|

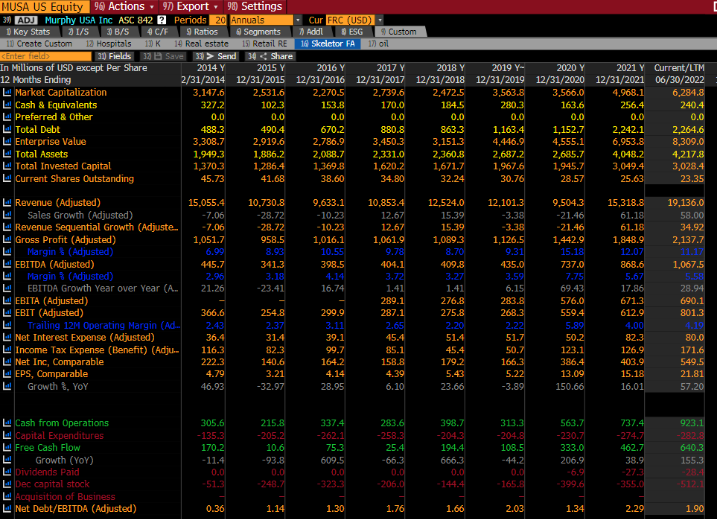

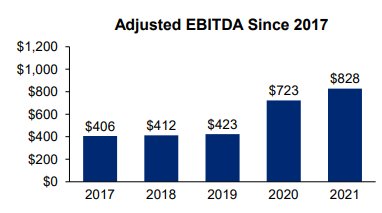

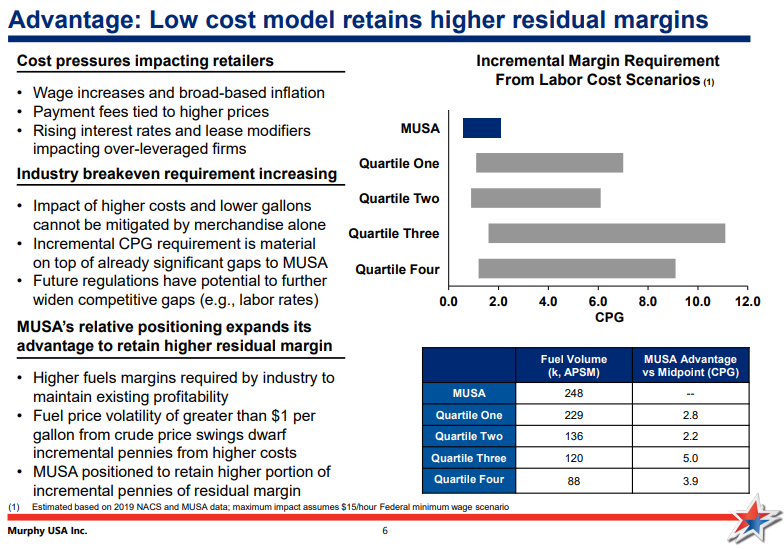

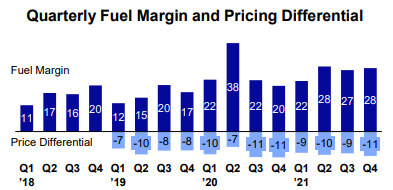

If you saw my post from last week, you’ll know that I have decided to study at least one new company every day and post on it. I’m a little behind already, but today’s second post looks at Murphy USA (ticker MUSA). Murphy USA runs gas stations, and had about 1700 locations at YE 2021. They were a 2012 spinoff from Murphy Oil, a $10b enterprise value oil producer based in Houston. At the time of the spinoff, the firm listed the following “competitive strengths” “Strategic relationship with Walmart'': Roughly 1000 of their locations are located adjacent to Walmart, which drives significant traffic for MUSA. They collaborate with Walmart on a fuel discount program. “Cheap gas prices”: Their business is built around efficiency, high traffic, high volumes, and low prices. They are also a leader in low-priced tobacco products. “Low-cost operating model”: MUSA’s small-footprint stores, with a focus on fuel sales, drive low capital and maintenance costs. Only one or two attendants need to be present during business hours. Also, they own their locations so do not incur rent expense. “Advantaged fuel supply”: MUSA claims to source fuel “at or below industry benchmark pricing”. I’m not sure how much I believe this is a real advantage relative to peers. At the time of the spin, the company did about $300m of EBITDA at just under 1200 locations. Their footprint has grown relatively slowly, building stores both adjacent to and independent from Walmart locations. In 2019, the final pre-COVID year, the company did $435m of EBITDA out of 1500 units. The Walmart agreement ended a few years back, and now they are focused on freestanding locations for growth. The valuation is tricky. On 2022e earnings, the stock looks cheap at about 11x PE. The problem is that earnings are at a cyclical peak, having ballooned from $160m in 2019 to $570m for 2022e. Below are the adjusted EBITDA figures they present in their most recent investor deck. Did anything fundamentally change in this business to create this hockey stick in earnings? Or is this ephemeral? In most cases, margins distributing pure commodities, like gasoline, should be cyclical. The company argues that fuel margins are “expected to settle at a higher equilibrium”. They claim that most fuel retailers are experiencing labor cost inflation, and must therefore raise their per-gallon price. But since MUSA locations do very high volumes, they can raise their prices less and continue to generate high fuel margins with best-in-class consumer pricing. I don’t buy this line of argument. In the model above, MUSA calculates that their competitors need to generate 1-11 cents per gallon more in gross profit to offset a minimum wage increase to $15 per hour, which would be a roughly 30% increase for gas station attendants according to Payscale. But passage of a $15 min wage is seen as a remote possibility. Also, it is not clear to me why stores couldn’t raise prices on convenience store items (where much of gross profit comes anyways), rather than gas prices. Finally, MUSA’s fuel margins have already increased >10c per gallon, so seem sure to fall regardless. I find it hard to believe that a bout of sub-10% inflation has somehow permanently changed the profitability of selling gasoline to consumers. We expect margins to fall back to historical levels. And if margins do fall back to historical levels, MUSA seems quite richly valued. The company trades at about 40x 2019 earnings. We’re going to pass on this one. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |