|

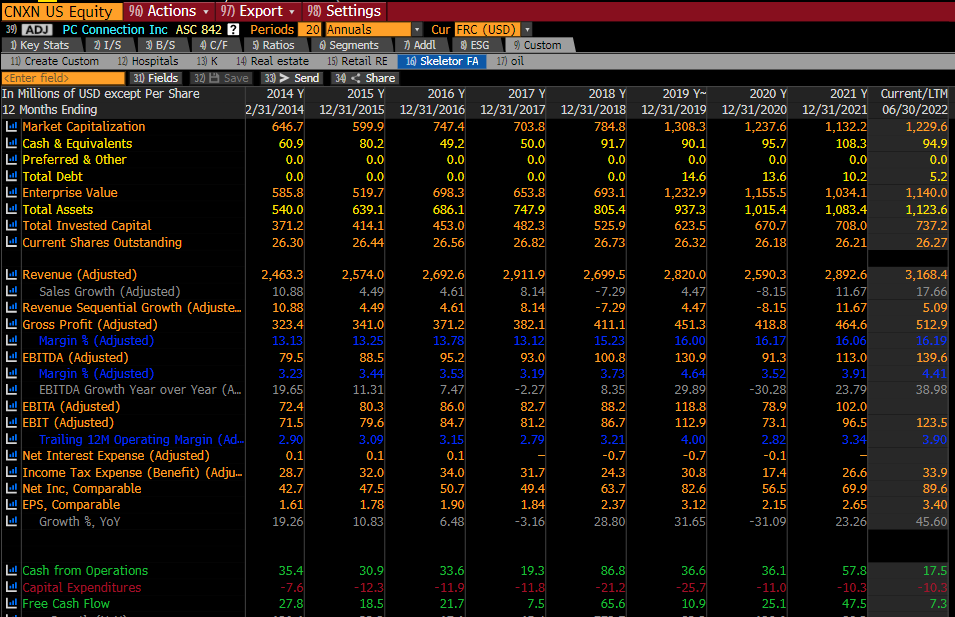

If you haven’t heard, Twitter investors may be getting a slug of cash they need to put to work. This is a good thing, but it means we need to sharpen our pencils on where to reinvest this cash. The timing is decent, with the market down more than 20% and value indices also down double digits on the year. It’s time to turn over some rocks. I plan to read about at least one new company every day this month and will post the results here. First up is a company called PC Connection (ticker CNXN). Founded in 1982 to sell Macintosh computers, the company was named as the second fastest growing company in the US in 1987. In 1998 they IPO'd after growing 65% in the previous year. At year end 1999, the company had $1.1b of trailing sales, $22m of net profit, and a $550m market capitalization. After the tech bubble burst the company struggled with declining sales, and its market cap bottomed out at a mere $100m. This was the beginning of a very slow comeback in terms of both profits and valuation. Today the firm has a market cap of $1.2b on $3.3b of sales and $70m of trailing net income (about 17x PE). The share price has gone essentially nowhere since 2019. The business hasn’t changed that much, with PC sales still accounting for nearly half of revenue. The rest is made up of accessories, servers, and software. This is, unsurprisingly, a low margin operation, and EBIT margins have varied between 2.5% and 4% in recent years. But despite these low margins, high inventory turnovers and low fixed capital requirements give the firm around a 10% return on equity. Revenue growth has been rather anemic over the past decade, with sales increasing from $2.2b to $2.9b. This makes sense given the overall saturation of PCs in the modern economy as well as tough competition from both Amazon and OEMs selling direct to consumers. One thing that is notable about the stock is that almost no one talks about it. SumZero (a well-trafficked buy-side investment site) has zero writeups, and the most recent one on Value Investors Club (“VIC”) is from 2008, when it went by a different ticker (PCCC). That 2008 VIC writeup cites the stock’s valuation of “near tangible book value” as a key component of the thesis. In other words, it was not a pitch based on the quality or growth of the business. Such a thesis wouldn’t really apply in 2022, with the stock trading at around 2x book value. The stock also traded at about 3x EBITDA and 6x earnings in 2008, much cheaper than today. Sell side coverage is also non-existent, with only Sidoti and Raymond James covering the company. Clearly, this is the type of boring, ignored stock that could get mispriced.

Still, given the business they are in, I fail to see why I should pay more than 10x earnings for this stock. If you want to invest in a business that sells PCs and accessories, why not own DELL or HPQ at 6-7x earnings? I’m going to pass on this one for now. Let me know if I’m missing something.

RJ Rhodes

10/6/2022 09:56:17 am

You are missing nothing. Did quick look at co. and it seems at unjustified premium to HPQ given PC shipments will be down this year and according to forecasts, next year as well.

Diego

10/6/2022 10:28:34 am

I like reading your thoughts and we are both value guys. As a student, I wanted to ask about how you get a feel for how good a company can execute? Unrelated questions to the article, but when investigating a company how would you find out whether a company gathers resources for one product in one group? Like for one project they have design, manufacturing, sales together physically on site where they will manufacture the product v.s. a team is spread out across geographies that has all sales in this building and then all manufacturing done in a different country and has a lot of middle management doing nothing. I am trying to determine whether a company can execute well, how fast its design cycle is and how quickly feedback travels throughout the company. Also, how would you find out how many people are typically involved in a project and then what percentage of that are functional heads? How do you figure out what incentives a middle manager has? Would having the answers to any of this matter? How do you get a middle managers number to interview them? You are very busy; thank you so much again.

Stephen Lerner

10/6/2022 10:39:27 am

Lots of insider selling, most notably by Patricia Gallup (Chairman, CAO and co-founder)... I agree, it's a pass

Bobby Vas

10/6/2022 07:12:02 pm

Easy pass…. Better options like Disney, 3M, FB, TCEHY and BABA Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |