|

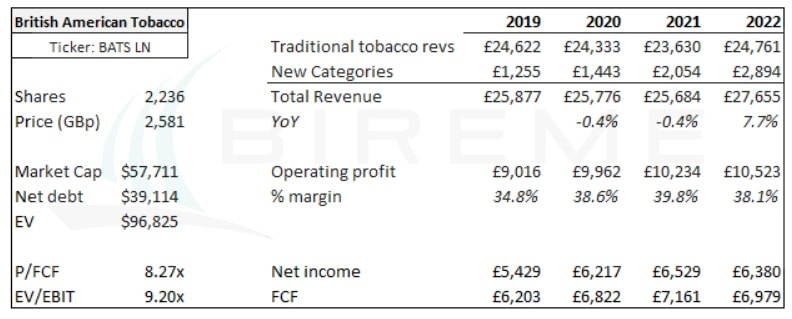

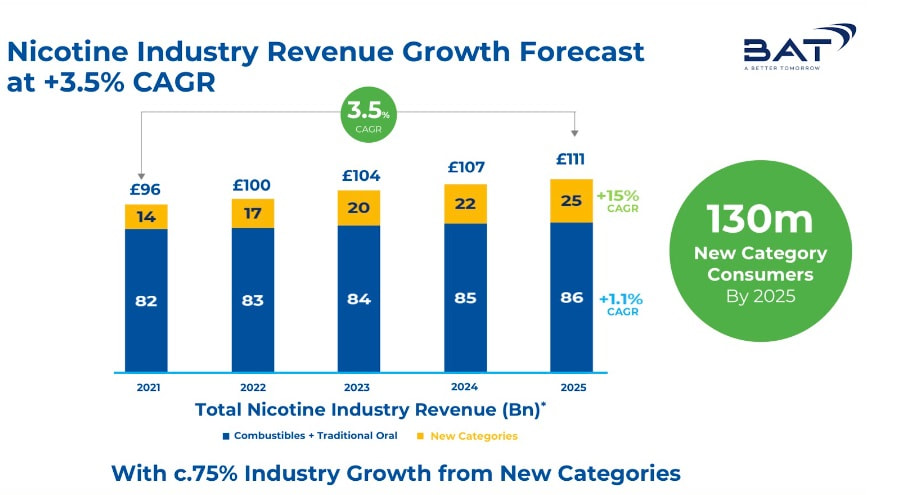

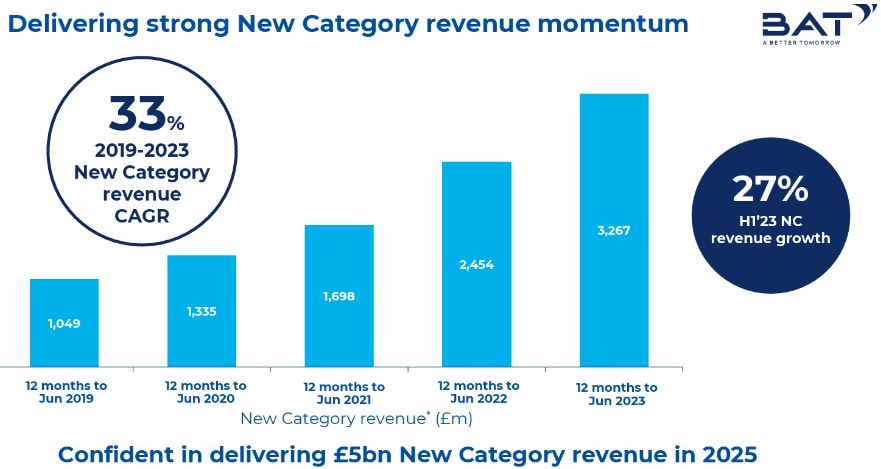

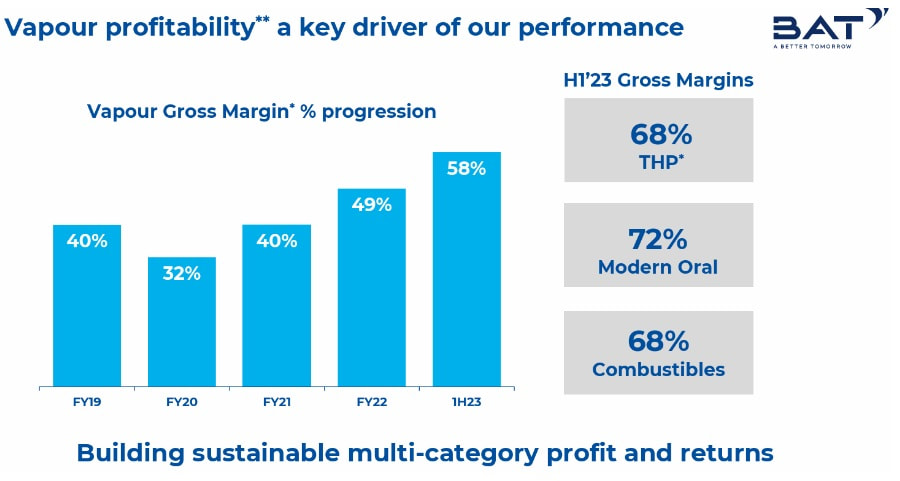

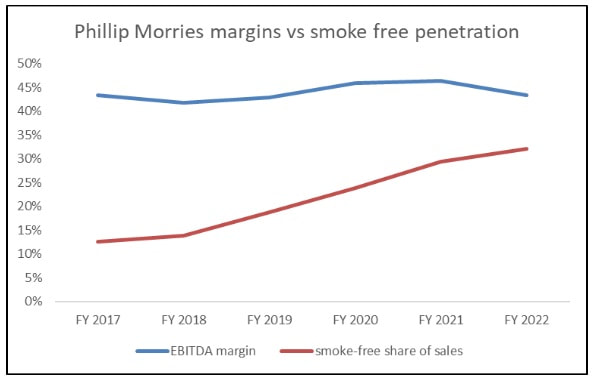

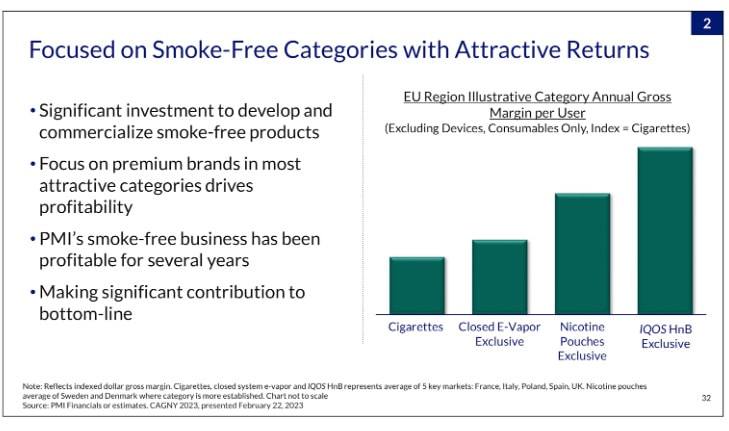

We recently invested in British American Tobacco (BAT). BAT, formed in 1902, is a global tobacco company with a strong position in next-generation products. Despite its growing profits BAT's valuation has dwindled to just 8x FCF. At these levels we think BAT offers a compelling investment opportunity. Theory of cognitive bias Whatever you think of the push towards ESG investing in the United States, it is stronger in Europe. Amazingly, a 2022 survey by PWC revealed that 60% of fund managers in Europe are planning to halt fund launches that don’t comply with ESG standards by year end 2024. It should be no surprise, then, that tobacco stocks like BAT with primary listings in Europe have underperformed lately. Despite steady to growing profits, BAT’s share price has fallen about 40% over the past five years, massively underperforming both the S&P 500 and the MSCI World Index. At Bireme, we believe that professional investors who invest based on ESG related factors are not performing their fiduciary duties to their clients. We call this “social conformity bias” — the desire to invest in companies based on social, rather than financial, returns. While this may or may not positively impact the world in the long term, it certainly leaves opportunities for firms like ours that are willing to take a different approach. These investors are also ignoring a key aspect of BAT’s portfolio: their “reduced harm” products. These products, which do not burn tobacco, have only a fraction of the health risk of traditional cigarettes. In fact, UK Public Health said in 2015 that vaping was “at least 95% safer than tobacco” and recently confirmed these findings in a 2022 report. Interestingly, public perception of the safety of these products lags the data, with only a third of those studied in the UK report correctly perceiving that vaping was less harmful than smoking. As perception changes to match reality, usage of smoke-free nicotine products should continue to grow. Despite this misconception around nicotine, these products are taking off in many markets. We believe that investors that have historically eschewed tobacco stocks like BAT will one day realize that these firms have a key role to play in the transition from cigarettes to lower-risk products. Viewed from this perspective, BAT may one day be considered a socially responsible firm and receive the 15-20x PE ratio that it deserves. In the meantime, we can collect a large and growing dividend. Traditional brands BAT owns some of the most beloved brands in traditional combustible tobacco products. These include Kent, Dunhill, Lucky Strike, Newport, and Camel. While volumes have declined consistently as customers quit, die, or switch to non-combustibles, price increases have made up most of the difference. BAT’s revenues are flat since 2018 at around GBP 24 billion. To be conservative, we estimate that revenue from combustibles will decline 2% going forward. Volumes will probably decline around 5% but we assume that prices will increase 3% annually. The US is BAT’s largest market, but Europe, Asia, and Americas / Sub-Saharan Africa are also substantial geographical segments doing 4b GBP or more of sales. BAT has more than >40% market share in Australia, Bangladesh, Brazil, Canada, Chile, Denmark, Malaysia, New Zealand, and Pakistan. Reduced Risk Products While the segment has yet to achieve profitability, BAT’s reduced risk products are the crown jewel of their portfolio. The firm has dominant market share in vaping and “modern oral” products in many countries. Also called next-generation products or "NGP", these products are altering the growth trajectory of the entire nicotine industry. The following projection from Kantar (via BAT’s management) shows the math. As new products grow at double digit rates, they create overall market growth of 3.5% annually. For BAT, as we mentioned above, we forecast a -2% decline in traditional tobacco products, while next gen sales increase from 2.9b GBP in 2022 to 12b by 2030. The total company should grow from 27.7b in sales to almost 30b. Profits are harder to forecast, but Phillip Morris’s consistent 40-45% EBITDA margin on 30% reduced risk share has shown that these products can be as profitable as traditional tobacco sales once the business has scaled. Our forecast for BAT’s reduced risk portfolio lines up with the company’s projection of 5b GBP in revenue by 2025. The slide below shows their 33% sales CAGR over the last 4 years. They’ve achieved this growth by developing three impressive brands: Vuse, Glo, and Velo. Vuse Vuse is a vapor product. It uses an electronic device to heat a liquid into a vapor, which is then inhaled. It does not contain tobacco, but the liquid does contain nicotine. While the risks of vaping and popularity among young people have made the products somewhat controversial, the largest study to date, published by King’s College of London in Sept 2022, showed that the exposure to cancer-causing chemicals was much lower for people who vaped as compared to smokers. Vuse market share in its top 5 markets has grown from 16% to 36% since 2019. The product has tremendous momentum, displacing Juul in the US and driving almost a billion dollars of revenue for the company. BAT also disclosed that Vuse had positive contribution margins in 3 of the 5 top markets, an indication that overall profitability is within reach. Their “Vuse Go” disposable product is also well positioned, with premium pricing and #2 market share in the UK, France, Germany, and South Africa. Glo Glo is BAT’s “heated, not burned” product and has also seen category market share growth over the past few years, up from 12% to 20% since 2020. Glo’s share in the top 8 markets ex-Russia stands at around 19%. Data from Statista shows PMI and BAT dominating the market in Japan, one of the world’s largest, with 5 of the top 6 SKUs. HNB products now make up more than 30% of the market in Japan. Velo Velo is BAT’s “modern oral” product. It does not contain tobacco per se but delivers nicotine through a pouch that the consumer puts in their cheek. Velo is dominant in the European market for modern oral. We expect this segment to grow the fastest of all. These three brands drive BAT’s new category growth. Margins on “next generation” products One important question is where margins will end up in NGPs. We think they will be quite high, eventually, despite the fact that they have generated losses to date. Unit economics Fundamentally, vape pods or heated tobacco sticks should have excellent unit economics. To see why, let’s look at the US market, although the economics of NGP sales should be similar in many other jurisdictions. Vape pods cost between $1-2 to manufacture according to most analyst estimates. Compare this to the prices people are willing to pay to smoke cigarettes: $6-9 per pack in the US. If BAT priced its pods – which are roughly equivalent to a pack of cigarettes– at $8, this could allow for 70% gross margins, even after wholesale discounts and the collection of excise taxes (only in some states, unlike cigarettes). However, BAT has been implementing a discounting strategy to induce consumer trials, and raising prices over time from that low base. The first half of 2023 saw Vapor gross margins reach 58%, nearly matching the margins on their other products. Management has previously stated that Vapor gross margins are even higher in the US.. Of course, gross margin is not the whole story. It is possible to spend an infinite amount of money on marketing in a battle with peers for high *gross* margin customers. However, we think that logic and historical precedent dictates that this sort of dynamic is unlikely to doom the NGP profit pool. Swedish Match and Philip Morris We have already seen two examples of scaled NGP businesses. Philip Morris is the best known, with their IQOS (heated tobacco) product delivering more than 12b EUR of sales last year and constituting about ⅓ of company revenues. Margins have not suffered. EBITDA margins are flat at around 43% during this period, indicating that IQOS is extremely profitable. PM management explains very clearly during their earnings calls that they expect their NGPs to be more profitable than traditional cigarettes. The following slide compares gross margins of cigarettes versus various NGP products: The “nicotine pouches” mentioned in that slide refer primarily to those made by Swedish Match (SWMA), a company PM acquired in 2022. SWMA is another example of a company that showed increasing profitability as lower-risk products scaled into the portfolio. The pouch business has been growing as a portion of Swedish Match’s sales since 2010. Over that time Swedish Match grew their EBIT margins from 30% in 2011 to 41% in 2022 when they were finally purchased by Philip Morris. They disclosed at one point that the US market, where nicotine pouches have the largest share relative to chewing tobacco, had EBIT margins approaching 50%. We think the margin success of these two companies, which were the first to get to scale on NGPs, further demonstrates the potential profitability of these products and confirms our unit economics analysis. Barriers to entry The reason SWMA and PM have enjoyed such fat margins is the existence of substantial barriers to entry in the NGP industry. These include:

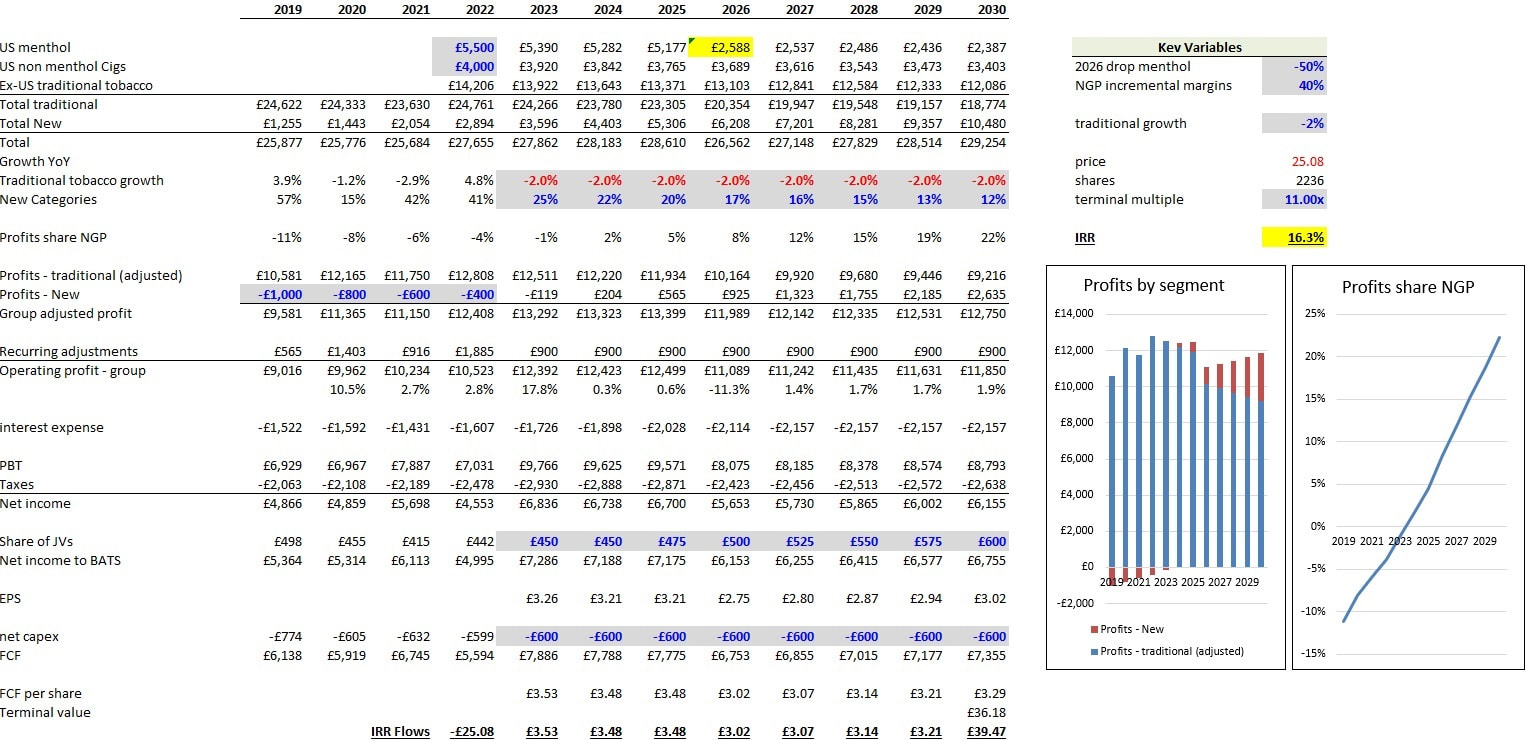

Regulation Regulation is a risk for any tobacco company, but it is a particularly large risk for BAT. This is due to the large portion of the company’s US sales that come from menthol cigarettes, which the FDA has been threatening to ban for years. The FDA claims that menthol makes the product more addictive and more likely for kids to use. Menthol cigs have already been banned in the UK, Canada, and recently California. If the FDA moves against menthol cigarettes it will be much more disruptive than what happened in other countries, because 40% of the US market is menthol vs <10% in the UK and Canada. BAT is particularly dependent on menthol in its US business due to the popular Newport brand. Estimates vary but we guess that menthol sales make about 5b GBP of 8b GBP US cigarette sales for BAT. A nationwide ban on menthol cigarettes seems quite possible at this point given that it has reached the “proposed rule” status. The last update given by the FDA was in September, when they said they planned to issue the regulations “in the coming months”. Most analysts expect litigation to drag out the implementation of the rule to 2026 or so. The California menthol ban has given us a preview of what this could look like. Barclay’s, using Nielsen data, estimates that BAT’s California cigarette volumes are down about 30%. We think this indicates BAT has lost about 50% of its menthol volumes, with half of consumers sticking with the new menthol-free “fresh” or “crisp” Newports and the other half either quitting, vaping, or moving to other brands. In our modeling work on the US business, we assume a menthol ban is implemented in 2026 and that 50% of BAT menthol volumes disappear. This is in line with the early California data, but might be conservative given that BAT claims they retained 90%+ of menthol consumers after the bans in the UK and Canada. We also assume 60% decremental margins. We do not assume any acceleration in vaping growth, which could prove conservative, given the obvious potential of substituting for menthol e-cigarettes. Unfortunately, Menthol vapes have their own regulatory issues. The FDA issued “market denial orders” for Vuse’s menthol pods in October, although BAT was successful in receiving a stay of this denial a few days later. While it may require a trip to the Supreme Court, we think eventually menthol vapes will be broadly approved in this country. There is even evidence that the FDA internally recommended menthol pods be approved, only to be stopped by an unscientific decree from politically appointed bosses. Regardless, even a ban on menthol-flavored vape pods in the US would not stop the longer term trend towards vaping in dozens of markets around the world. Forecast and IRR We are believers BAT will continue to grow NGP sales out to 2030, at which time we estimate new category sales will make up about ⅓ of total company revenue in our base case. We forecast traditional tobacco to decline by 2% per year excluding the menthol ban. We think this is conservative given traditional tobacco sales at BAT have been flat over the past 5 years. This also takes into account the company’s H1 2023 trading update, which noted “disappointing” US combustibles results, in part due to the California ban on menthol cigarettes mentioned above. In our base case model, we assume NGP sales generate 40% incremental EBIT margins. What this means is that NGPs will be doing a 26% operating margin by 2030, from ~zero in 2024. In summary, here are all the key assumptions in our model:

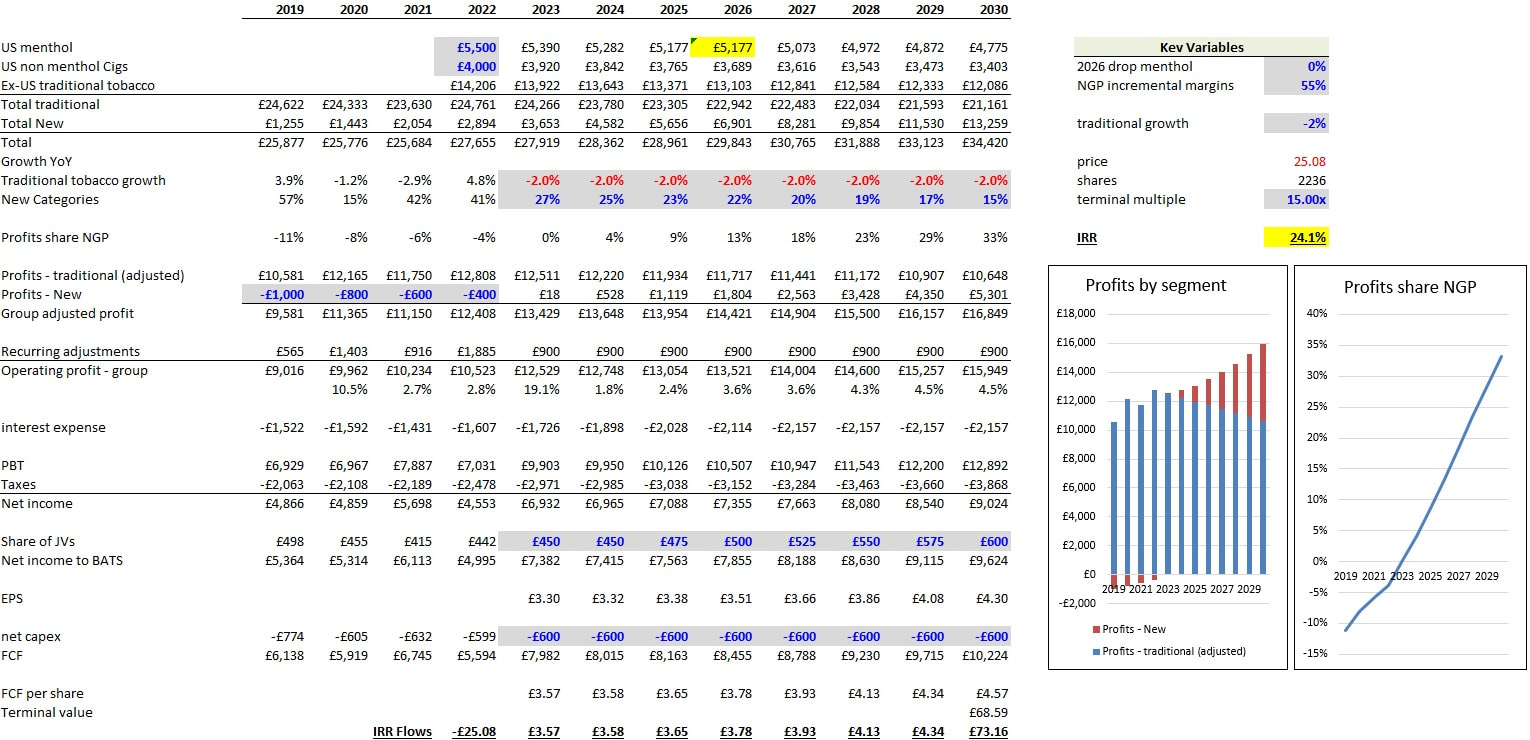

These assumptions forecast operating profits to fall from 12.4b GBP to 11.9b GBP between 2023 and 2030, due solely to the menthol ban. Profits begin to grow after 2026. These assumptions generate a 16.3% IRR from current prices. Upside Case Our model is conservative in a number of ways. Below is the upside case:

The above are very much possible. If they all occur, we expect operating profits to rise to 16b GBP and the IRR to be 24.1% over the 7.5 year holding period. We would 4x our initial investment over that period. While one can model an even more draconian case based on faster declines in combustibles and a lack of profitability in NGPs, we think some combination of the above two cases are overwhelmingly likely. We are long BAT. Appendix - ITC stake ITC was originally called “Imperial Tobacco Company” and operates in India. It is 30% owned by BAT, and trades at a near all-time high valuation of just under $70b and 25x forward earnings. While the company does sell cigarettes, the firm has diversified materially over the past ten years. Today it does about $4b in cigarette revenues, $2.4b in packaged food revenues, and about $2b in other business. Cigarettes are still the most profitable segment, but clearly investors are excited about the prospects of the combined company. Total segment profits grew to an all-time high $3.1b in FY 2023 and sell side analysts estimate that profits will grow further in 2023 and 2024. While the profits on the ITC stake already enter the income statement below operating income, they aren’t directly material in the near term. In effect, this asset which trades at 25x in India is only valued at 7x by British investors. This leaves BAT with two possible opportunities. One would be to sell down the ITC stake. Given BAT’s market cap of $71b USD / 59b GBP, their $20b stake in ITC would allow for a massive dividend, even after any capital gains taxes. Another possibility is that ITC can grow into its valuation by doubling or tripling profits over a few years, as the valuation implies. Either way, BAT’s valuable stake in ITC appears to be completely ignored by today’s valuation. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. If not specified, quarter end values are used to calculate returns. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. For current performance information, please contact us at (813) 603-2615.

Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |