|

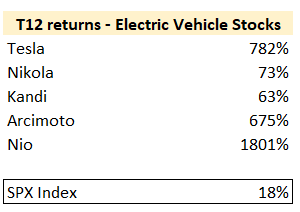

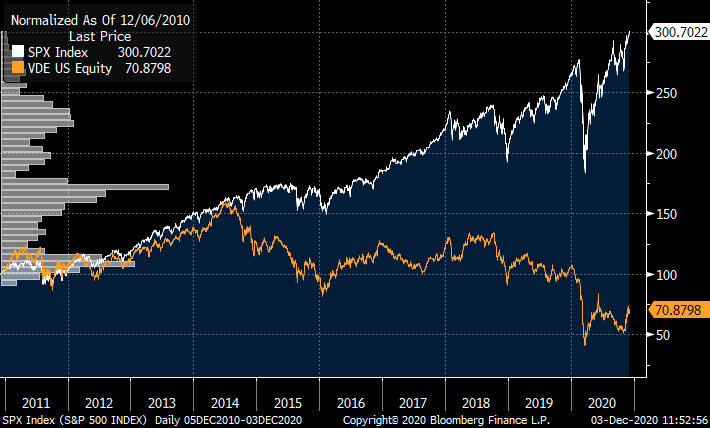

It is very common for gamblers to learn lessons. It is easy to see why: there is so much data for the gambler to consider. In roulette alone there are all the numbers... are they low numbers? Red numbers? Numbers divisible by three? What color shirt is the dealer wearing? There are so many opportunities to learn lessons if you are looking for them! Almost all of these lessons are nonsense. Rational people understand this because the randomness in a casino is very explicit: an equal-weighted die, a well-spun wheel, or a shuffled deck of cards. For these games, anything except a mathematical analysis of optimal play -- based solely on the rules of the game -- is irrational. It is superstition. In the real world, the lines are more blurred between what is random and what is not. One could even argue there is no such thing as randomness at all. Was the person that took a job at a future unicorn the beneficiary of chance, or just prescient? If you were smart enough -- or perhaps had a computer in your shoe -- couldn’t you predict where the roulette ball would land? Is it lucky that the Pfizer / BioNTech vaccine works so well, or is it the result of decades of scientific research? Cleary there are opportunities in this world to sift through randomness and find truths which can be exploited. At the very least, there are opportunities to tilt the odds in our favor. The world of investing, though, is a particularly difficult place to spot such truths. Yesterday's “truth” may merely be noise. Or, if enough people are aware of it, yesterday’s truth will become today’s random walk. There is still an active debate about whether skill exists at all in investing. I do believe there is skill in investing. As a former poker player, however, I am acutely aware that small sample sizes can be misleading. This applies to investors, strategies, or simple rules of thumb like “sell in May and go away”. And learning too much from small sample sizes is particularly dangerous for bottom-up stock pickers. Some quick math will help us see why. Let’s say you are a fairly concentrated portfolio manager that typically holds 20 positions. If you turn over 5 positions per year that means over a period of 10 years you will own 70 stocks (the 20 you start with and 10 x 5 new ones). If you do a good job, maybe 10-15 of these stocks show losses over your 4-year average holding period. Perhaps 5 of them will suffer large losses of >50%. If you throw in thematic errors of omission like “missing out on the SAAS rally”, you may have ten total mistakes to analyze. Is it possible to learn anything from these ten mistakes? The answer is likely no. There is just too much randomness involved. Unless you can identify an underlying causal factor which is applicable across market cycles, taking lessons from such a small number of cases is a fool’s errand. It leads investors to double down on today’s hot strategies and divest from what is underperforming. If enough market participants invest based on these “lessons”, price movements can become self-fulfilling and move towards extremes. Below is a partial list of market “lessons” that have been learned by investors over the years: 1960s: only invest in the largest fifty companies 1970s: don’t invest in bonds 1990: don’t invest in banks 1999: buy anything tech, stay away from value 2002: don’t buy anything tech 2005: invest only in value stocks, especially banks 2007: commodities and resource stocks are an asset class 2017-today: bitcoin is an asset class 2010-today: valuation doesn’t matter, #neversell, only buy growth stocks Of course, all but the final two “lessons” have proven to be mirages. These mirages are top of mind for me when people on twitter ask what lessons we have learned from our past mistakes. Are people really learning the right lessons from their own small sample size? And further, have the past ten years really been a good teacher, or are all of these *lessons* merely a reflection of larger market trends? On the long side, the lessons being learned are obvious: Always invest in electric vehicle IPOs. Make sure not to pass on Special Purpose Acquisition Companies. You can’t lose money on SAAS stocks. 30x sales is still cheap for a “good business”. And the most frequent lesson of the past decade: never sell based on valuation. The opposite lessons are also being learned: you can’t make money in stocks that don’t grow. There is no such thing as a mediocre company being “too cheap”. Don’t invest in banks, cyclicals, or energy, because “bad” industries should be avoided altogether. The performance of the Vanguard Energy ETF demonstrates how long investors have been trained to avoid bad industries: As we mentioned earlier, these "lessons" can become self-fulfilling, as more and more investors "learn" them. This dynamic can cause trends to stray beyond pure randomness, and even beyond what is warranted by underlying industry dynamics. If they go far enough, they can create opportunities for investors who pay attention to valuation and are willing to look into the future rather than the past. These are the investors that buy 30 year bonds in 1982 or value stocks in 2000. Perhaps the right approach to the "lessons learned" question is to invert it: What lessons are investors learning today that aren’t based on any fundamental truth? In other words, what does the market know for sure that just ain’t so? This is where you will find the real opportunities. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |