|

The number of investment ideas and full-fledged stock writeups in the public domain has got to be at an all-time high. Whether its on Value Investor's Club, SumZero, Seeking Alpha, or simply on twitter, there are probably multiple writeups on the vast majority of publicly traded equities. I look at all the above. But one of the places I enjoy browsing for ideas the most is in quarterly investor letters. The folks at r/securityanalysis make this process extremely easy by collating a vast array of publicly-available letters. Here is the posting for Q3 if you want to check it out. Below are a few ideas from that post that I thought were interesting. AT&T Single digit stock tickers tell you something about a company: it is probably old, and it is probably boring. Citigroup, Ford, Hyatt Hotels, Kellogg, Loews, Macy's, and US Steel are some examples (although in recent year's Pandora and Zillow have joined the club). AT&T (NYSE: T) is a great example of this. It is as old and boring as it gets. The name comes from "American Telephone and Telegraph", the successor name of the original Bell Telephone Company which was founded by Alexander Graham Bell in 1885. After that monopoly was broken into "Baby Bells" in the 1980s, Southwestern Bell Corporation started an acquisition spree that eventually saw it acquire the AT&T name. The new AT&T then rode the wave of increasing telecommunications penetration in the US, with EBIT rising from $3b in 1993 to $23b in 2008. The stock did well too. Over that time period, AT&T slightly beat the market and returned 173% vs the telecom industry's 74% total return [1]. However, since early 2009 the S&P 500 has crushed AT&T, which has returned just 9% annually to the market's 14.7% return. Activism in large caps It would not be surprising, then, to find out that AT&T shareholders are unhappy, as they've suffered below-average returns for over a decade. And when shareholders are mad, management teams get nervous. After all, the shareholders have an opportunity every year to vote out them out. Historically, the chances of this happening at a company the size of AT&T was exceedingly low. There are simply too many shareholders, and the biggest ones these days are often passive funds. Looking at AT&T's shareholder list, I don't see a single truly active investment fund in the top 20 as of 6/30/19. In the last decade, though, the rate at which activists are targeting large companies has increased dramatically. For example, just in the last 3 years [2], the percentage of activist campaigns at US companies with a market cap of >$10b has increased from 22% to 35% according to Activist Insight. One the reasons for this rise is the increasing willingness of conservative, passive-ish institutions like BlackRock, CalPers, and Vanguard to see activism in a positive light. While these firms are unlikely to lead the charge to remove board members, they have begun to at least listen to shareholders who want to move the company in a new direction. For example, in 2017 Larry Fink -- CEO of BlackRock -- said "the role of activists is getting larger... and in many cases their role is a good one." The best example of a successful large-cap activist engagement was revealed to the business world in August 2013, when Microsoft announced a "cooperation agreement" with ValueAct Capital. ValueAct, an activist hedge fund that had taken a $2b stake in the company and had apparently been negotiating with the board behind the scenes, was allowed to nominate their own executive to the MSFT board. This came right on the heels of former CEO Ballmer's exit from the company and was seen as a huge coup for ValueAct since their position garnered a mere 0.8% voting power at the company. Many in the investment community viewed it as a sign that other, larger shareholders agreed with ValueAct about the need for new voices on the board. Since the date of ValueAct's investment, MSFT has been one of the best performing stocks in the S&P 500, returning over 400% and becoming the largest company in the world by market capitalization [3]. In the succeeding years some have attempted to follow in ValueAct's footsteps, using <5% voting positions in mega-cap companies to agitate for change while simultaneously trying to court larger institutional shareholders. Nelson Pelz's (eventually) successful campaign at Proctor and Gamble is the most well-known. I believe it is these successes that gave one of AT&T's shareholders the audacity to challenge management in a way that had never occurred at the company. Enter Elliott Elliot Management is one of the stock market's busiest activists, having launched 14 campaigns in 2019 alone. Still, given the gargantuan size of AT&T (over a $200b market value), it was a surprise when Elliott publicly released their letter to management on September 9th, 2019. That letter lays out:

It is a tour de force that I think people should read if they want to know how one of the world's best performing hedge funds thinks about an investment of this nature. One thing that is stunning is the amount of work they have done (outsourced?) on this investment. They commissioned a survey of 35k consumers, hired a consulting firm to analyze cost-cutting opportunities, engaged a technology-advisory firm to lay out AT&T's potential in 5G, and talked to 200 former industry executives. Whether all of this will result in an investment that outperforms the market remains to be seen, but I applaud their thoroughness. Underperformance This is simple. Over the last 10 years, AT&T has underperformed their proxy peers by over 100% in terms of total return. AT&T's mistakes Elliott argues a key factor in AT&T's underperformance has been their questionable M&A strategy. This make a lot of sense to me, as I have have long been skeptical of the type of unfocused vertical integration that AT&T has pursued. First they purchased DirecTV for $67b in 2014, which was completed at 13x EBIT and 8.5x EBITDA. Since then, AT&T's premium video subscribers have declined from 25m to 21.6m, and the entire industry has come to agree that video distribution platforms such as DirecTV are some of the most challenged business models in the entertainment industry. AT&T's "entertainment group" segment, which includes DirecTV, has seen its operating income fall by some 20% since 2016. AT&T would then agree to buy Time Warner (TWX) for $109b -- or 14x EBITDA -- in 2016, one of the largest mergers in history. This merger was finally completed in mid-2018. While it is too soon to fully judge the returns on this deal, I agree with Elliott's skepticism that this asset provides synergies to AT&T's other businesses. As Elliott points out, former Time Warner CEO Jeff Bewkes built TWX into the powerhouse that is by shunning vertical integration. In fact, Bewkes pursued multiple spinoffs and sales during his tenure that were designed to focus the company on video content: Warner music in 2004, Time Warner Cable in early 2009, AOL in late 2009, and Time Inc. in 2014. This is the focus that allowed TWX stock to outperform the market during the decade leading up to its acquisition by AT&T. But perhaps nothing was more damaging to AT&T than the merger that did NOT happen, with T-Mobile. Announced in 2011, the T-Mobile tie-up was eventually blocked by antitrust authorities and resulted in a breakup fee of $3b in cash and $1b in much-needed spectrum. T-Mobile would use the money and spectrum to acquire MetroPCS in 2012 and pursue an extremely aggressive marketing strategy thereafter. As a result, T-Mobile has seen its wireless revenue double since 2013, mostly at the expense of AT&T and Verizon. Elliott also argues that, besides initiating these mergers on shaky analytic foundations, they have also mismanaged these businesses. They point to executive departures at both DirecTV and Time Warner, with org charts showing that none of the top executives of these companies remain at AT&T. Elliott also highlights AT&T's significant market share losses in mobile wireless, their largest business segment, as evidence of management's incompetence. AT&T's assets Despite the miscues described above, Elliott argues that AT&T still has some compelling assets. They are the second largest wireless company, with over $70b in revenues and tens of millions of subscribers. On top of that, Elliott believes they have a good chance to be the leader in 5G, with an opportunity to displace Verizon as the market leader. A key driver of this, per Elliott, is AT&T's FirstNet deployment, which has resulted in improved network performance. FirstNet is a private network for first responders and public safety officers, built by AT&T under a $6.5b contract awarded by the federal government. If any readers have thoughts on the potential for AT&T to lead the market in 5G deployment based on their spectrum positioning and FirstNet contract, I would love to hear it. It seems like a key piece of this puzzle. The opportunity to gain ground on Verizon in wireless is a massive opportunity for AT&T if they can pull it off: Verizon generates over $30b in wireless segment EBIT. This is more than all of AT&T generated in 2018 despite contributions from Time Warner, the wireline business, and DirecTV. Elliott also highlights the high quality of AT&T's Time Warner assets, an assessment that I mostly concur with. While the traditional method of cable video distribution is challenged, WarnerMedia has some of the best intellectual property (some of which, like HBO, is not really tied to the traditional cable bundle) and largest subscriber bases in the industry. Elliott also notes that AT&T purchased TWX at 15x EBIT and a 20x PE while they themselves trade at a 10x PE. The plan Elliott's plan hits some of the most common activist themes:

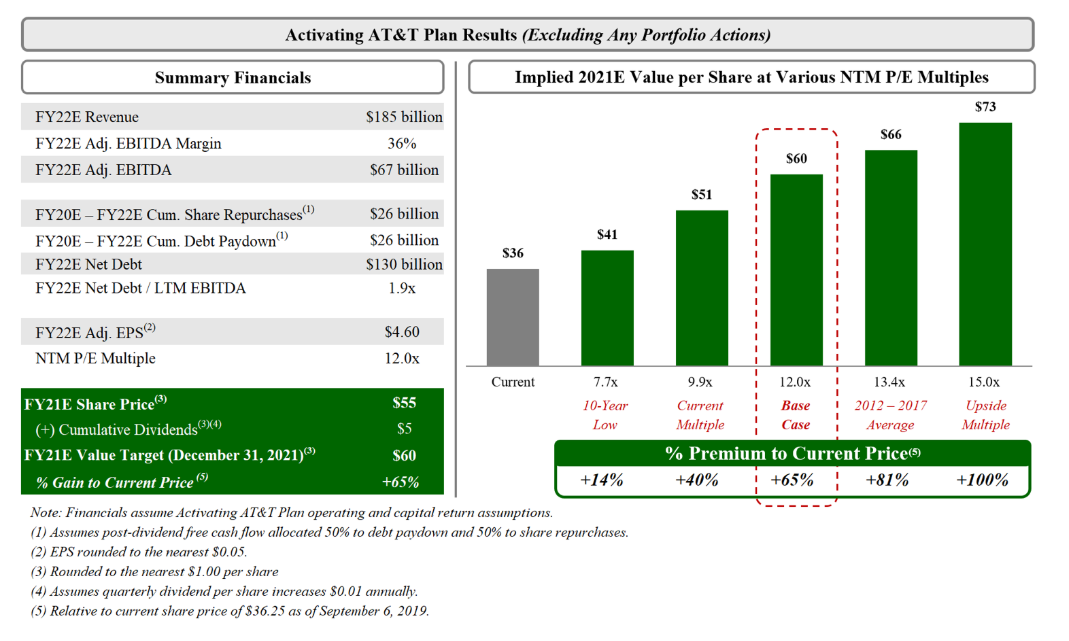

Regarding #1, it would be very interesting to see what would happen if they tried to sell some of their larger assets like DirecTV. DISH Network, DirecTV's main (but smaller) competitor, continues to trade a substantial valuation of $30.5b enterprise value (about 14x EBITDA) despite seeing consistent revenue declines and profit shortfalls[4]. A similar valuation for DirecTV could wipe out about half of AT&T's $190b in debt, although admittedly this seems far fetched. Elliott goes into a bit of detail regarding #3, and highlights AT&T's 15% lower wireless EBITDA margins relative to Verizon. It certainly does seem like AT&T's budget could use a skeptical eye, perhaps even the dreaded zero-based budgeting that has caused such controversy in the CPG space. Elliott claims to have identified $10b worth of cost cuts for AT&T to implement, and assumes $5b is achievable in their forecasts. Elliott's valuation In the graphic below, Elliott lays out how AT&T can be worth $60 per share (including $5 of dividends along the way) if they successfully implement their plan by year end 2021. This would still be a compelling return from the current price of $40. The key assumptions are relatively flat revenue, 300 bps margin enhancement on cost cutting, and free cash flow being used for dividends, share repurchases, and debt repayment. It does not appear to include any assumptions around asset divestitures. My thoughts Overall, I find this to be an intriguing idea, although I'm nowhere near ready to pull the trigger. But I like the idea of taking a boring, stodgy business and turning it into an exciting investment opportunity based on valuation and operational improvement. What really concerns me, though, is the level of debt combined with the seemingly secular nature of AT&T's problems. Debt of 3x EBITDA is certainly manageable for an organically growing business like Comcast, but many of AT&T's cash flow streams may be in decline. Elliott chalks up the losses in mobile wireless and DirecTV to mismanagement, but I think the problems may be secular. Here are some quick thoughts on AT&T's key business lines: Wireline business: AT&T's product in this space is generally inferior to cable operators like CHTR and CMCSA. This segment includes substantial legacy revenues such as legacy voice subscriptions (cable operators have these too, but they are a smaller piece of the pie). Building out the fiber network to compete is very expensive. Mobile wireless: They have a large current subscriber base but are increasingly challenged by T-Mobile. As a happy T-Mobile customer myself, it seems highly likely to me that T-Mobile will continue taking share. An attempt to unseat Verizon by investing heavily in 5G sounds like it will take significant capital. HBO/Cinemax etc: HBO has great content and a large international subscriber base, but greatly lags Netflix in terms of worldwide control of distribution and international revenues. This limits HBO's ability to compete in terms of sheer quantity and quality of product. I think that HBO will continue to do pretty well, but cannot come close to supporting AT&T's valuation on its own. Turner (TNT, TBS, CNN, etc): Many of these networks are dependent on sports content and are therefore exposed to rising content costs in that space. Most of them have also benefited historically from being part of standard cable bundles. It remains to be seen how well they can transition to the OTT world. DirecTV and video subscriptions generally (including U-Verse): This business is very challenged, as described at length by Elliott. It is not merely mismanagement, but aggressive moves from OTT players that are causing the disruption and cord cutting. These are issues that aren't going away and can't be solved by zero-margin offerings like DirecTV Now. I'll be staying on the sidelines regarding AT&T for the moment. Below are some other interesting ideas I came across in recent investor letters. Third Point on EssilorLuxxottica EssilorLuxxotica is a vertically integrated, dominant player in eyewear that was created in late 2018. Third Point thinks they'll do about €4b in EBITDA in 2019, roughly in line with street estimates. But on top of this, Third Point thinks the merger can generate over €1b of synergies (double the company's guidance). At that point, the company's current valuation would be 12x EBITDA, potentially quite cheap for this dominant portfolio of brands that include Oakley, Ray-Ban, LensCrafters, Pearle Vision, and Sunglass Hut. Gator Capital on Western Alliance Gator Capital has to be one of the best performing hedge funds over the last 10-15 years, having generated a 21.5% annualized net return since July 2008. They accomplished this while focusing on the financials sector (which has underperformed over that time period) and generally maintaining <100% net exposure (currently 60% net long). In their Q3 letter, they make a good case for "growth banks", a group of faster-than-average growing regional banks that collectively trade at about a 10x PE on 2020 estimates. He highlights Western Alliance Bancorp as one of the best of that group. Please leave a comment or contact me on twitter if you have any comments on the above. Our Q3 letter will be out soon. -Evan [1] Based on GICS code. Data from Bloomberg.

[2] Comparing full year 2016 to H1 2019. [3] Unfortunately for ValueAct, they only participated in part of this advance, selling some in 2015 and closing the position in 2018. [4] It should be noted that many analysts think that DISH's valuation ascribes material value to its spectrum position, rather than just its satellite TV business. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. For current performance information, please contact us at (813) 603-2615. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |