|

To my wife's chagrin, I'm slightly obsessed with another woman. The other woman is smart, accomplished, and ... 76 years old. Her name is Judy Faulkner. Here are some of her accomplishments:

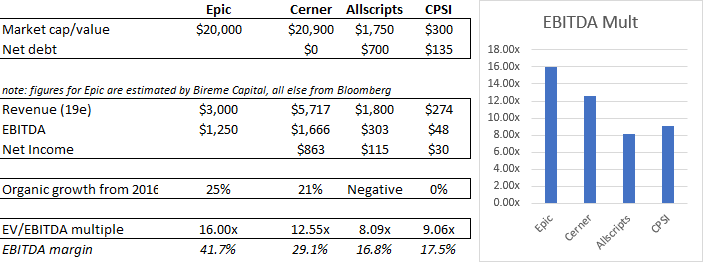

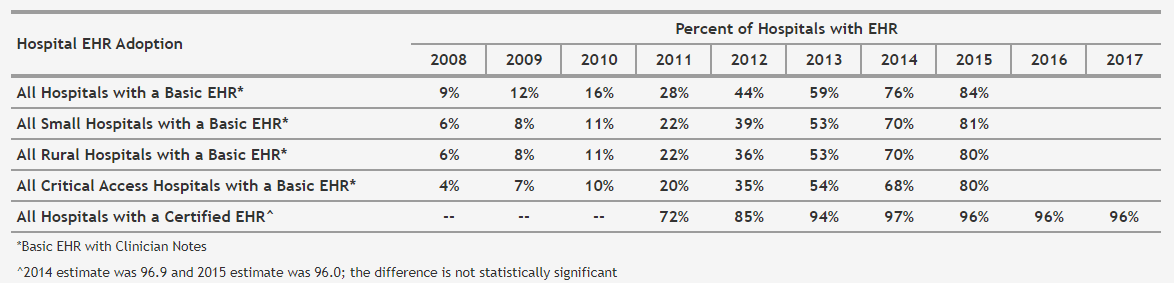

Perhaps now you understand why I think she's so cool. Epic: the king of EHR Epic Systems did not invent Electronic Health Records. There were a few different systems developed in the 1960s, and a predecessor of Epic's competitor Allscripts (MDRX) created an EHR system in 1971. All of this came before Epic got it's start in a Madison, Wisconsin basement in 1979. But although they were a few years behind when they started, over the past 15 years Epic has come to define medical software in the United States. Their market share gains have been striking. Over the past ten years, Epic's share of implementations has increased from 5% to 30%. Among academic hospitals and those larger than 500 beds -- the most tech-savvy facilities -- their dominance is even more pronounced, with market share of 58%. A list of the top hospitals using Epic is a who's who of leading research facilities. Epic has a lead on its competitors in terms of technology as well as market share. This should not come as a surprise due to the huge investment the company makes in R&D. While it is a private company, Epic has disclosed that over 50% of its expenses are R&D, a figure which is likely to be more than a billion dollars annually. They spend a greater portion of their expenses on research and development than Apple and Google. One of the reasons Epic spends so much on development is that it builds everything from scratch; it does not acquire other software companies or license modules of other software. While this may seem excessively strict, it has allowed them to avoid the integration problems that have plagued some of their smaller competitors. In my view, Faulkner should be lauded as one of the greatest founders of all time, and certainly the most successful female CEO. But instead of taking my word for it, let's take a closer look at the numbers. Here are some data points that we have for Epic historically: So this is a company that has nearly quadrupled their revenue over the last decade. They have done this without ANY acquisitions - it is purely organic. They also don't advertise and have fewer salespeople than most companies of the same size. Since they largely eschew SG&A costs, we can surmise Epic's profit margins are pretty high. Probably higher than a company like Cerner, their chief competitor, who not only spends significantly on advertising but also gets most of its revenue from lower-margin outsourcing and service contracts. The also-rans Cerner, Allscripts (MDRX), and CPSI -- three of the largest competitors of Epic -- are all public companies. This is one of the reasons I dug into researching Epic in the first place. The valuation of the smaller competitors (Allscripts and CPSI) look enticing at first. This is until you discover that Epic is eating their lunch. Let's take a look at Allscripts. First, they have an R&D problem. They spend $250m each year on this line item, which sounds like a lot but is merely 1/3 of Cerner's R&D and likely less than a quarter of what Epic spends. It is hard to see how Allscripts can compete on features with Epic and Cerner. There are reverse network effects as well. Employees that are familiar with Epic want to work in Epic-based systems. Nurses don't want to spend time becoming an expert in a defunct, doomed EHR system. This makes Allscripts and CPSI products a harder sell: no hospital wants to hurt their ability to recruit top-notch nurses and physicians. Despite larger market share, Cerner has problems too, if the 2018 data is any indication. Last year was an active one for hospital EHR contracting, with both Epic and Cerner adding over 100 facilities. However, 146 of Cerner's 177 gross client additions were from a single DoD contract. If we look only at private hospitals, Cerner LOST about 70 contracts. Government incentives One of the problems with looking at the historical record for these EHR companies is that they've seen a huge tailwind from increasing penetration of the US market. As recently as 2008, very few hospitals used EHR. But embedded in the 2009 American Recovery and Reinvestment Act was a $34b incentive to make the shift to digital health records. Facilities that could show "meaningful use" of EHR by 2011 could receive up to $63,750 per physician and avoid reimbursement cuts. This incentive worked. The huge, government-incentivized ramp-up in EHR use must be noted when looking at the historical income statement for a company like CPSI, which doubled its revenue between 2009 and 2016. The EHR market was just opening up, and Epic was focused on selling to larger hospital systems. This provided plenty of white space for a smaller firm like CPSI to gain customers in rural areas. These wins, combined with acquisitions, resulted in material revenue growth for CPSI and Allscripts over the last decade. But today, nearly 100% of US hospitals have EHR systems. What this means is that a) the industry no longer has a tailwind from increasing penetration and b) Epic and Cerner have to turn to smaller facilities, the main clients of MDRX and CPSI, for growth. The behemoths have started to see some success in this regard, after releasing pared-down versions of their software to sell at lower price points. In my opinion, MDRX and CPSI will continue to lose revenue (on an organic basis) over the next few years. This makes their 8-9x EBITDA valuations look a lot less appealing, especially given that they have debt loads of 2.5x and 4x EBITDA respectively. Conclusion The EHR industry is somewhat unique in healthcare, as their products have recurring revenue and strong customer lock-in. Yet they are covered by analysts that spend their days thinking about insurance and pharmacies, businesses with fewer competitive advantages, lower margins, and lower multiples than platform software. I thought perhaps this association between EHR and healthcare might result in cases of representativeness bias, which can cause people to make overly-simplistic categorizations or assumptions based on initial appearance. The search for this sort of error causes us to seek out firms with unique advantages that we suspect are hiding out in boring or otherwise-competitive industries. In this case, the home-run result would be a strong platform software company trading at a pharmacy multiple. Unfortunately, the only strong company in this industry is private. -Evan Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may have positions in the securities mentioned.

Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. For current performance information, please contact us at (813) 603-2615. 6/25/2021 06:50:46 am

Starting an LLC is an important step in building and maintaining your business. This is the first business model that allows each individual business owner to achieve two goals quickly and efficiently. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |