|

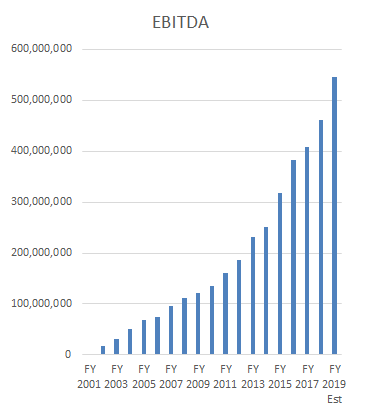

What multiple would you pay for a business with the following EBITDA profile? To help you out a bit, allow me to include a couple more details:

Does 10x EBITDA sound like the right number? To me, it sounds pretty, pretty, pretty low. This is not some pharmaceutical business where customers are getting scammed. This is not a hardware business that has generated a hit that will be tough to replicate. This is an advertising and subscription business. One caveat: the growth has mostly been generated by acquisition. This is not an organic grower. They have completed >150 acquisitions over the years, mostly of obscure companies. But while investors have gotten occasionally burned by acquisition-driven growth (Valeant, Tyco, and others), in certain cases they have come to view this strategy as sustainable. Here I'm thinking of a TDG or a Constellation Software, both of which trade at higher multiples (15x and 20x EBITDA respectively) than our mystery stock. Before I reveal the ticker, I must disclose that I was short (and wrong) on this name at a previous firm. The thesis went something like this:

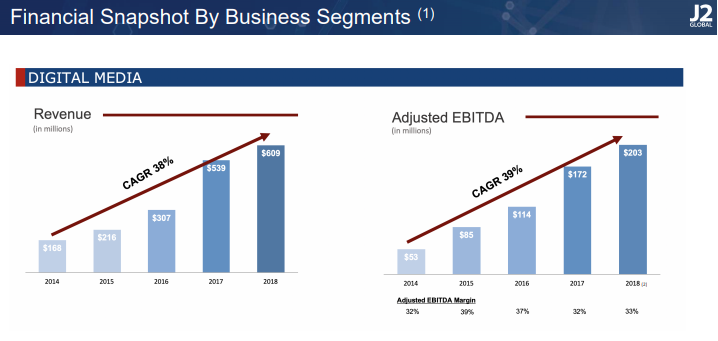

I was short the company around 2013. As you can see from the EBITDA chart, their core business was NOT in material decline. Acquisitions were additive and weren't merely for treading water. In fact, deals totally $1.5b since Dec '13 have generated substantial returns: EBITDA has grown from $230m to $500m, implying a roughly 18% incremental ROIC (and more if you believe their core business declined). These would be good ROIC numbers for a company pursuing an obvious organic growth path. For an acquisition strategy this is tremendous. The reveal: JCOM The name of the company in question is J2 Global, ticker JCOM. Their biggest product -- perceived by many to be in permanent decline -- is called eFax[1]. eFax is a software product that allows subscribers to convert their incoming and outgoing faxes into emails. Faxes still work exactly the same for the other side, but the eFax subscriber doesn't need a fax machine. They simply click on a link in their email to see an incoming fax. Shouldn't this business be going away? Do people still use faxes? This was always a key argument of the shorts. In actuality, this business has been stickier than many expected; certainly, its been much more resilient than short-sellers such as myself predicted 5-10 years ago. The company still does about $300m in fax revenue, which is likely to be pretty high margin. What is interesting about J2 Global is that management appears to be clear-headed about the flattish prospects of the fax business, and executed a strategy that reflects this. For nearly a decade, their capital allocation has been focused away from the fax business: they purchase small, SMB-targeted software companies focused on other verticals (although typically with similar customer acquisition channels). Often, these are not great businesses. JCOM runs them for cash and margins, recycling the extra FCF into more acquisitions, dividends, and stock buybacks. See below for two slides on how they think about M&A: This is not the typical tech acquisition strategy. In my opinion, most tech CEOs (especially legacy and enterprise tech companies) pursue acquisitions for all the wrong reasons: to plug technical holes in legacy products, to tell a good story to investors, and to build empires. Due to their focus on optics and not IRR, those CEOs often pay huge multiples for businesses that don't really have much strategic fit. The canonical examples of this are HP's failed deal for Autonomy and IBM's deals for... most of the companies they have bought. Smaller tech companies make these mistakes too: Progress Software (PRGS) even suffered a proxy fight over their failed venture capital-like acquisition strategy. JCOM, instead, has focused on tuck-ins of cash flowing businesses[2] at cheap prices. In this way, they are a more like a PE firm, which also extends to the ruthless way they operate their acquirees (this is hinted at in the slide referencing "shrink to grow"). There are many news stories about them laying off employees at newly acquired firms (see here and here) in order to increase profits. While some people might be turned off by these stories, I appreciate management teams that make the tough decisions needed to build a sustainable business. And JCOM has, in fact, built sustainable businesses outside of eFax. The largest of these is Ziff Davis, which they originally purchased in 2012 for $167m. At that time, Ziff Davis was a holding company for various tech and media-focused websites, with PC Mag being the best known. It was run by CEO Vivek Shah, who worked closely with private equity firm Great Hill Partners to buy the business out of bankruptcy in 2010. Vivek and Great Hill initiated the strategy of buying up underperforming tech-focused websites that Ziff Davis/J2 continues to this day. As a result of this strategy, Ziff Davis now owns the following sites in addition to PC Mag: IGN, Speedtest.net, Mashable, Everyday Health, Medpage Today, askmen.com, offers.com, and others. JCOM's "digital media" segment financials reveals the success of this strategy: From a start of about $30m in EBITDA in 2013, JCOM's digital media segment (synonymous with Ziff Davis) now does over $165m in EBITDA ($203m as adjusted), or about 40% of the company's total. Perhaps it is no surprise then that Mr. Shah was announced as the company's CEO in September 2017. I'm still early on in my research of JCOM, but I'm pretty interested. At 10x EBITDA and around 12x 2019 EPS[3], the stock could well be undervalued. I also think it could tick some of my boxes[4] for being subject to investor bias: perhaps investors are overly focused on the (admittedly mediocre) fax business, despite it being <50% of EBITDA. This would be an example of availability bias, and I can tell you that I definitely fell prey to this when I was short the stock in 2013. I absolutely did not understand the savvyness and repeatability of the company's acquisition strategy. In my research, I plan to dig in to the following:

Feel free to leave any comments below. -Evan [1] Here and elsewhere, I'm using "eFax" as a catch-all for their fax-to-email business, which includes many other brands such as MyFax and MetroFax.

[2] They don't always generate cash at first. Sometimes these are struggling websites that need to shut down segments of the business and lay off employees before they become profitable. [3] These are street estimates from Bloomberg - almost certainly adjusted for things like intangibles amortization. [4] For more about how we think cognitive biases create mispriced stocks, see here. Bireme Capital LLC is a Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. For current performance information, please contact us at (813) 603-2615. 10/31/2020 08:06:24 am

We are thrilled to be working with Stewart Smythe again and delighted to be investing in Ascent, a high quality platform from which to drive consolidation of a fragmented and high growth market. Under Stewart’s leadership Ascent’s technical excellence and long-term client relationships position it well to become a stand out asset in the sector. We look forward to supporting such a talented management team on the next phase of their growth journey Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |