|

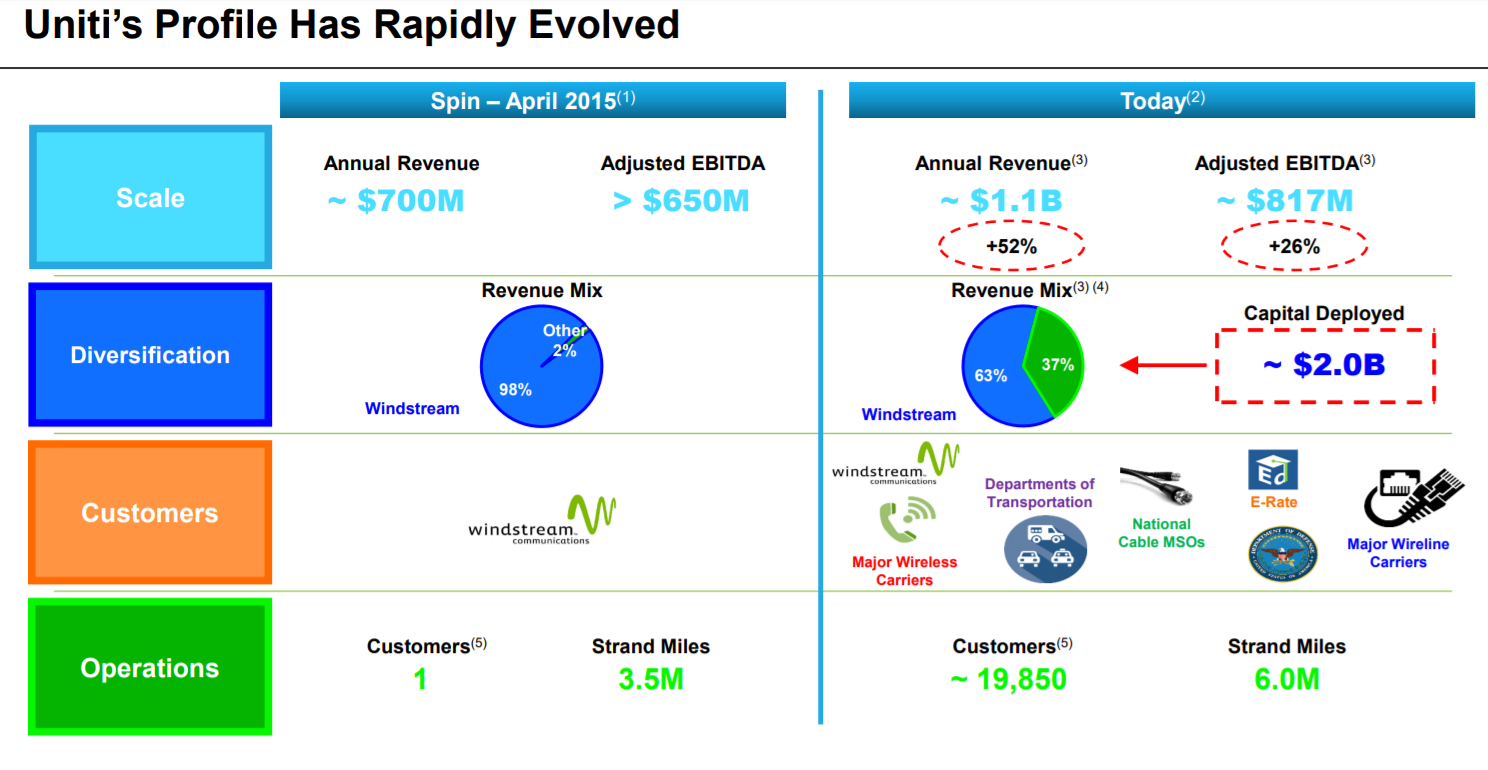

Uniti Group is a weird little company that trades 9x EBITDA and arguably a ~20% free cash flow yield to the equity. The company owns fiber optic cables and copper wires and leases them to ISPs, mobile wireless providers, and businesses. Comps Owning fiber-optic cables can be a good business. Fundamentally, they are the key asset behind a roughly $70b market in the US - fixed broadband internet (and increasingly important in mobile wireless as well). Once deployed, fiber is costly to compete with: the only real way to do so is to “overbuild” your own fiber. Estimates of the cost to run fiber to one household varies between about $700 for telcos to wire existing customers to $1250 per home for a near-nationwide build-out. Costs are even higher in some rural areas where homes are far apart. Maintenance capex for this business is minimal, as are operating costs. This makes sense: they are just sending light through a piece of glass. Margins are high, and Uniti is no exception with EBITDA margins of >70%. While many customers build fiber networks themselves (for example Verizon has spent an estimated $15b to connect 17m customers to fiber), they often rent capacity from third-party players as well. The ever-increasing data needs of end users means that these telco and cable customers will probably continue to need more fiber capacity in the future. Uniti is not the first company to see the opportunities in this space. The largest publicly held pure-play in the industry is Zayo Group. Zayo won’t be public for long: the company agreed to a $14.3b buyout last year. This buyout implies a valuation of roughly 11x EBITDA, a fairly significant premium to Uniti’s current trading price of about 9x 2020 EBITDA. The reason Uniti trades so cheaply is customer concentration and related... complications. Windstream Uniti is a REIT that was spun off from a telco called Windstream Communications in early 2017. At the time of the spin, Uniti was granted ownership of the copper wiring and fiber cabling that Windstream’s customers depend on for internet, TV, and phone service. Windstream and Uniti signed a 15-year contract, renewable for an additional 20 years at Windstream’s option, with an initial “rent” of $650m per year. This contract was >90% of revenue for Uniti initially, and today still contributes 85% of Uniti’s EBITDA and 63% of revenue. In their concentration with a single customer Uniti is similar to Chesapeake Energy’s spin of its natural gas gathering pipelines or Darden’s spin of the real estate under its restaurants. The idea behind these spins is that an infrastructure company with long-term leases and little exposure to industry or commodity price changes should enjoy a lower overall cost of capital than the consumer-facing business. There is also the opportunity to structure the spinoff as a REIT or an MLP, as in the above examples, allowing for cash flows to be paid to investors tax-free. The obvious problem with these spinoffs is that the assets are initially dependent on their former parent company. Darden’s real estate spin, for example, at first collected 100% of rent from Darden brands and 74% from Olive Garden in particular. Uniti’s customer concentration risk has materialized in dramatic fashion: But it gets weirder. The reason Windstream went bankrupt was actually related to the Uniti spin itself: it violated Windstream’s bond indentures, according to a claim made by Aurelius Capital in 2017. A judge agreed, and all $5.7b of Windstream’s debts became due immediately. They could not come up with this money and promptly filed for bankruptcy protection. Windstream is now using the bankruptcy process to try to renegotiate their deal with Uniti. Windstream sued Uniti in August 2019, claiming that the lease agreement was actually a disguised financing. If the judge were to agree with this claim, the lease obligations -- which Windstream argues are above-market -- would become unsecured debt and Uniti would head to the back of the bankruptcy line. With this in mind, Uniti’s auditors have included the following passage in the company’s annual report: I find a number of Windstream’s arguments compelling:

There have been attempts to settle the dispute between Uniti and Windstream, but the two companies seem pretty far off from agreement. Windstream has proposed that Uniti pay it $525m in cash and 19.99% of UNIT stock, as well as $175m per year for maintenance capex. Uniti has proposed $100m in cash, no stock, and Windstream to pay an 8% cap rate in additional revenues on the $175m per year of capex. In other words, Windstream’s “rent” would increase by ~$14m per year due to this capex. What do you think - is this truly a financing transaction? What would Uniti be worth if they accepted Windstream’s settlement offer? Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |