additional capital in the future. Investment strategy Here, I give the nod to PSH. In their annual report, they discuss the potential benefits of the PSH investment strategy as compared to private equity:

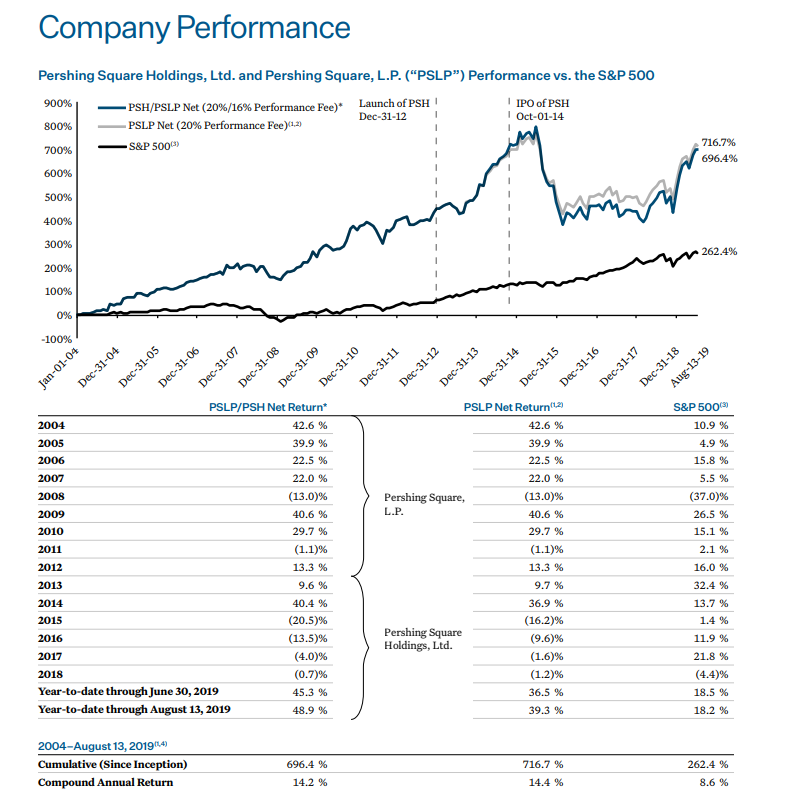

I think most of these claims have merit. #3 through #5 give PSH the potential to generate superior returns to PE funds despite the lower use of leverage. #1 improves the actual realized returns to investors in PSH (relative to PE), whereas #2 lowers risk. Fees PSH's fees are paid to Pershing Square Capital Management, an investment vehicle founded by Bill Ackman in 2004. The fees paid include a 1.5% management fee and a 16% performance fee. Importantly, the performance fees are only paid above a high-water mark, which stands at $26.37 [4]. As of year end 2018, this figure was well ahead of PSH's NAV of $17.30. However, the firm's excellent YTD investment returns year to date have eliminated this gap; NAV stood at $26.89 as of 9/17/19. Given the fact that the firm is above its high water mark, it is quite likely that performance fees will be paid on a going-forward basis. In other words, the performance fees are in play from here on out. With this in mind, I rate PSH's 1.5/16% fees as only slightly better than the average private equity fund [5]. Track Record Pershing Square, and its leader Bill Ackman, have one of the industry's most enigmatic track records. Since inception in 2004, $1,000 invested in the fund has turned into about $8,000, vs about $3,600 if invested in the S&P 500. This huge multiple on invested capital has been generated largely without leverage. That being said, prior to 2019, the fund had suffered from four consecutive years of losses, underperforming the market by 67%. Said another way, if you had invested in PSH at year end 2014, by year end 2018 you would have half as much as if you had invested in the S&P 500. In his attempts to right the ship after years of underperformance, Ackman has attributed the firm's poor performance from 2015 to 2018 to a few factors [6]:

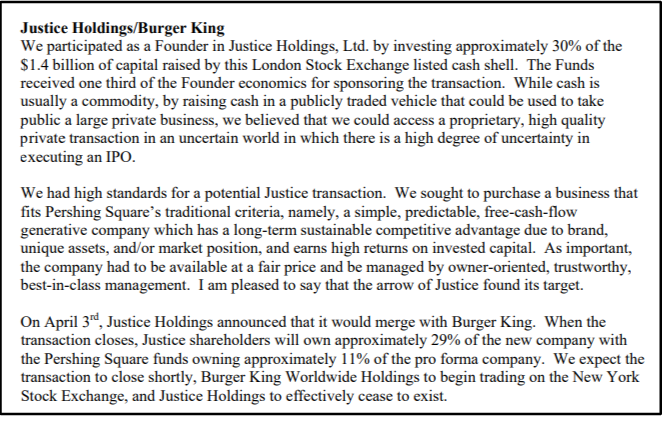

Regarding operational distractions, Ackman's deputy Nick Botta has taken over all day-to-day organizational and management duties. The idea is that this should give Ackman the time to dig into individual names and generate the analysis and insight required to regain Pershing’s performance edge. Regarding the types of companies they are invested in, the current portfolio does seem to better reflect Ackman's stated investing beliefs. Between SBUX, LOW, UTX, BRK, ADP, QSR, and HLT, these businesses represent extremely strong consumer-facing brands and large barriers to entry. They aren't incredibly cheap statistically, but these are businesses that have almost no chance of turning out like Valeant. These are exactly the type of stocks that Ackman has made lots of money on in the past. In fact, even during the Valeant years of 2015-2017, Ackman was notching some big wins on this sort of company. He was also making some sound investments that would eventually show up in returns in 2018 and 2019. Canadian Pacific: Ackman fought for board seats at the underperforming railroad and won in 2012. His handpicked CEO went on to turn around the business, generating a 4x return for Pershing Square investors. They sold their final shares in August 2016. Justice/Burger King/QSR: in 2011, PSCM invested $500m investment in Justice Holdings, a blank-check SPAC based in Europe. This SPAC bought 29% of Burger King from 3G and listed on the NYSE. Below is what PSH said about this investment in 2012. It is interesting to look at Ackman's contemporaneous investment thesis on this name, as it shows how squarely it fits with Pershing's historical investment criteria. This investment has been extremely successful, despite plenty of doubters along the way. The company has since turned around Burger King, growing the business both organically and through timely acquisitions of Tim Horton's and Popeyes. PSH's position in QSR is now worth almost $3 billion. Chipotle: Ackman first invested in CMG in 2016 and was roundly criticized. CMG had been experiencing dramatic food-safety problems, and some of the worst of their business deterioration was still ahead of them when PSCM invested. PSCM was underwater on this position for over a year, and would double down at around $300 per share. After seeing a stabilization of the business and recent increases in same-store sales, the stock now trades at over $800 per share. ADP: In 2017, Pershing initiated a proxy contest at ADP. In his presentations to shareholders and the ADP board, Ackman argued that the company needed to improve operating margins (among other things). Pershing lost the vote, although they did convince proxy advisors Egan-Jones and Glass Lewis to back their slate of directors. Although they did not win board seats, Ackman credits his involvement with lighting a fire under management, and notes that the company's current EPS forecast of $7 by 2021 dwarfs the goal of $4 that ADP had when Pershing first invested. Since Pershing's involvement, ADP has returned over 40% vs about a 25% return for the S&P 500. So even during the four years of losses, some good things were happening under the hood. If Ackman had never heard the name "Valeant," I suspect the story around Bill Ackman would be a lot different. And that story may already be changing. After a monster 2019 to date, and a 2018 that saw some outperformance, the inception-to-date track record of Pershing Square remains market-beating: 14.2% annualized vs 8.6% for the S&P 500. While I don't put a ton of stock into Ackman's pre-2011 track record, I also think he is better than what the last five years would indicate. And he appears to be returning to what created his pre-2015 track record in the first place. That said, his historical alpha of 5-6% annualized is eerily similar to that generated by US private equity over the last 15 years [7]. And yet, as we've noted, private equity LP stakes still trade at median discounts of about 10%. The proper discount and final thoughts It seems likely to me that Ackman can outperform the market before fees going forward. However, I'm not sure I'm willing to bet that he can outperform after his 1.5% management fee and 16% performance fee. This is not dissimilar from my view on go-forward returns in most private equity vehicles. Since investors in PSH are stuck with their fee arrangement in a similar manner to private equity LPs, it seems fair that PSH would trade at a similar discount of 10-15%. Notably, this is materially smaller than the 28% discount that stands in PSH today. If we assume that the NAV discount closes to 12.5% over five years, this implies a ~4% annual return tailwind on top of underlying portfolio returns. This would be a material tailwind. However, I personally seek investments that are more dramatically undervalued than PSH is at the present time. I may take another look if the NAV discount reaches 35 or 40%, or if the NAV again dives substantially below the high-water mark of $26.37. -Evan [1] For more background, see here. [2] See recent data from Invesco here, showing 5-10% average discounts. Malkiel 2005 calculated an average discount of 8.42% for the period of 1993-2001 and Thaler 1991 showed similar discounts in the 1970s and 80s. [3] Page 1 of the Investment Company Institute 2019 Fact Book. [4] From PSH's 2017 Annual Report. [5] Recent survey data from MJ Hudson indicates typical fees (weighted by assets) of PE funds are 1.5% management fees and 20% performance fees. [5] See page 17-23 of PSH"s January 2018 presentation. [6] See page 7 of Cambridge Associates Q1 2019 Private Equity Report, showing 490 bps of annualized outperformance vs the S&P 500 for their "US Private Equity Index" over the last 15 years. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may have positions in the securities mentioned.

Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. For current performance information, please contact us at (813) 603-2615.

Jim

10/21/2019 12:38:26 pm

do you see any advantages to buying in London vs. OTC vs Netherlands? Also, how does performance of British pound affect PSH shares traded in London? Thanks for a great article. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |