|

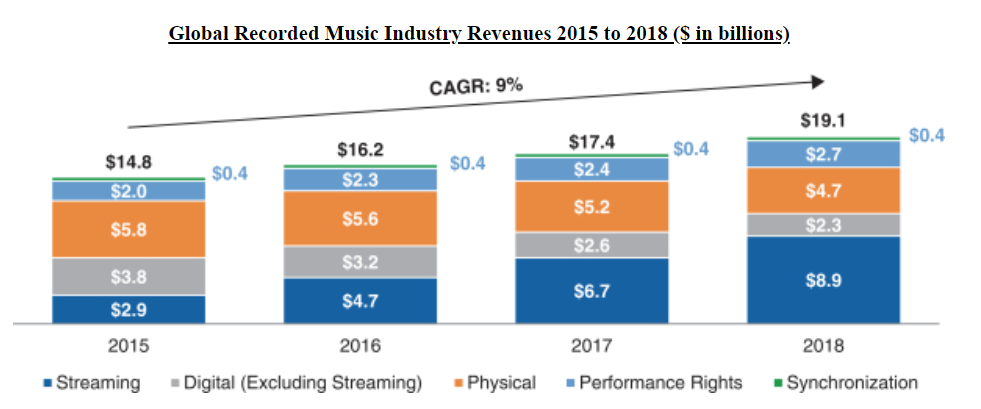

Given that Warner Music Group has recently had an IPO, I thought it would be interesting to compare the company to privately held UMG, which we own via Bollore. UMG and Warner, along with Sony, make up the "big three" music labels owning 80-90% of revenue-producing music. History of Warner Music In 1957, an actor for Warner Brothers movies made a hit song for an independent record company. Sensing a missed opportunity, Warner created Warner Bros. Records in 1958. This served as a platform for numerous acquisitions, including Atlantic Records. Atlantic paved the way for WMG's success, and during the 60s and 70s became the home of hit artists such as Ray Charles, Aretha Franklin, Led Zeppelin, Bette Midler, Neil Young, and Cream. Today, WMG traces its roots back to 1811 via their Chappell and Co subsidiary, which was purchased in 1987. That firm was once called "one of the best publishers" by Beethoven himself. The WMG entity has gone through various owners, generating large returns at times, including a >8x return for one owner in the 1960s. It eventually fell under the umbrella of Time Warner, which sold it to private equity investors in 2004 as part of their effort to refocus the company. Warner Music went public in 2005, with a peak year-end market cap of $3.9b. The value of the company dropped precipitously during the financial crisis, with the company's market cap falling all the way to $700m in September of 2010. Not long after this the company put its self up for sale. The winning bid came from Len Blavatnik, a Russian-born American Jewish billionaire with degrees from Columbia and Harvard. He paid $1.3b in cash and assumed $2b in debt. At the time, it was not at all clear that this was a cheap price. It was a 34% premium to the stock's six-month average price, and the deal was described as follows by the NYTimes: The sale of Warner Music, long considered a trophy asset given its glamorous heritage, comes as the record industry continues to struggle with its transition to a digital future. Digital music downloads have been rising, but not nearly at fast enough a pace to replace the revenue lost from falling CD sales. Mr. Blavatnik will also have to contend with Warner Music’s strained financials; the company’s revenue declined 6.7 percent to less than $3 billion last year. His investment company will assume Warner Music’s roughly $2 billion of debt in the deal, as well as pay about $1.3 billion in cash. Most analysts said Warner Music shareholders wouldn't receive a surprisingly rich payday — $8.25 a share, which is about 34 percent higher than Warner Music’s average stock price over the last six months. When the auction started, it was unclear if anyone at all would bid or whether bidders would seek to carve the company up. “For Warner Music, it’s almost the perfect scenario,” said Tuna N. Amobi, a media analyst at Standard & Poor’s Equity Research. “The best outcome for the auction is to sell the entire company, and the value they’re getting is at the high of any estimate.” As it turns out, $1.3b in cash was an almost preposterously cheap price for the company. No one realized the huge opportunity that streaming represented (this is understandable, since Spotify didn't launch in the US until 2011). Today, the market cap of the company is nearly $16b. When combined with roughly $1b of dividends paid over the years, Blavatnik appears to have generated a nearly 13x return. The business of Warner Music Music labels make money via royalties, which are paid by those wishing to reproduce music owned by the labels. These reproductions take various forms: "performance rights" for broadcast TV and public venues such as sports stadiums, physical CDs and records, digital album downloads, radio play, use in recorded TV or movies, and digital streams. Some of this revenue is paid to artists, and some is paid to songwriters. The figure below, from Warner's S-1, shows how these revenue streams have trended over time: As is obvious from that chart, streaming is the main source of growth for the industry. Streaming music rides a number of tailwinds (from WMG's S-1):

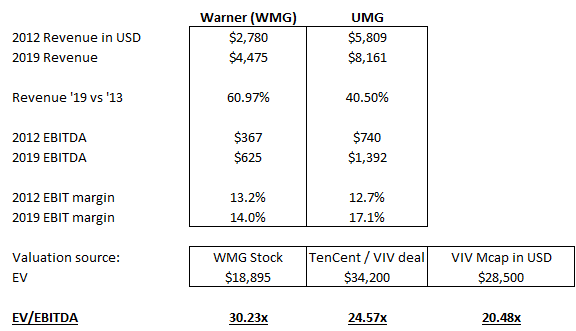

Comparison to UMG Given the potential for continued growth in digital music revenues, it is unsurprising that WMG has garnered a premium market valuation. We are familiar with the dynamics at play here, as we are invested in the industry via Bollore, which has a major stake in Vivendi (the owner of Universal Music). Let's compare UMG with Warner Music: The businesses are similar in terms of what they do, but the financials reveal three main differences:

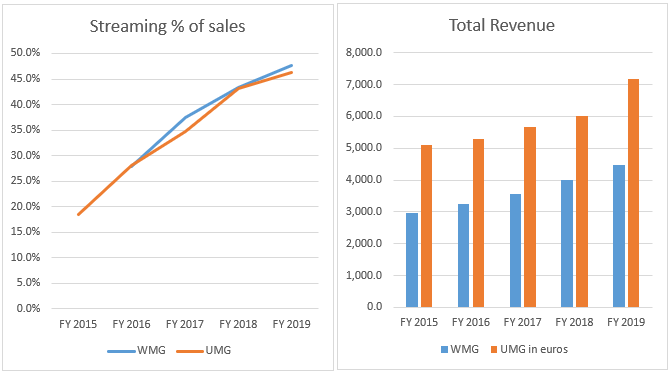

The growth driver for both businesses has been streaming music apps (Spotify, Apple, etc). Streaming's share of revenue has grown to nearly half for both companies. The interesting thing about UMG is you don't have to pay a valuation of $34b to own it. Let's walk through the math. As of 12/31/19, Vivendi owned 100% of UMG, had 6.4b EUR of debt, and 1.185b shares outstanding. Vivendi has a few other assets which complicate things slightly. To keep things simple, I'll assume that Vivendi's other assets, which include subsidiaries generating 700m EUR of operating income as well as 4b in cash and investments, merely offset the firm's 6.4b EUR of debt. In this framework, which I find quite conservative, Vivendi can be valued as simply owning UMG debt-free. At a last price of 22.1 EUR, this means the market's implied valuation of UMG is 25 billion euros or about $28b. This price is:

In our view, Warner Music's IPO shows just how cheap Vivendi really is. We think investors in Vivendi will do well, but you can get even cheaper exposure to UMG by investing in Bollore, as we have. Or, as someone on twitter put it: -Evan Bireme Capital LLC is an SEC Registered Investment Advisor. Registration does not constitute an endorsement of the firm nor does it indicate that the advisor has attained a particular level of skill or ability. This piece is for informational purposes only. While Bireme believes the sources of its information to be reliable, it makes no assurances to that effect. Bireme is also under no obligation to update this post should circumstances change. Nothing in this post should be construed as investment advice, and it is not an offer to sell or buy any security. Bireme clients may (and usually do) have positions in the securities mentioned. Advisory fees and other important disclosures are described in Part 2 of Bireme’s Form ADV. For current performance information, please contact us at (813) 603-2615. Comments are closed.

|

What this isInformal thoughts on stocks and markets from our CIO, Evan Tindell. Archives

December 2023

Categories |

Telephone813-603-2615

|

|

Disclaimer |