|

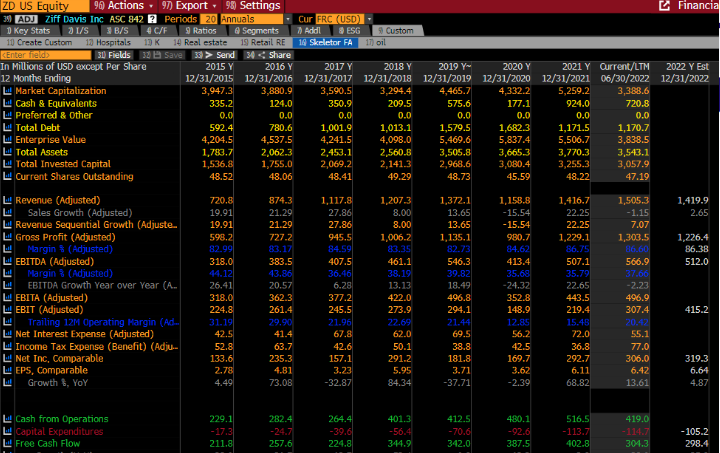

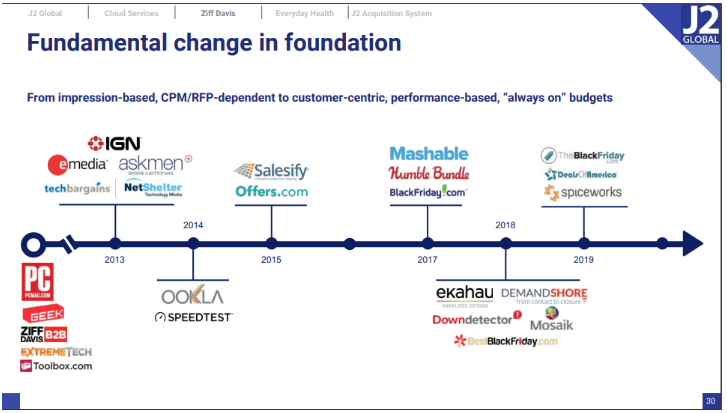

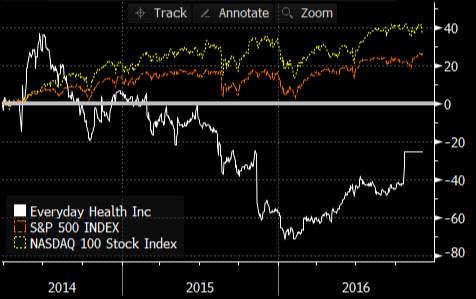

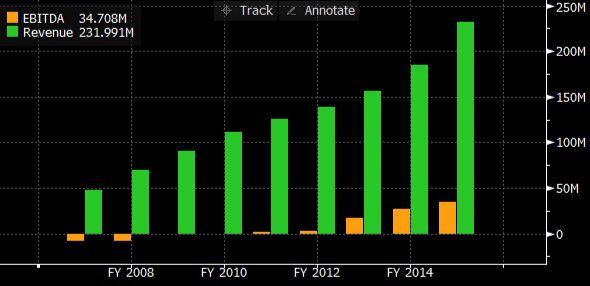

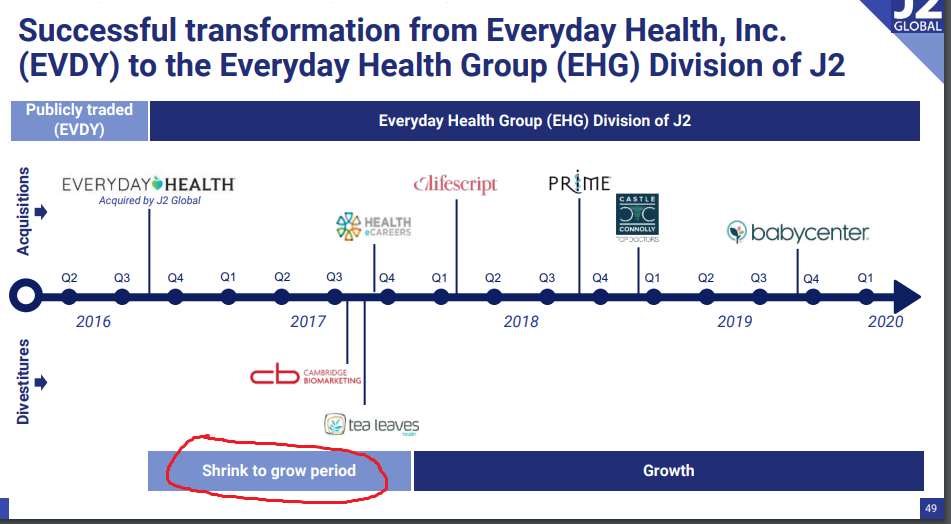

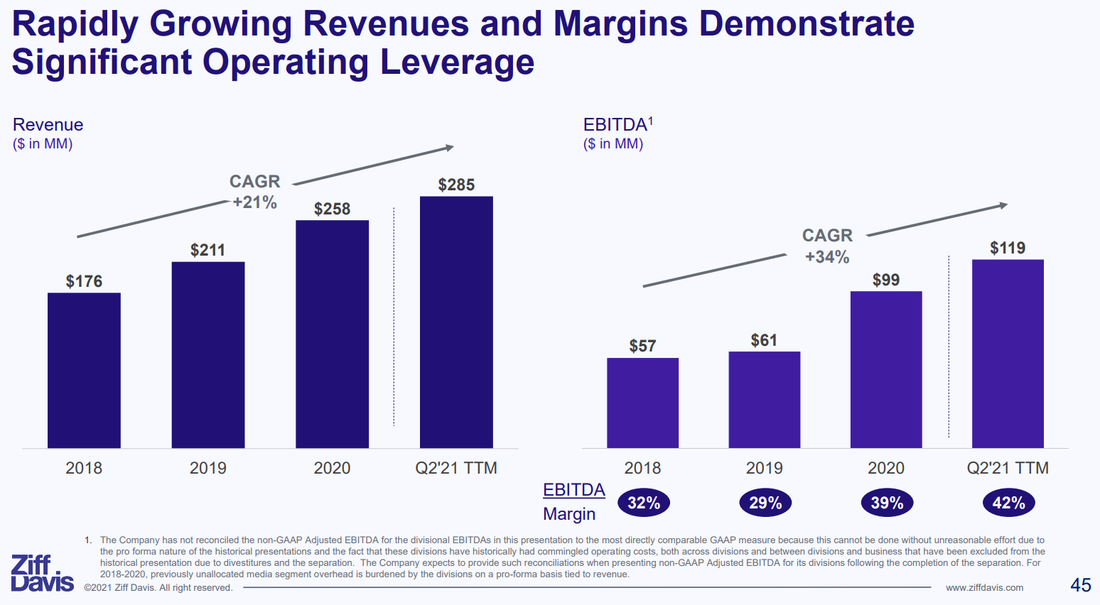

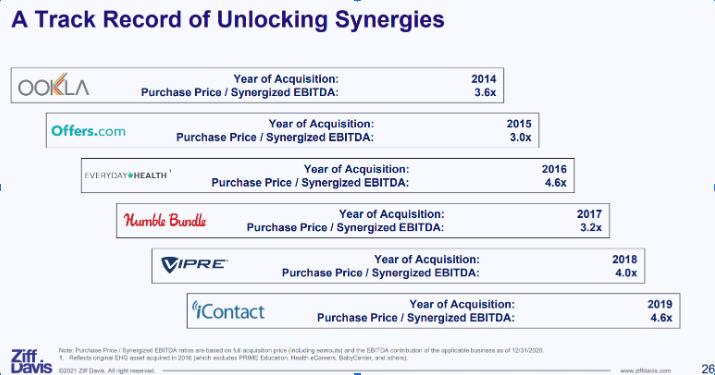

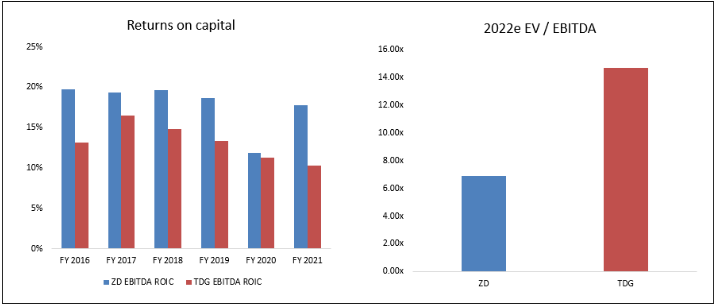

Ever heard of a company called J2 Global? I thought not. Originally, J2 Global was a company that sold fax-to-email subscription software. Over the years it took the profits from the subscription business – about $150-200m per year – and bought underperforming websites. They eventually built up a base of about $1b of non-fax revenues before separating into two publicly traded companies. Today the fax business is called Consensus Cloud Solutions (CCSI), and has a $950m market cap. Ziff Davis (ZD), the websites, are what’s left. The stock is down almost 50% since Nov 2021 and trades at a market value of about $3.4b. This comes to about 11x earnings and less than 7x this year’s EBITDA. This is quite a modest valuation for a firm that has grown revenues at its stable of websites 6x since 2014 (results below include the jettisoned fax business). The properties at ZD are IGN, Mashable, Ookla, PCMag, DownDetector, Everyday Health, and others. Below is a timeline of some of their key acquisitions from the JCOM 2020 Investor Day: The Mashable acquisition is instructive as to how Ziff Davis operates. Mashable was valued at $250m in 2016, but ZD managed to buy it for just $50m the next year. So ZD got an 80% discount vs the prior year’s valuation. The purchase was about 1x revenues, according to estimates seen by Variety. Today Mashable probably generates $50-75m in annual revenue according to estimates by similarweb.com. So slightly more than when it was purchased. But ZD operates with ruthless efficiency: the company has 35% adjusted EBITDA margins. This implies that today Mashable could be doing $20-25m of EBITDA. At a 10x valuation, this implies that ZD has generated a 4-5x return on its initial investment. I consider these estimates fairly conservative. Another notable purchase was the website everydayhealth.com, which Ziff Davis bought in 2016 for $465m. Like the Mashable deal, this was also a substantial discount to previous valuations. After going public in March 2014, EVDY had traded down more than 40% by October of 2016. It trailed the market substantially, with the S&P 500 up 26% and the Nasdaq up 39% over that time frame. This was not due to poor financial performance as far as I can tell. As of Q3 2016, EVDY had grown revenues 9% on a T12 basis and grew revenue 29%, 21% and 10% in the preceding years. Margins were decent too, with EBITDA margins clocking in at 11.9%. Perhaps initial expectations at the IPO were simply too high. ZD’s acquisition of the site was at 15x trailing EBITDA, but this is not the full story. ZD slashed costs, putting the segment into a “shrink to grow” period. This drove revenue below $200m. From the 2020 J2 Global analyst day: These cuts, while shrinking revenue, resulted in dramatically increased profitability. Meanwhile, ZD bolted on smaller acquisitions like BabyCenter. Today, the Health Group at ZD now has around 100m monthly unique visitors and is one of the largest contributors to ZD results with ~$120m of EBITDA. Deals like Mashable and Everyday Health seem to demonstrate ZD's prowess in acquiring these underperforming and low-profitability websites. This strategy has few publicly traded competitors. But despite the uniqueness of their strategy, we see no reason why it can't be successful, In fact, it strikes us as a little bit similar to what Constellation Software does in niche SaaS or Transdigm does in airplane parts. One advantage ZD has is that it appears there is not much competition in acquiring these assets. ZD claims they have averaged purchases at 5x EBITDA and highlights a number of deals that were even cheaper than that on a fully-synergized basis: You should never trust a company with data like this, because they could be cherry picking. Cheap acquisitions must show up in the final numbers. In ZD’s case, the consolidated financial statements show that 5x EBITDA is a reasonable estimate. If we exclude cash of around $750m, total operating assets at ZD are $2.75b essentially all of which was acquired. This figure is about 5.2x expected EBITDA for this year. In other words, EBITDA returns on invested capital are around 20%. While this can’t compare to Constellation’s near 50% EBITDA ROIC, it compares quite well against Transdigm’s ~15% EBITDA returns. Despite better returns on capital, ZD trades at half the EBITDA multiple of TDG. We are sticking ZD on our watchlist and will be following it closely going forward.

Phanindra Yadlapalli

10/12/2022 06:50:50 am

Very interesting analysis on ZD, thanks a lot. Yes, after digging through ZD seems like reasonable well managed business. only risk recently they were doing deals on the higher end like RetailMeNot was brough for 420Million, is it doing 5 X EBITA before Aquisition? May be not by looking at groupon business. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |